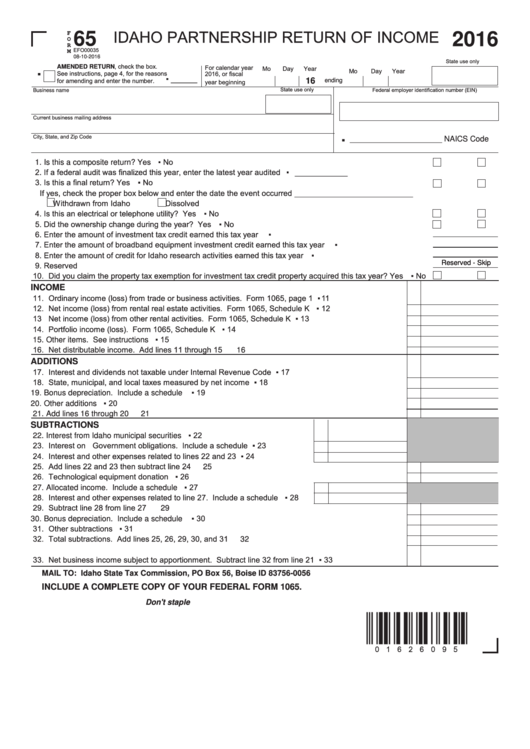

IDAHO PARTNERSHIP RETURN OF INCOME

F

65

2016

O

R

EFO00035

M

08-10-2016

State use only

For calendar year

.

AMENDED RETURN, check the box.

Mo Day Year

Mo Day Year

See instructions, page 4, for the reasons

2016, or fiscal

▪ ______

for amending and enter the number.

16

ending

year beginning

State use only

Federal employer identification number (EIN)

Business name

Current business mailing address

.

City, State, and Zip Code

_____________________ NAICS Code

Yes ▪

No

1. Is this a composite return? .................................................................................................................................

2. If a federal audit was finalized this year, enter the latest year audited ................................. ▪ ____________

3. Is this a final return? ...........................................................................................................................................

Yes ▪

No

If yes, check the proper box below and enter the date the event occurred ___________________________

Withdrawn from Idaho Dissolved

4. Is this an electrical or telephone utility? .............................................................................................................

Yes ▪

No

5. Did the ownership change during the year? ......................................................................................................

Yes ▪

No

6. Enter the amount of investment tax credit earned this tax year ........................................................................ ▪

7. Enter the amount of broadband equipment investment credit earned this tax year .......................................... ▪

8. Enter the amount of credit for Idaho research activities earned this tax year .................................................... ▪

Reserved - Skip

9. Reserved ...........................................................................................................................................................

1 0. Did you claim the property tax exemption for investment tax credit property acquired this tax year? ...............

Yes ▪

No

INCOME

1 1. Ordinary income (loss) from trade or business activities. Form 1065, page 1 ....................................... ▪ 11

1 2. Net income (loss) from rental real estate activities. Form 1065, Schedule K ........................................ ▪ 12

1 3 Net income (loss) from other rental activities. Form 1065, Schedule K ................................................. ▪ 13

1 4. Portfolio income (loss). Form 1065, Schedule K ................................................................................... ▪ 14

15. Other items. See instructions ................................................................................................................ ▪ 15

1 6. Net distributable income. Add lines 11 through 15 ................................................................................

16

ADDITIONS

1 7. Interest and dividends not taxable under Internal Revenue Code .......................................................... ▪ 17

1 8. State, municipal, and local taxes measured by net income .................................................................... ▪ 18

19. Bonus depreciation. Include a schedule ................................................................................................ ▪ 19

20. Other additions ....................................................................................................................................... ▪ 20

21. Add lines 16 through 20 ..........................................................................................................................

21

SUBTRACTIONS

22. Interest from Idaho municipal securities ....................................................... ▪ 22

2 3. Interest on U.S. Government obligations. Include a schedule ..................... ▪ 23

2 4. Interest and other expenses related to lines 22 and 23 ................................ ▪ 24

2 5. Add lines 22 and 23 then subtract line 24 ...............................................................................................

25

2 6. Technological equipment donation ......................................................................................................... ▪ 26

27. Allocated income. Include a schedule ......................................................... ▪ 27

2 8. Interest and other expenses related to line 27. Include a schedule ............ ▪ 28

2 9. Subtract line 28 from line 27 ...................................................................................................................

29

30. Bonus depreciation. Include a schedule ................................................................................................ ▪ 30

3 1. Other subtractions .................................................................................................................................. ▪ 31

3 2. Total subtractions. Add lines 25, 26, 29, 30, and 31 ...............................................................................

32

3 3. Net business income subject to apportionment. Subtract line 32 from line 21 ....................................... ▪ 33

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise ID 83756-0056

INCLUDE A COMPLETE COPY OF YOUR FEDERAL FORM 1065.

Don't staple

{"_]¦}

1

1 2

2 3

3 4

4