Instructions For Form Sc 1040a - South Carolina Income Tax - 1999

ADVERTISEMENT

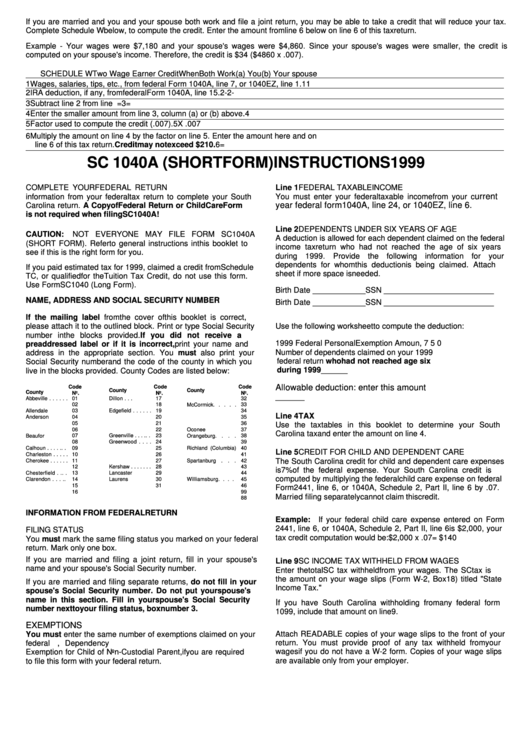

If you are married and you and your spouse both work and file a joint return, you may be able to take a credit that will reduce your tax.

Complete Schedule W below, to compute the credit. Enter the amount from line 6 below on line 6 of this tax return.

Example - Your wages were $7,180 and your spouse's wages were $4,860. Since your spouse's wages were smaller, the credit is

computed on your spouse's income. Therefore, the credit is $34 ($4860 x .007).

SCHEDULE W

Two Wage Earner Credit When Both Work

(a) You

(b) Your spouse

1 Wages, salaries, tips, etc., from federal Form 1040A, line 7, or 1040EZ, line 1.

1

1

2 IRA deduction, if any, from federal Form 1040A, line 15.

2-

2-

3 Subtract line 2 from line 1. Enter the result here.

3=

3=

4 Enter the smaller amount from line 3, column (a) or (b) above.

4

5 Factor used to compute the credit (.007).

5

X .007

6 Multiply the amount on line 4 by the factor on line 5. Enter the amount here and on

line 6 of this tax return. Credit may not exceed $210.

6=

SC 1040A (SHORT FORM) INSTRUCTIONS 1999

COMPLETE YOUR FEDERAL RETURN FIRST. You need the

Line 1

FEDERAL TAXABLE INCOME

urrent

information from your federal tax return to complete your South

You must enter your federal taxable income from your c

year federal form 1040A, line 24, or 1040EZ, line 6.

Carolina return. A Copy of Federal Return or Child Care Form

is not required when filing SC1040A!

Line 2

DEPENDENTS UNDER SIX YEARS OF AGE

CAUTION:

NOT EVERYONE MAY FILE FORM SC1040A

A deduction is allowed for each dependent claimed on the federal

(SHORT FORM). Refer to general instructions in this booklet to

income tax return who had not reached the age of six years

see if this is the right form for you.

during 1999. Provide the following information for your

.

dependents for whom this deduction is being claimed

Attach

If you paid estimated tax for 1999, claimed a credit from Schedule

sheet if more space is needed.

TC, or qualified for the Tuition Tax Credit, do not use this form.

Use Form SC1040 (Long Form).

Birth Date ____________

SSN _________________________

NAME, ADDRESS AND SOCIAL SECURITY NUMBER

Birth Date ____________

SSN _________________________

If the mailing label from the cover of this booklet is correct,

please attach it to the outlined block. Print or type Social Security

Use the following worksheet to compute the deduction:

number in the blocks provided. If you did not receive a

1999 Federal Personal Exemption Amount . . . . . . .

2,750

preaddressed label or if it is incorrect, print your name and

Number of dependents claimed on your 1999

address in the appropriate section. You must also print your

federal return who had not reached age six

Social Security number and the code of the county in which you

during 1999 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

x ______

live in the blocks provided. County Codes are listed below:

Allowable deduction: enter this amount

Code

Code

Code

County

County

County

No.

No.

No.

on line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______

01

Dillon . . . . . . . . .

17

32

Abbeville . . . . . .

Lexington . . . . . .

Aiken . . . . . . . . .

02

Dorchester . . . . .

18

McCormick. . . . .

33

Allendale . . . . . .

03

Edgefield . . . . . .

19

Marion . . . . . . . .

34

Line 4

TAX

Anderson . . . . . .

04

Fairfield . . . . . . .

20

Marlboro . . . . . . .

35

Bamberg . . . . . . .

05

Florence . . . . . . .

21

Newberry . . . . . .

36

Use the tax tables in this booklet to determine your South

Barnwell . . . . . . .

06

Georgetown . . . .

22

Oconee . . . . . . . .

37

Carolina tax and enter the amount on line 4.

Beaufort . . . . . . .

07

Greenville . . . . . .

23

Orangeburg. . . .

38

Berkeley . . . . . . .

08

Greenwood . . . .

24

Pickens . . . . . . . .

39

Calhoun . . . . . . .

09

Hampton . . . . . . .

25

Richland (Columbia)

40

Line 5

CREDIT FOR CHILD AND DEPENDENT CARE

10

Horry . . . . . . . . .

26

41

Charleston . . . . .

Saluda . . . . . . . .

11

Jasper . . . . . . . .

27

42

The South Carolina credit for child and dependent care expenses

Cherokee . . . . . .

Spartanburg . . .

Chester . . . . . . .

12

Kershaw . . . . . . .

28

Sumter . . . . . . . .

43

is 7% of the federal expense. Your South Carolina credit is

Chesterfield . . . .

13

Lancaster . . . . . .

29

Union . . . . . . . . .

44

computed by multiplying the federal child care expense on federal

Clarendon . . . . .

14

Laurens . . . . . . .

30

Williamsburg . . . .

45

Colleton . . . . . . .

15

Lee . . . . . . . . . . .

31

York . . . . . . . . . . . . .

46

Form 2441, line 6, or 1040A, Schedule 2, Part II, line 6 by .07.

Darlington . . . . . .

16

Out of SC . . . . . . .

99

Married filing separately cannot claim this credit.

Out of US . . . . . . . .

88

INFORMATION FROM FEDERAL RETURN

Example: If your federal child care expense entered on Form

2441, line 6, or 1040A, Schedule 2, Part II, line 6 is $2,000, your

FILING STATUS

tax credit computation would be:

$2,000 x .07= $140

You must mark the same filing status you marked on your federal

return. Mark only one box.

If you are married and filing a joint return, fill in your spouse's

Line 9

SC INCOME TAX WITHHELD FROM WAGES

name and your spouse's Social Security number.

Enter the total SC tax withheld from your wages. The SC tax is

the amount on your wage slips (Form W-2, Box 18) titled "State

If you are married and filing separate returns, do not fill in your

Income Tax."

spouse's Social Security number. Do not put your spouse's

name in this section. Fill in your spouse's Social Security

I

f you have South Carolina withholding from any federal form

number next to your filing status, box number 3.

1099, include that amount on line 9.

EXEMPTIONS

Attach READABLE copies of your wage slips to the front of your

You must enter the same number of exemptions claimed on your

return. You must provide proof of any tax withheld from your

federal return. Also attach federal Form 8332, Dependency

wages if you do not have a W-2 form. Copies of your wage slips

Exemption for Child of Non-Custodial Parent, if you are required

are available only from your employer.

to file this form with your federal return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1