Instructions For Ia 8801

ADVERTISEMENT

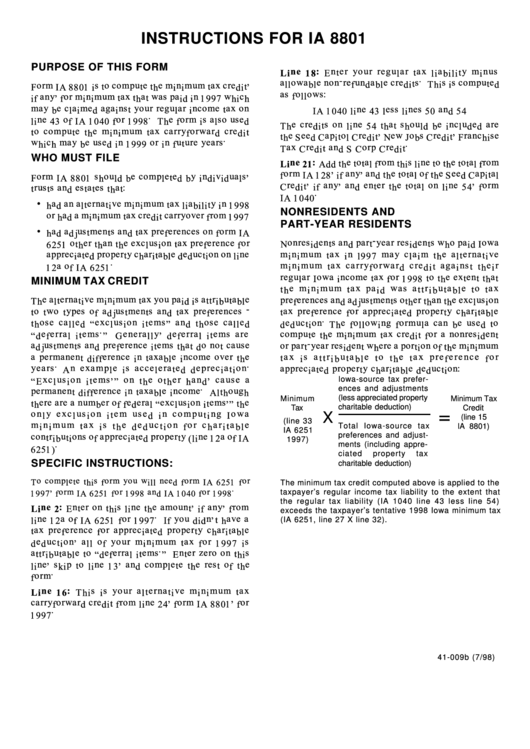

INSTRUCTIONS FOR IA 8801

PURPOSE OF THIS FORM

WHO MUST FILE

NONRESIDENTS AND

PART-YEAR RESIDENTS

MINIMUM TAX CREDIT

Iowa-source tax prefer-

ences and adjustments

(less appreciated property

Minimum

Minimum Tax

charitable deduction)

Tax

Credit

=

X

(line 15

(line 33

Total Iowa-source tax

IA 8801)

IA 6251

preferences and adjust-

1997)

ments (including appre-

ciated

property

tax

SPECIFIC INSTRUCTIONS:

charitable deduction)

The minimum tax credit computed above is applied to the

taxpayer’s regular income tax liability to the extent that

the regular tax liability (IA 1040 line 43 less line 54)

exceeds the taxpayer’s tentative 1998 Iowa minimum tax

(IA 6251, line 27 X line 32).

41-009b (7/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1