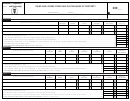

Schedule Z - Oregon Exclusion For Natural Resource Or Commercial Fishing Property Page 2

ADVERTISEMENT

Schedule Z — Oregon Exclusion for Natural Resource or Commercial Fishing Property

(page 2)

Estate of:

Date of death

Decedent’s Social Security number

Part 3

. Valid exclusion. Natural resource property.

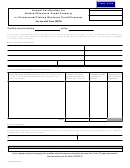

We (list the qualified heirs having an interest in the excluded property)

are the qualified heirs having interest in the exclusion property. We approve of the exclusion made by

Executor/Administrator of the estate of

We, the qualified heirs, understand 2007 House Bill 3201, section 68, requires the following conditions:

1. The qualified heir must use the natural resource property initially excluded from the value of the gross estate for at least five out of eight

calendar years following the decedent’s death to qualify for the inheritance tax exclusion.

2. During the five out of eight calendar year required use period, described in number 1 above, the qualified heir may transfer the excluded

property to another family member who is eligible for the exclusion.

3. If the heir does not use the excluded property as natural resource property for five out of eight calendar years following the decedent’s death,

or the heir disposes of the excluded property, an additional tax under ORS 118.005 to 118.840 is due from the heir.

a. The additional tax liability will be an amount no greater than taxes that would have been due had the property been included in the gross

estate, but at least the amount of such additional taxes multiplied by [(five minus the number of years the property was used as

natural resource property) divided by five].

b. The additional tax liability will be apportioned to the estate for any time prior to transfer to the heirs, and apportioned to the heirs for any

time after transfer to the heirs.

c. An amended Form IT-1, Oregon Inheritance Tax Return, will be required from the heir and the additional inheritance tax paid.

Signature of each qualified heir for a valid exclusion:

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

(Signature of qualified heir)

Date (MM/DD/YYYY)

Attach additional pages if more signature lines are needed.

Schedule Z, page 2 of 2

150-103-003 (12-07) draft 10/02/07-B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2