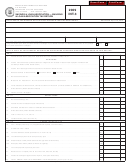

Form Int-3 Draft - Savings & Loan Association - Building & Loan Association Tax Return - 2017 Page 3

ADVERTISEMENT

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

Missouri Department of Revenue

General Instructions - 2016 Savings and Loan Return

Section 148.610

–

148.710, RSMo

This information is for guidance only and does not state the complete law.

If any association operates more than one office or branch in

The 2016 Savings and Loan Return

(Form

INT-3) must be completed

and filed by April 18, 2017. The tax is based upon the taxpayer’s net

Missouri, the association shall file one return. The association

income for the 2016 calendar year. An extension of time for filing

must complete the Financial Institution Tax Schedule B

(Form

2331), listing the address of each office or branch and showing the

this return may be granted by the Director of Revenue. When an

extension is granted, the taxpayer is required to pay, as part of any

total dollar amount of savings accounts, deposits and repurchase

agreements of each office or branch and the total for the association.

tax due, interest thereon at the rate determined by

Section 32.065,

RSMo, from the day when such return should have been filed, if no

If an association has an office or offices outside Missouri, the total

of the dollar amount of deposits and accounts at an office or offices

such extension had been granted. Visit the Department’s website

at

to obtain the annual interest rate.

outside Missouri shall be excluded in determining the total deposits

Pursuant to Regulation

12 CSR

10-10.070, an extension of time may

and accounts of the taxpayer. Schedule B must be completed and

not exceed 180 days from the due date of April 18.

submitted with the Savings and Loan Tax Return.

Review the state law prior to the completion of this tax return, since

All savings and loan associations must complete this tax return

reflecting their total business activities from all sources. Savings

the Internal Revenue Code and the state law differ in the accounting

for various transactions. A copy of your Federal Form 1120 or 1120S

and loan associations conducting business in multiple states should

must be attached to the Missouri Savings & Loan Tax Return.

refer to the instructions for Line 19.

Instructions

County Code - Enter your three digit county code of the principal

Line 8

Enter deductions claimed on the federal return which

place of your institution from the list provided at the end of these

are not allowable on this return and income not included on the

federal return which is required to be included on this return. Attach

instructions.

a detailed schedule.

Part I

Line 1

Enter the amount of taxable income (loss) from Federal

Line 9

Enter the total of Lines 1 through 8.

Form 1120, Line 28, before any net operating loss deduction or

Part II

special deduction is applied, or Federal Form 1120S, Line 21.

Line 10 Enter the amount of actual bad debt charge offs.

Line 2

Enter all income received from state and political

Line 11 Enter the current year deduction for federal income

subdivision obligations excluded on the federal return. Explain

taxes. The current year deduction will be the amount actually

if different from tax-exempt interest shown on the federal return.

accrued (if an accrual basis taxpayer) or paid (if a cash basis

Line 3

Enter all income received from federal government

taxpayer) during the year. Accrual basis taxpayers that are

members of an affiliated group filing a consolidated federal

se cur i ties excluded from the federal return.

income tax return shall allocate its consolidated federal tax

Line 4

Enter the bad debt claimed on the federal return or any

liability among the members of the group for the year by using

additions to a bad debt reserve claimed as a de duc tion on the

the method elected to allocate earnings and profits by the group

federal return. (The reserve method is not a permissible method on

under Internal Revenue Code Section 1552, without regard to any

this return.) In the appropriate box, indicate the bad debt method

additional allocations under Treasury Regulation 1.1502-33(d).

used on the federal return.

If no election was made, the taxpayer shall allocate according

Line 5

Enter the excess, if any, of recoveries of bad debts

to Section 1552(a)(1), IRC.

previously charged off over current year’s charge offs. Attach

Cash basis taxpayers that are members of an affiliated group

schedule of bad debt computation.

filing a consolidated federal income tax return shall allocate the

Line 6

Enter the amount of Missouri Savings and Loan tax

consolidated tax paid or refunded during the year by using the

(imposed by Chapter 148, RSMo) deducted on the federal return.

method elected to allocate earnings and profits by the group

under Internal Rev e nue Code Section 1552 for the applicable

Line 7

Enter the total credits from Schedule A of this return. The

year without regard to any additional allocations under Treasury

amount of taxes claimed as a deduction on the federal return but

Regulation 1.1502-33(d). If no election was made, the taxpayer

claimed as a credit on Line 20 of this return includes all taxes paid

shall allocate according to Section 1552(1)(1), IRC.

directly to the State of Missouri or any political subdivision thereof,

except taxes on tangible personal property owned by the taxpayer

Line 12 Enter the amount of charitable contributions actually

and held for lease or rental to others, contributions paid pursuant

made in excess of the amount allowed, if any, on the federal

to the unemployment compensation law of Missouri, real estate

return. Attach a schedule of charitable con tri bu tions if not

taxes, social security taxes, sales and use taxes and taxes imposed

included with the federal return.

by this law. Explain the difference, if any, between the amount

Line 13 Enter the total amount of any deduction claimed on this

shown on Line 7 of this return and the federal return. Please submit

return and not included on the federal return. These deductions

the schedule of taxes deducted on the federal return for verification

must be itemized on a schedule attached to this return.

purposes. The savings and loan assessment fee is not an allowable

credit. The annual registration fee is not an allowable credit because

Line 14 Enter the total amount of Lines 10, 11, 12, and 13.

it is not a tax.

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4