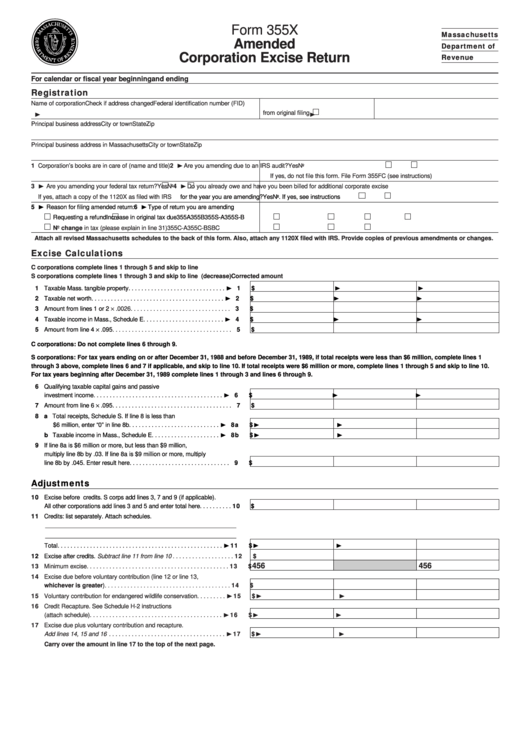

Form 355x - Amended Corporation Excise Return

ADVERTISEMENT

Form 355X

Massachusetts

Amended

Department of

Corporation Excise Return

Revenue

For calendar or fiscal year beginning

and ending

Registration

Name of corporation

Check if address changed

Federal identification number (FID)

¨

from original filing

¨

Principal business address

City or town

State

Zip

Principal business address in Massachusetts

City or town

State

Zip

2 ¨ Are you amending due to an IRS audit?

1 Corporation’s books are in care of (name and title)

Yes

No

If yes, do not file this form. File Form 355FC (see instructions)

3 ¨ Are you amending your federal tax return?

4 ¨ Do you already owe and have you been billed for additional corporate excise

Yes

No

If yes, attach a copy of the 1120X as filed with IRS

4.

for the year you are amending?

Yes

No. If yes, see instructions

5 ¨ Reason for filing amended return:

6 ¨ Type of return you are amending

Requesting a refund

Increase in original tax due

355A

355B

355S-A

355S-B

No change in tax (please explain in line 31)

355C-A

355C-B

SBC

Attach all revised Massachusetts schedules to the back of this form. Also, attach any 1120X filed with IRS. Provide copies of previous amendments or changes.

Excise Calculations

C corporations complete lines 1 through 5 and skip to line 10.

Column A

Column B

Column C

S corporations complete lines 1 through 3 and skip to line 6.

As originally filed

Net increase or (decrease)

Corrected amount

11 Taxable Mass. tangible property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 11

¨

¨

$

12 Taxable net worth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 12

¨

¨

$

× .0026 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Amount from lines 1 or 2

13

$

14 Taxable income in Mass., Schedule E . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 14

¨

¨

$

15 Amount from line 4 × .095. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

$

C corporations: Do not complete lines 6 through 9.

S corporations: For tax years ending on or after December 31, 1988 and before December 31, 1989, if total receipts were less than $6 million, complete lines 1

through 3 above, complete lines 6 and 7 if applicable, and skip to line 10. If total receipts were $6 million or more, complete lines 1 through 5 and skip to line 10.

For tax years beginning after December 31, 1989 complete lines 1 through 3 and lines 6 through 9.

16 Qualifying taxable capital gains and passive

investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 16

¨

¨

$

17 Amount from line 6 × .095. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

$

18 a Total receipts, Schedule S. If line 8 is less than

$6 million, enter “0” in line 8b . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 18a

¨

¨

$

b Taxable income in Mass., Schedule E . . . . . . . . . . . . . . . . . . . . . ¨ 18b

¨

¨

$

19 If line 8a is $6 million or more, but less than $9 million,

multiply line 8b by .03. If line 8a is $9 million or more, multiply

line 8b by .045. Enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

$

Adjustments

10 Excise before credits. S corps add lines 3, 7 and 9 (if applicable).

All other corporations add lines 3 and 5 and enter total here . . . . . . . . . . 10

$

11 Credits: list separately. Attach schedules.

_________________________________________________________

_________________________________________________________

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 11

¨

¨

$

12 Excise after credits.

Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . 12

$

456

456

13 Minimum excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

$

14 Excise due before voluntary contribution (line 12 or line 13,

whichever is greater) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

$

15 Voluntary contribution for endangered wildlife conservation . . . . . . . . . ¨ 15

¨

¨

$

16 Credit Recapture. See Schedule H-2 instructions

(attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 16

¨

¨

$

17 Excise due plus voluntary contribution and recapture.

Add lines 14, 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 17

¨

¨

$

Carry over the amount in line 17 to the top of the next page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4