PRIMARY

SPOUSE

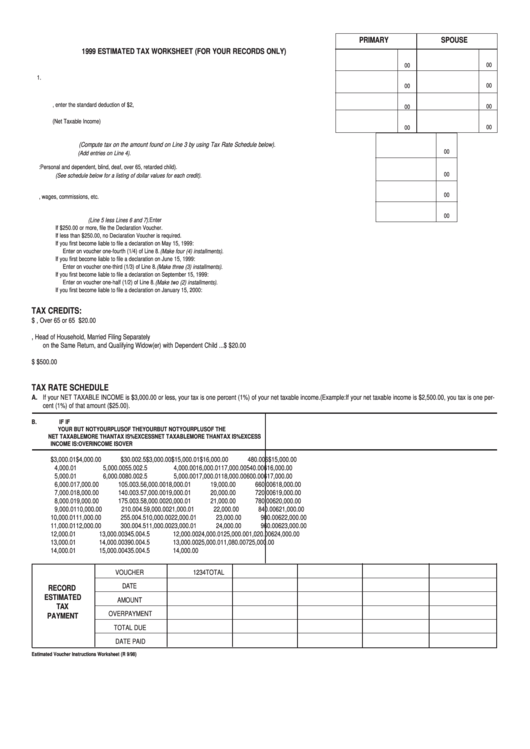

1999 ESTIMATED TAX WORKSHEET (FOR YOUR RECORDS ONLY)

00

00

1.

00

00

1.

Enter amount of adjusted Gross Income expected in 1999. .................................................................................................

2.

If you expect to itemize deductions, enter the standard deduction of $2,000. .....................................................................

00

00

3.

Line 1 less Line 2. (Net Taxable Income). .............................................................................................................................

00

00

4.

Tax (Compute tax on the amount found on Line 3 by using Tax Rate Schedule below).

..................................................

00

5.

Total Tax. (Add entries on Line 4). ...........................................................................................................................................................................

6.

Tax Credits: Personal and dependent, blind, deaf, over 65, retarded child).

00

(See schedule below for a listing of dollar values for each credit). ............................................................................................................................

00

7.

Estimated amount of income tax to be withheld during 1999 from salaries, wages, commissions, etc. ................................................................

00

8.

Estimated Tax (Line 5 less Lines 6 and 7). Enter here. ...........................................................................................................................................

If $250.00 or more, file the Declaration Voucher.

If less than $250.00, no Declaration Voucher is required.

If you first become liable to file a declaration on May 15, 1999:

Enter on voucher one-fourth (1/4) of Line 8. (Make four (4) installments).

If you first become liable to file a declaration on June 15, 1999:

Enter on voucher one-third (1/3) of Line 8. (Make three (3) installments).

If you first become liable to file a declaration on September 15, 1999:

Enter on voucher one-half (1/2) of Line 8. (Make two (2) installments).

If you first become liable to file a declaration on January 15, 2000:

TAX CREDITS:

1. Single and Married Filing Separate Forms ...............................................

$20.00

4. Blind, Over 65 or 65 Special ........................................................................

$20.00

2. Married Filing Joint Return, Head of Household, Married Filing Separately

on the Same Return, and Qualifying Widow(er) with Dependent Child ...

$40.00

5. Deaf..............................................................................................................

$20.00

3. Each Dependent........................................................................................

$20.00

6. Retarded Child ............................................................................................. $500.00

TAX RATE SCHEDULE

A. If your NET TAXABLE INCOME is $3,000.00 or less, your tax is one percent (1%) of your net taxable income. (Example: If your net taxable income is $2,500.00, you tax is one per-

cent (1%) of that amount ($25.00).

B.

IF

IF

YOUR

BUT NOT

YOUR

PLUS

OF THE

YOUR

BUT NOT

YOUR

PLUS

OF THE

NET TAXABLE

MORE THAN

TAX IS

%

EXCESS

NET TAXABLE

MORE THAN

TAX IS

%

EXCESS

INCOME IS:

OVER

INCOME IS

OVER

$3,000.01

$4,000.00

$30.00

2.5

$3,000.00

$15,000.01

$16,000.00

480.00

6

$15,000.00

4,000.01

5,000.00

55.00

2.5

4,000.00

16,000.01

17,000.00

540.00

6

16,000.00

5,000.01

6,000.00

80.00

2.5

5,000.00

17,000.01

18,000.00

600.00

6

17,000.00

6,000.01

7,000.00

105.00

3.5

6,000.00

18,000.01

19,000.00

660.00

6

18,000.00

7,000.01

8,000.00

140.00

3.5

7,000.00

19,000.01

20,000.00

720.00

6

19,000.00

8,000.01

9,000.00

175.00

3.5

8,000.00

20,000.01

21,000.00

780.00

6

20,000.00

9,000.01

10,000.00

210.00

4.5

9,000.00

21,000.01

22,000.00

840.00

6

21,000.00

10,000.01

11,000.00

255.00

4.5

10,000.00

22,000.01

23,000.00

900.00

6

22,000.00

11,000.01

12,000.00

300.00

4.5

11,000.00

23,000.01

24,000.00

960.00

6

23,000.00

12,000.01

13,000.00

345.00

4.5

12,000.00

24,000.01

25,000.00

1,020.00

6

24,000.00

13,000.01

14,000.00

390.00

4.5

13,000.00

25,000.01

1,080.00

7

25,000.00

14,000.01

15,000.00

435.00

4.5

14,000.00

VOUCHER

1

2

3

4

TOTAL

DATE

RECORD

ESTIMATED

AMOUNT

TAX

OVERPAYMENT

PAYMENT

TOTAL DUE

DATE PAID

Estimated Voucher Instructions Worksheet (R 9/98)

1

1 2

2 3

3