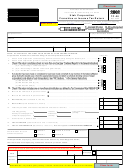

Form It-20np (State Form 148) - Indiana Not-For-Profit Organization Income Tax Return - 2002 Page 4

ADVERTISEMENT

IT-20NP Apportionment of Income Worksheet (Attach to return, if apportioning income)

(R1 /9-02)

Name of Organization

Federal Identification Number

B

A

The following information must be submitted by all organizations having income from sources both within and outside Indiana .

(Interstate transportation entities must use Schedule E-7). Omit cents. Round to two decimal places in column C.

Apportionment of Adjusted Gross Income for Indiana for Tax

Column C

Column B

Column A

Year Beginning 1-1-2002, or Fiscal Year Beginning in 2002

Indiana

Total

Total Within and

Percentage

through December 31, 2002.

Within Indiana

Outside Indiana

1. Property Factor - Average value of owned property from the beginning and the

end of the tax year. (Value of real and tangible personal property used in the

business at original cost).

(a) Property reported on federal return (average value for tax year) ......................

(b) Fully depreciated assets still in use at cost (average value for tax year) ...........

(c) Inventories, including work in progress (average value for tax year) ...............

(d) Other tangible personal property (average value for tax year) .........................

(e) Rented property (8 times the annual net rental) ................................................

Total Property Values for Period: Add lines 1(a) through 1(e) .........................

_ _ _ . _ _ %

1A

1B

1C

2. Payroll Factor - Wages, salaries, commissions, and other compensation of

employees related to business income included in the return. If the amount

reported in column A does not agree with the total compensation reported

for unemployment insurance purposes, attach a detailed explanation.

2A

2B

2C

_ _ _ . _ _ %

Total Payroll Value for Period: ..........................................................................

3. Receipts Factor (less returns and allowances) Include all non-exempt

apportioned gross business income. Do not use non-unitary partnership

income or previously apportioned income that must be separately reported

as allocated income.

Sales delivered or shipped to Indiana:

(a) Shipped from within Indiana ............................................................................

(b) Shipped from outside Indiana ..........................................................................

Sales shipped from Indiana to:

(c) The United States Government ........................................................................

(d) Purchasers in a state where the taxpayer is not subject to income tax

(under P.L. 86-272) .................................................................................................

(e) Interest income and other receipts from extending credit attributed to Indiana ..

(f) Other gross business receipts not previously apportioned .............................

Total Receipts for Period: Add column A lines 3 (a) through 3 (f) and enter in line 3A;

3A

enter all receipts in line 3B, column B .......................................................................

3B

4. Summary - Apportionment of Income for Indiana for Reporting Period

_ _ _ . _ _

4(a)1

__ __ __ . __ __%

(a) Receipts Percentage for factor 3 above: Divide 3A by 3B, enter result here:

4a

X 200% (2.0) double-weighted adjustment ....

%

_ _ _ . _ _

(b)Total Percents: Add percentages entered in lines 1C, 2C and 4a of column C. Enter sum ...........................................................................................................

4b

%

_ _ . _ _

(c) Indiana Apportionment Percentage for Period: Divide line 4b by 4 if all three factors are present. (Enter here and on Schedule C, line 64) .......................

4c

%

NOTE: If either property or payroll factor for column B is absent, divide line 4b by 3. If the receipts factor (3B) is absent, you must divide line 4b by 2.

Sales/Use Tax Worksheet for Line 19, Form IT-20NP

List all purchases made during calendar year 2002 from out-of-state companies.

Purchase Price

Purchase(s)

Purchase(s)

Purchase Price

of Property(s)

on or after

made prior

of Property(s)

Description of personal property

from Column A

to 12-1-2002

12/1/2002

from Column C

purchased from out-of-state

Column B

Column A

Column C

Column D

Magazine subscriptions:

Mail order purchases:

Internet purchases:

Other purchases:

1. Total purchase price of property subject to the sales/use tax:

1B

1D

Enter total of Columns B and D ...............................................

2. Sales/use tax: Multiply line 1B by .05 (5%); multiply

2B

2D

line 1D by .06 (6%) ...................................................................

3. Sales tax previously paid on the above items (up to 5% per

3B

3D

item in Column B; up to 6% per item in Column D) ...............

4. Total amount due: Subtract: line 3B from line 2B and line 3D

from line 2D. Add lines 4B and 4D. Carry to Form IT-20NP, .

line 19. If the amount is negative, enter zero and put no entry

4D

4B

on line 19 of the IT-20NP ..........................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4