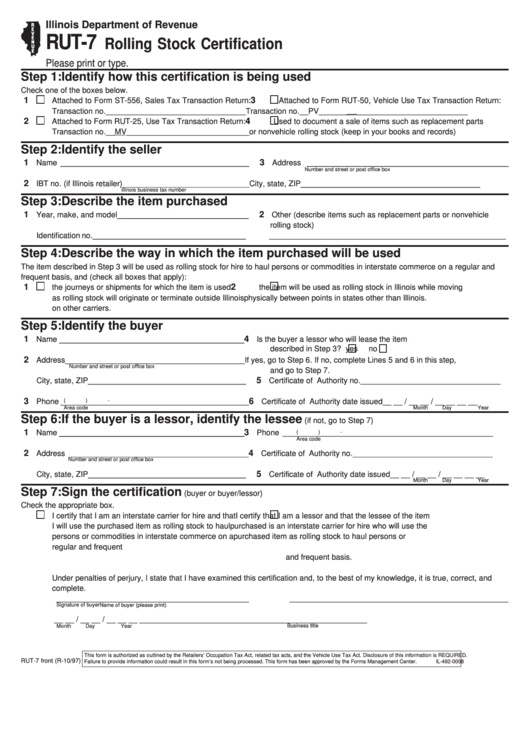

Illinois Department of Revenue

RUT-7

Rolling Stock Certification

Please print or type.

Step 1: Identify how this certification is being used

Check one of the boxes below.

1

3

Attached to Form ST-556, Sales Tax Transaction Return:

Attached to Form RUT-50, Vehicle Use Tax Transaction Return:

Transaction no. ________________________________

Transaction no.__PV__________________________________

2

4

Attached to Form RUT-25, Use Tax Transaction Return:

Used to document a sale of items such as replacement parts

Transaction no. __MV____________________________

or nonvehicle rolling stock (keep in your books and records)

Step 2: Identify the seller

1

3

Name ___________________________________________

Address ______________________________________________

Number and street or post office box

2

IBT no. (if Illinois retailer)_____________________________

City, state, ZIP _________________________________________

Illinois business tax number

Step 3: Describe the item purchased

1

2

Year, make, and model ______________________________

Other (describe items such as replacement parts or nonvehicle

rolling stock)

Identification no. ___________________________________

______________________________________________________

Step 4: Describe the way in which the item purchased will be used

The item described in Step 3 will be used as rolling stock for hire to haul persons or commodities in interstate commerce on a regular and

frequent basis, and (check all boxes that apply):

1

2

the journeys or shipments for which the item is used

the item will be used as rolling stock in Illinois while moving

as rolling stock will originate or terminate outside Illinois

physically between points in states other than Illinois.

on other carriers.

Step 5: Identify the buyer

1

_______________________________________

4

Name

Is the buyer a lessor who will lease the item

described in Step 3?

yes

no

2

Address _________________________________________

If yes, go to Step 6. If no, complete Lines 5 and 6 in this step,

Number and street or post office box

and go to Step 7.

5

City, state, ZIP ____________________________________

Certificate of Authority no. ________________________________

3

6

Phone ___________________________________________

(

)

-

Certificate of Authority date issued

__ __ / __ __ / __ __ __ __

Area code

Month

Day

Year

Step 6: If the buyer is a lessor, identify the lessee

(if not, go to Step 7)

1

_______________________________________

3

Name

Phone ________________________________________________

(

)

-

Area code

2

4

Address _________________________________________

Certificate of Authority no. ________________________________

Number and street or post office box

5

City, state, ZIP ____________________________________

Certificate of Authority date issued

__ __ / __ __ / __ __ __ __

Month

Day

Year

Step 7: Sign the certification

(buyer or buyer/lessor)

Check the appropriate box.

I certify that I am an interstate carrier for hire and that

I certify that I am a lessor and that the lessee of the item

I will use the purchased item as rolling stock to haul

purchased is an interstate carrier for hire who will use the

persons or commodities in interstate commerce on a

purchased item as rolling stock to haul persons or

regular and frequent basis.

commodities in interstate commerce on a regular

and frequent basis.

Under penalties of perjury, I state that I have examined this certification and, to the best of my knowledge, it is true, correct, and

complete.

____________________________________________

__________________________________________________

Signature of buyer

Name of buyer (please print)

__ __ / __ __ / __ __ __ __

__________________________________________________

Business title

Month

Day

Year

This form is authorized as outlined by the Retailers’ Occupation Tax Act, related tax acts, and the Vehicle Use Tax Act. Disclosure of this information is REQUIRED.

RUT-7 front (R-10/97)

Failure to provide information could result in this form’s not being processed. This form has been approved by the Forms Management Center.

IL-492-0008

1

1