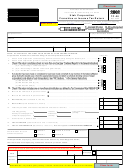

Form It-20np (State Form 148) - Indiana Not-For-Profit Organization Income Tax Return - 2002 Page 2

ADVERTISEMENT

Not-for-Profit Organization Unrelated Business Income Tax

IT-20NP

Page 2

2002

Computation Schedules B, C, D, and E (Attach Federal Form 990T)

(Do not duplicate entries from ScheduleA)

Schedule B — Final Unrelated Gross Income Tax Computation for

Calendar Year Beginning 1-1-2002 or Fiscal Year Beginning in 2002 through December 31, 2002.

Column B

Column A

Gross Receipts Received

High Rate Items

0.3% Low Rate

1.2% High Rate

35. Commissions and fees ..............................................................................................................

36. Interest and dividends ..............................................................................................................

37. Rents, leases, and sale of real estate .......................................................................................

38. Sale of securities and personal property (without deductions) ............................................

39. Gross earnings ...........................................................................................................................

40. Contractor receipts and other service receipts .....................................................................

41. Illegal gaming gross receipts (Explain on Schedule G) ...................................................

Gross Receipts Received

Low Rate Items

42. Contractor’s sale of materials ................................................................................................

43. Selling at retail ..........................................................................................................................

44. Laundering, drycleaning, industrial processing (excluding receipts from coin-operated equipment)

and commercial printing (excluding photocopying) .........................................................................

45. Sales of agricultural products ...................................................................................................

46. Manufacturer’s sales at wholesale ..........................................................................................

47. Other sales at wholesale ...........................................................................................................

48. Totals (add lines 35 through 47 columns A and B) ..............................................................

49. Nontaxable receipts (Explain on Schedule F) ..................................................................

50. Balance (line 48 minus line 49 of each column) ..................................................................

51. Exemptions ($83.33 per month, total from both columns and line 15 of Schedule A

may not exceed $1,000 and limited to the number of months in tax period ...................

52. Amount subject to final gross tax (line 50 minus line 51). If less than zero, enter zero

53. Enter the amounts from line 52 multiplied by the respective tax rates for each column

54. Total final unrelated gross income tax (Column A plus Column B from line 53) .................................................................

54

Schedule C — Adjusted Gross Income Tax Computation on Unrelated Income for Calendar Year

Ending December 31, 2002 or Fiscal Year Beginning in 2002 through December 31, 2002

55. Unrelated business taxable income (before net operating loss deduction from Form 990T (use pro forma amount for period)

56. Addback: All state income taxes (taxes based on income) ..................................................

All fiscal year taxpayers

57. Do not use. For Departmental use only.

must also file Form IT-

58. Deduct: Tax exempt portion of lottery prize money .........................................................

20NP(FY) to report annual

59. Deduct: Interest on US Government obligations on the federal return less related expenses

unrelated business income.

60. Total modifications (add line 56 minus lines 58 and 59) ....................................................

61. Subtotal (add lines 55 and 60) .........................................................................................................................................................

62. Other adjustments (explain on Schedule G) enter deductions in <brackets> ..............

63.

Net adjusted gross income (add lines 61 and line 62) (If not apportioning, proceed to line 65. If apportioning continue to line 64) ......

.

%

64. Enter Indiana apportionment percentage for period, if applicable, from line 4(c) of worksheet .................................

65. Unrelated business income apportioned to Indiana (Multiply line 63 by line 64, see line 65 instructions) .....................

66. Enter Indiana portion of net operating loss deduction reduced by specific deduction (Attach Schedule IT-20NOL) ....

67. Taxable Indiana adjusted gross income for calendar year and for short period (line 65 less line 66) also see line 69 .....................

68. Indiana adjusted gross income tax for period (Multiply line 67 by 3.4%) ............................................................................

6 8

Schedule D — Final Supplemental Net Income Tax Computation on Unrelated Income

for Calendar Year Beginning 1-1-2002 or Fiscal Year Beginning in 2002 through December 31, 2002.

69. Enter Indiana taxable adjusted gross income from line 67 (If a loss is shown on line 67 enter zero) ...............................

70. Enter the greater of final gross income tax (Sch. A, line 18 plus Sch. B, line 54) or adjusted gross income tax (Sch. C, line 68) .......

71. Supplemental net income for period (line 69 minus line 70) If less than zero, enter zero here and on line 72. .............

72. Final supplemental net income tax (Multiply line 71 by 4.5%) ............................................................................................

7 2

Schedule E — Total Unrelated Business Income Tax Computation for 2002 or Fiscal Year through 12-31-2002

.

73. Calendar year taxpayers enter the greater of final gross income tax (Schedule B, line 54) or adjusted gross income tax

(Schedule C, line 68) Fiscal year taxpayers enter only the amount from line 54 (see instructions) .............................

74. Enter final supplemental net income tax from Schedule D, line 72 (cannot be less than zero) ........................................

75. Total unrelated business income tax for tax period (Add lines 73 and 74 and carry to line 20 on front of return) .......

7 5

Vehicle Information Section

a

Enter number of motor vehicles operated by the organization in the State of Indiana as of December 31, 2002

c

b

Are these vehicles registered in the State of Indiana

Yes

No

If no, attach explanation why these vehicles are not registered in Indiana.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4