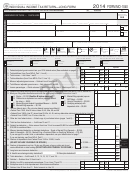

PART 1

ADDITIONS TO FEDERAL TAXABLE INCOME

Dollars

Cents

00

34 Out-of-state losses - see instructions.

34

00

35 Expenses related to National Guard and military reserve income.

35

36 Interest income on obligations of states and political subdivisions

00

other than South Carolina .

36

00

37 Other additions to income. (See instructions.) Attach an explanation.

37

00

38 TOTAL ADDITIONS ---- add lines 34 through 37 and enter your total additions to income here.

38

PART 2

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

00

39 Interest income from obligations of the US government.

39

00

40 National Guard or Reserve annual training and drill pay. (See instructions.)

40

00

41 Permanent disability retirement income, if taxed on your federal return.

41

00

42 Social Security and/or railroad retirement, if taxed on your federal return.

42

43 Caution: Retirement Deduction - See instructions.

00

a) Taxpayer: Birth Date _________

43a

00

b)

Spouse: Birth Date _________

Surviving Spouse

43b

44 Age 65 and older deduction - See instructions.

00

a) Taxpayer: Birth date _____________

44a

00

b) Spouse: Birth date _____________

44b

00

45 Out-of-state income/gain - See instructions.

45

00

46 Negative amount of federal taxable income.

46

00

47 44% of net capital gains with two years holding period (See instructions.)

47

00

48 Subsistence Allowance ______________ days @ $5.00

48

49 Dependents under 6 years of age. See instructions.

Birth Date ________________ SSN __________________________

00

_

49

Birth Date ________________ SSN _________________________

00

50 Other subtractions. (See instructions.) ____________________

50

00

51 TOTAL SUBTRACTION ---- add lines 39 through 50 and enter the total.

51

52 NET ADJUSTMENT: If line 38 is greater than line 51, the difference is a plus

figure. However, if line 51 is

+

00

greater than line 38, the difference is a minus

figure. Enter the difference here and on line 5 of this return.

52

-

Schedule W

TWO WAGE EARNER CREDIT WHEN BOTH SPOUSES WORK

Step 1

Compute your earned income

(a) You

(b) Your spouse

1 Wages, salaries, tips, etc., from federal Form 1040, line 7 or 1040A, line 7, or

1040EZ, line 1. (Do not include pensions or annuities. See instructions, Step 1,

00

00

page 6.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1

2 Net profit or (loss) from self-employment (from Schedules C and F of Form

1040 and/or Schedule K-1 of Form 1065) and any other earned income . . . . . .

00

00

2

2

00

00

3 Add lines 1 and 2. This is your total earned income . . . . . . .. . . . . . . . . . . . . . . .

3

3

Step 2

Compute your qualified earned income

4 Add amounts entered on federal Form 1040, lines 23, 27, 28, and 29 and any

repayment of supplemental unemployment benefits (sub-pay) included on line

00

00

32, or on 1040A, line 15. Enter the total. (See instructions) . . . . . . . . . . . . . . . .

4

4

5 Subtract line 4 from line 3. This is your qualified earned income. If the amount

in column (a) or (b) is zero (-0-) or less, stop here. You may not take this credit

00

00

5

5

Step 3

Compute your credit

6 Compare the amounts in columns (a) and (b) of line 5 above. Enter the smaller amount here. (Enter either

00

6

amount if 5(a) and 5(b) are the same.) Do not enter more than $30,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Factor used to compute the credit (.007) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

X

.007

8 Multiply the amount on line 6 by the factor on line 7. This is the amount of your credit, which cannot exceed

$210. Enter the amount here and on line 11 of this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8

MAIL RETURN TO: PROCESSING CENTER, P.O. BOX 101100, COLUMBIA, SC 29211-0100

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Your Signature

Date

Day Phone #

Spouse's Signature (if jointly, BOTH must sign)

I authorize the Director of the Department of Revenue or delegate to

Preparer's Printed Name

Yes

No

discuss this return, attachments and related tax matters with the preparer.

If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

Prepared by

Date

Address

Telephone #

Identification No.

See instructions inside back cover of tax booklet to determine if you are liable for use tax and/or accommodations tax.

1

1 2

2