Local Services Tax (Lst) Form - Richland Township - 2014

ADVERTISEMENT

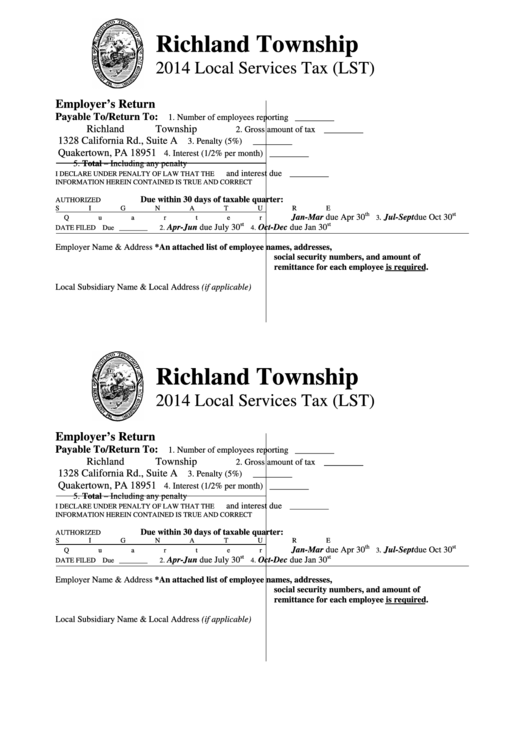

Richland Township

2014 Local Services Tax (LST)

Employer’s Return

Payable To/Return To:

1. Number of employees reporting

_________

Richland Township

2. Gross amount of tax

_________

1328 California Rd., Suite A

3. Penalty (5%)

_________

Quakertown, PA 18951

4. Interest (1/2% per month)

_________

5. Total – Including any penalty

and interest due

__________

I DECLARE UNDER PENALTY OF LAW THAT THE

INFORMATION HEREIN CONTAINED IS TRUE AND CORRECT

Due within 30 days of taxable quarter:

AUTHORIZED

SIGNATURE

th

st

Jan-Mar due Apr 30

. Jul-Sept due Oct 30

Quarter

1.

3

st

st

Apr-Jun due July 30

Oct-Dec due Jan 30

DATE FILED

Due ________

2.

4.

Employer Name & Address

*An attached list of employee names, addresses,

social security numbers, and amount of

remittance for each employee is required.

Local Subsidiary Name & Local Address (if applicable)

Richland Township

2014 Local Services Tax (LST)

Employer’s Return

Payable To/Return To:

1. Number of employees reporting

_________

Richland Township

2. Gross amount of tax

_________

1328 California Rd., Suite A

3. Penalty (5%)

_________

Quakertown, PA 18951

4. Interest (1/2% per month)

_________

5. Total – Including any penalty

and interest due

__________

I DECLARE UNDER PENALTY OF LAW THAT THE

INFORMATION HEREIN CONTAINED IS TRUE AND CORRECT

Due within 30 days of taxable quarter:

AUTHORIZED

SIGNATURE

th

st

Jan-Mar due Apr 30

. Jul-Sept due Oct 30

Quarter

1.

3

st

st

Apr-Jun due July 30

Oct-Dec due Jan 30

DATE FILED

Due ________

2.

4.

Employer Name & Address

*An attached list of employee names, addresses,

social security numbers, and amount of

remittance for each employee is required.

Local Subsidiary Name & Local Address (if applicable)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3