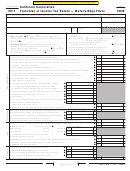

Form 100w Draft - California Corporation Franchise Or Income Tax Return - Water'S-Edge Filers - 2010 Page 2

ADVERTISEMENT

37 Tax due. If line 31 is more than line 36, subtract line 36 from line 31 . Go to line 41 . . . . . . . . . . . . . . . .

37

00

38 Overpayment. If line 36 is more than line 31, subtract line 31 from line 36 . . . . . . . . . . . . . . . . . . . . . . .

38

00

39 Amount of line 38 to be credited to 2011 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

00

40 refund. Amount of line 38 to be refunded . Line 38 less line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

00

See instructions to have the refund directly deposited .

a Routing number . . . . . . . . . . . . . . .

40a

b Type: Checking

Savings

c Account number . . . . . . . . . . . . . . . . . . . . . . .

40c

4 a Penalties and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

00

b

Check if estimate penalty computed using Exception B or C . See instructions.

42 Total amount due. Add line 37 and line 41a . Pay this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

00

Schedule Q Questions (continued from Side 1)

C This return is being filed pursuant to a water’s-edge

If 1 or 3 is “Yes,” enter the country of the ultimate parent

election under R&TC Section 25113,

_______________________________________________

commencing on

(enter date) ________/________/____________

If 1, 2, or 3 is “Yes,” furnish a statement of ownership indicating

D Was the corporation’s income included in a

pertinent names, addresses, and percentages of stock owned .

consolidated federal return? . . . . . . . . . . . . . . . . . . . .

Yes

No

If the owner(s) is an individual, provide the SSN/ITIN .

L Has the corporation included a reportable transaction

E Principal business activity code .

or listed transaction within this return?

(Do not leave blank): . . . . . . . . . . . . . . . . . . .

(See instructions for definitions) . . . . . . . . . . . . . . . . .

Yes

No

Business activity __________________________________________

If “Yes,” complete and attach federal Form 8886 for each transaction .

Product or service _________________________________________

M Is this corporation apportioning income to California

F Date incorporated: ________/________/____________

using Schedule R? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Where:

State

Country _____________________________

N How many affiliates in the combined report are claiming

immunity from taxation in California under

G Date business began in California or date income was first derived from

California sources

________/________/____________

Public Law 86-272?

______________________________________

O Corporation headquarters are:

()

Within California

H First return?

Yes

No If “Yes” and this corporation is a

(2)

Outside of California, within the U .S . (3)

Outside of the U .S .

successor to a previously existing business, check the appropriate box .

P Location of principal accounting records ________________________

()

sole proprietorship (2)

partnership (3)

joint venture

________________________________________________________

(4)

corporation (5)

other

Q Accounting method:

()

Cash (2)

Accrual (3)

Other

(attach statement showing name, address, and FEIN/SSN/ITIN of

R Does this corporation or any of its subsidiaries have a

previous business)

Deferred Intercompany Stock Account (DISA)? . . . .

Yes

No

I “Doing business as” name . See instructions:

____________________

If “Yes,” enter the total balance of all DISAs

$__________________

_________________________________________________________

S Is this corporation or any of its subsidiaries a RIC? . .

Yes

No

J . For this taxable year, was there a change in control

T Is this corporation treated as a REMIC for

or majority ownership for this corporation or any of

California purposes? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

its subsidiaries that owned or (under certain

U Is this corporation a REIT for California purposes? . .

Yes

No

circumstances) leased real property in California? .

Yes

No

V Is this corporation an LLC or limited partnership

2. For this taxable year, did this corporation or any of its

electing to be taxed as a corporation for federal

subsidiaries acquire control or majority ownership of

purposes? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

any other legal entity that owned or (under certain

W Is this corporation to be treated as a credit union? . .

Yes

No

circumstances) leased real property in California? .

Yes

No

X Is the corporation under audit by the IRS or has it

3. If this corporation or any of its subsidiaries owned or

been audited by the IRS in a prior year? . . . . . . . . . .

Yes

No

(under certain circumstances) leased real property

Y Have all required information returns (e .g . federal

in California, has more than 50% of the voting stock

Forms 1099, 5471, 5472, 8300, 8865, etc .) been

of any one of them cumulatively transferred in one

filed with the Franchise Tax Board? . . . . . . . . .

N/A

Yes

No

or more transactions since March 1, 1975, which

Z Does the taxpayer (or any corporation of the

was not reported on a previous year’s tax return? . .

Yes

No

taxpayer’s combined group, if applicable) own 80%

(Penalties may apply – see instructions.)

or more of the stock of an insurance company? . . . . . .

Yes

No

K At any time during the taxable year, was more than

AA Did the corporation file the federal

50% of the voting stock:

Schedule UTP (Form 1120)? . . . . . . . . . . . . . . . . .

Yes

No

. Of the corporation owned by any single interest? . .

Yes

No

BB Does any member of the combined reporting group

2. Of another corporation owned by this corporation?

Yes

No

own an SMLLC or reporting credits attributable

3. Of this and one or more other corporations owned or

to SMLLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

controlled, directly or indirectly, by the same interests?

Yes

No

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

Sign

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Telephone

Title

Date

Signature

of officer

Officer’s email address (optional)

( )

Date

Paid

Preparer’s SSN/PTIN

Check if self-

Preparer’s

Preparer’s

signature

employed

Use Only

FEIN

-

Firm’s name (or yours,

if self-employed)

Telephone

and address

( )

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . .

Yes

No

Side 2 Form 100W

2010

3622103

C1

For Privacy Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5