General Instructions For All Business Entities Including Estates And Trusts - City Of Loveland Ohio Business Income Tax Return - 2003

ADVERTISEMENT

CITY OF LOVELAND OHIO BUSINESS INCOME TAX RETURN

2003 GENERAL INSTRUCTIONS

FOR ALL BUSINESS ENTITIES INCLUDING ESTATES AND TRUSTS

BUSINESSES REQUIRED TO FILE

Each C-corporation, S-corporation, partnership, LLC, trust, estate or other business entity, other than non-profit organizations (as

determined by the I.R.S.), that have gross receipts from sales made, work done, services performed or rendered and business or other

activities (including rental activities and property, plant or equipment) in the Cit y of Loveland, whether or not such organization has

an office or place of business inside the City, is subject to Loveland income tax. If appropriate, entities may allocate their

profits/losses within and outside of the City by using the business allocation formula (Schedule Y) on page 2 of the tax form.

Schedule Y must be used if the books and records of the business entity do not accurately reflect the specific items of revenue and

expense attributable to business conducted in Loveland.

Sole propriet ors who are residents of the City of Loveland should file an Individual Income Tax return and report Schedule C or C-EZ

profits/losses on that form.

If an entity filed a return, or was required to file a tax return in previous years, but did not do any business within Loveland in calendar

or fiscal year 2003, please indicate so on a 2003 form and submit to the City of Loveland tax office on or before the regular filing

deadline.

For tax years 2003 and after, any flow-through entity domiciled or having a place of business within Loveland will be taxed at the

entity level only. This rule basically affects Loveland residents who report their flow-through income (loss) on Schedule E of their

individual returns. Any loss carry forward remaining after the 2002 tax year that is attributable to a specific entity will transfer and be

recognized under the new account. Please contact the Tax Administrator for further information.

TAXABLE INCOME

Taxable income should be computed using the starting point indicated below and inserting that amount on line 1, completing Schedule

X on page 2 of the form and inserting those amounts on lines 2A and 2B, and adding and/or subtracting as indicated to arrive at

Adjusted Net Income on line 3. Certain items of income are exempted from municipal tax by the Ohio Revised Code. These are as

follows: Capital Gains (excluding ordinary gains), Dividend income, Interest income, and other income derived from intangible

property/sources. These are reported on lines I – M of Schedule X. Certain items expensed on the federal return are disallowed as

deductions for municipal tax purposes as they are not considered ordinary, reasonable and necessary. These are as follows: Capital

Losses (excluding ordinary losses), Charitable contributions, Expenses applicable to the production of nontaxable income (at least 5%

of the amounts reported on lines J & K), and Guaranteed payments. All city and state taxes based on income are then added back in to

taxable income. All of these items are reported on lines A – F of Schedule X. Lines G and M of this schedule are for the reporting of

miscellaneous items that have been deemed taxable or deductible by Loveland city ordinance, rule, or regulation. These may include

½ of self-employment tax as reported on a sole proprietor’s federal return or certain Federal tax credits. Please contact the Tax

Administrator if you require information specific to your return. The objective of these additions and subtractions is to arrive at an

income or loss figure that is reflective of true business-related operations for the fiscal period.

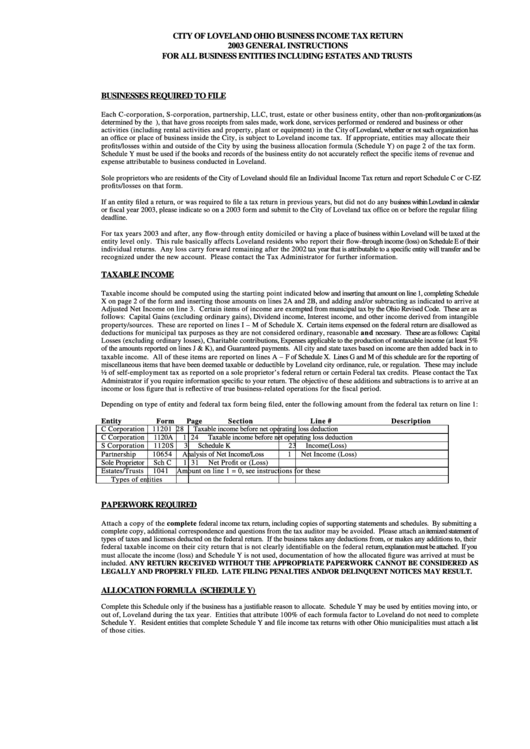

Depending on type of entity and federal tax form being filed, enter the following amount from the federal tax return on line 1:

Entity

Form

Page

Section

Line #

Description

C Corporation

1120

1

28

Taxable income before net operating loss deduction

C Corporation

1120A

1

24

Taxable income before net operating loss deduction

S Corporation

1120S

3

Schedule K

23

Income(Loss)

Partnership

1065

4

Analysis of Net Income/Loss

1

Net Income (Loss)

Sole Proprietor

Sch C

1

31

Net Profit or (Loss)

Estates/Trusts

1041

Amount on line 1 = 0, see instructions for these

Types of entities

PAPERWORK REQUIRED

Attach a copy of the complete federal income tax return, including copies of supporting statements and schedules. By submitting a

complete copy, additional correspondence and questions from the tax auditor may be avoided. Please attach an itemized statement of

types of taxes and licenses deducted on the federal return. If the business takes any deductions from, or makes any additions to, their

federal taxable income on their city return that is not clearly identifiable on the federal ret urn, explanation must be attached. If you

must allocate the income (loss) and Schedule Y is not used, documentation of how the allocated figure was arrived at must be

included. ANY RETURN RECEIVED WITHOUT THE APPROPRIATE PAPERWORK CANNOT BE CONSIDERED AS

LEGALLY AND PROPERLY FILED. LATE FILING PENALTIES AND/OR DELINQUENT NOTICES MAY RESULT.

ALLOCATION FORMULA (SCHEDULE Y)

Complete this Schedule only if the business has a justifiable reason to allocate. Schedule Y may be used by entities moving into, or

out of, Loveland during the tax year. Entities that attribute 100% of each formula factor to Loveland do not need to complete

Schedule Y. Resident entities that complete Schedule Y and file income tax returns with other Ohio municipalities must attach a list

of those cities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2