Print Blank Form

Print

Clear

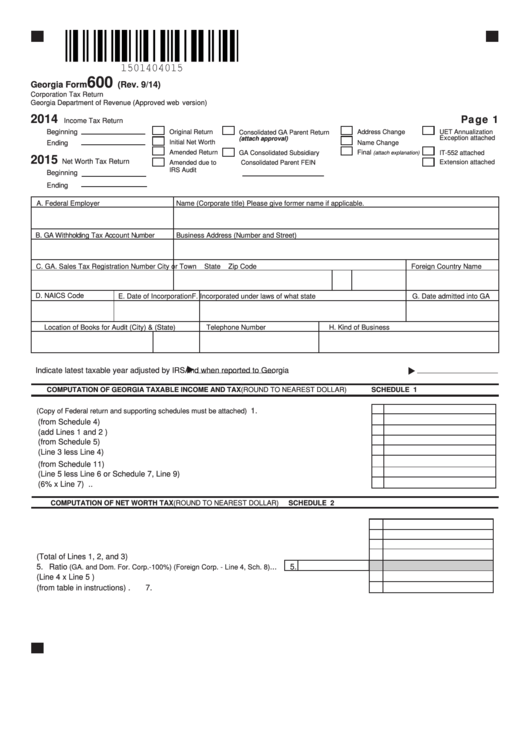

600

Georgia Form

(Rev. 9/14)

Corporation Tax Return

Georgia Department of Revenue (Approved web version)

Page 1

2014

Income Tax Return

Beginning

Original Return

Address Change

UET Annualization

Consolidated GA Parent Return

Exception attached

(attach approval)

Initial Net Worth

Ending

Name Change

Amended Return

Final

GA Consolidated Subsidiary

(attach explanation)

IT-552 attached

2015

Net Worth Tax Return

Extension attached

Amended due to

Consolidated Parent FEIN

IRS Audit

Beginning

Ending

A. Federal Employer I.D. Number

Name (Corporate title) Please give former name if applicable.

B. GA Withholding Tax Account Number

Business Address (Number and Street)

C. GA. Sales Tax Registration Number

City or Town

State

Zip Code

Foreign Country Name

D. NAICS Code

E. Date of Incorporation

F. Incorporated under laws of what state

G. Date admitted into GA

Location of Books for Audit (City) & (State)

Telephone Number

H. Kind of Business

Indicate latest taxable year adjusted by IRS

And when reported to Georgia

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1. Federal Taxable Income

1.

(Copy of Federal return and supporting schedules must be attached) ....

2. Additions to Federal Income (from Schedule 4) ..................................................................

2.

3. Total (add Lines 1 and 2 ) ....................................................................................................

3.

4. Subtractions from Federal Income (from Schedule 5) ........................................................

4.

5. Balance (Line 3 less Line 4) ................................................................................................

5.

6. Georgia Net Operating loss deduction (from Schedule 11) ................................................

6.

7. Georgia Taxable Income (Line 5 less Line 6 or Schedule 7, Line 9) ..................................

7.

8. Income Tax - (6% x Line 7) ...................................................................................................

8.

COMPUTATION OF NET WORTH TAX

(ROUND TO NEAREST DOLLAR)

SCHEDULE 2

1. Total Capital stock issued ...................................................................................................

1.

2. Paid in or Capital surplus ...................................................................................................

2.

3. Total Retained earnings .....................................................................................................

3.

4. Net Worth (Total of Lines 1, 2, and 3) ..................................................................................

4.

5. Ratio

...

5.

(GA. and Dom. For. Corp.-100%) (Foreign Corp. - Line 4, Sch. 8)

6. Net Worth Taxable by Georgia (Line 4 x Line 5 ) ................................................................

6.

7. Net Worth Tax (from table in instructions) ...........................................................................

7.

1

1 2

2 3

3 4

4 5

5