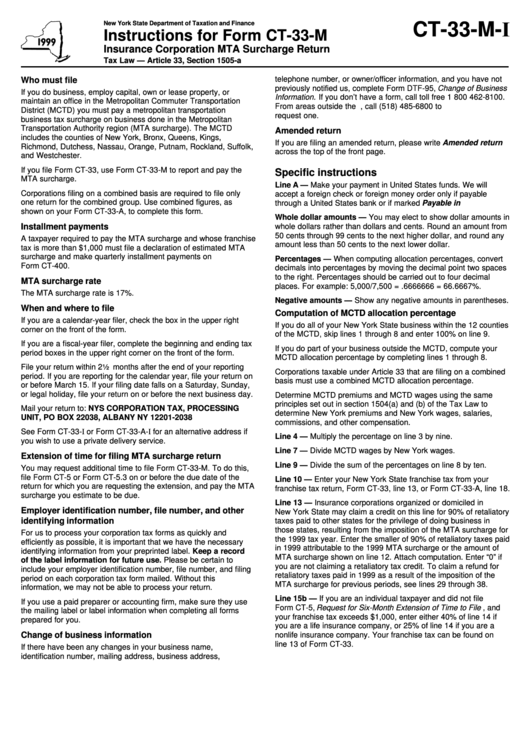

Instructions For Form Ct-33-M - Insurance Corporation Mta Surcharge Return - 1999

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-33-M-I

Instructions for Form CT-33-M

Insurance Corporation MTA Surcharge Return

Tax Law — Article 33, Section 1505-a

telephone number, or owner/officer information, and you have not

Who must file

previously notified us, complete Form DTF-95, Change of Business

If you do business, employ capital, own or lease property, or

Information. If you don’t have a form, call toll free 1 800 462-8100.

maintain an office in the Metropolitan Commuter Transportation

From areas outside the U.S. and Canada, call (518) 485-6800 to

District (MCTD) you must pay a metropolitan transportation

request one.

business tax surcharge on business done in the Metropolitan

Transportation Authority region (MTA surcharge). The MCTD

Amended return

includes the counties of New York, Bronx, Queens, Kings,

If you are filing an amended return, please write Amended return

Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk,

across the top of the front page.

and Westchester.

If you file Form CT-33, use Form CT-33-M to report and pay the

Specific instructions

MTA surcharge.

Line A — Make your payment in United States funds. We will

Corporations filing on a combined basis are required to file only

accept a foreign check or foreign money order only if payable

one return for the combined group. Use combined figures, as

through a United States bank or if marked Payable in U.S. funds.

shown on your Form CT-33-A, to complete this form.

Whole dollar amounts — You may elect to show dollar amounts in

Installment payments

whole dollars rather than dollars and cents. Round an amount from

50 cents through 99 cents to the next higher dollar, and round any

A taxpayer required to pay the MTA surcharge and whose franchise

amount less than 50 cents to the next lower dollar.

tax is more than $1,000 must file a declaration of estimated MTA

surcharge and make quarterly installment payments on

Percentages — When computing allocation percentages, convert

Form CT-400.

decimals into percentages by moving the decimal point two spaces

to the right. Percentages should be carried out to four decimal

MTA surcharge rate

places. For example: 5,000/7,500 = .6666666 = 66.6667%.

The MTA surcharge rate is 17%.

Negative amounts — Show any negative amounts in parentheses.

When and where to file

Computation of MCTD allocation percentage

If you are a calendar-year filer, check the box in the upper right

If you do all of your New York State business within the 12 counties

corner on the front of the form.

of the MCTD, skip lines 1 through 8 and enter 100% on line 9.

If you are a fiscal-year filer, complete the beginning and ending tax

If you do part of your business outside the MCTD, compute your

period boxes in the upper right corner on the front of the form.

MCTD allocation percentage by completing lines 1 through 8.

File your return within 22 months after the end of your reporting

Corporations taxable under Article 33 that are filing on a combined

period. If you are reporting for the calendar year, file your return on

basis must use a combined MCTD allocation percentage.

or before March 15. If your filing date falls on a Saturday, Sunday,

or legal holiday, file your return on or before the next business day.

Determine MCTD premiums and MCTD wages using the same

principles set out in section 1504(a) and (b) of the Tax Law to

Mail your return to: NYS CORPORATION TAX, PROCESSING

determine New York premiums and New York wages, salaries,

UNIT, PO BOX 22038, ALBANY NY 12201-2038

commissions, and other compensation.

See Form CT-33-I or Form CT-33-A-I for an alternative address if

Line 4 — Multiply the percentage on line 3 by nine.

you wish to use a private delivery service.

Line 7 — Divide MCTD wages by New York wages.

Extension of time for filing MTA surcharge return

Line 9 — Divide the sum of the percentages on line 8 by ten.

You may request additional time to file Form CT-33-M. To do this,

file Form CT-5 or Form CT-5.3 on or before the due date of the

Line 10 — Enter your New York State franchise tax from your

return for which you are requesting the extension, and pay the MTA

franchise tax return, Form CT-33, line 13, or Form CT-33-A, line 18.

surcharge you estimate to be due.

Line 13 — Insurance corporations organized or domiciled in

Employer identification number, file number, and other

New York State may claim a credit on this line for 90% of retaliatory

identifying information

taxes paid to other states for the privilege of doing business in

those states, resulting from the imposition of the MTA surcharge for

For us to process your corporation tax forms as quickly and

the 1999 tax year. Enter the smaller of 90% of retaliatory taxes paid

efficiently as possible, it is important that we have the necessary

in 1999 attributable to the 1999 MTA surcharge or the amount of

identifying information from your preprinted label. Keep a record

MTA surcharge shown on line 12. Attach computation. Enter “0” if

of the label information for future use. Please be certain to

you are not claiming a retaliatory tax credit. To claim a refund for

include your employer identification number, file number, and filing

retaliatory taxes paid in 1999 as a result of the imposition of the

period on each corporation tax form mailed. Without this

MTA surcharge for previous periods, see lines 29 through 38.

information, we may not be able to process your return.

Line 15b — If you are an individual taxpayer and did not file

If you use a paid preparer or accounting firm, make sure they use

Form CT-5, Request for Six-Month Extension of Time to File , and

the mailing label or label information when completing all forms

your franchise tax exceeds $1,000, enter either 40% of line 14 if

prepared for you.

you are a life insurance company, or 25% of line 14 if you are a

Change of business information

nonlife insurance company. Your franchise tax can be found on

line 13 of Form CT-33.

If there have been any changes in your business name,

identification number, mailing address, business address,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2