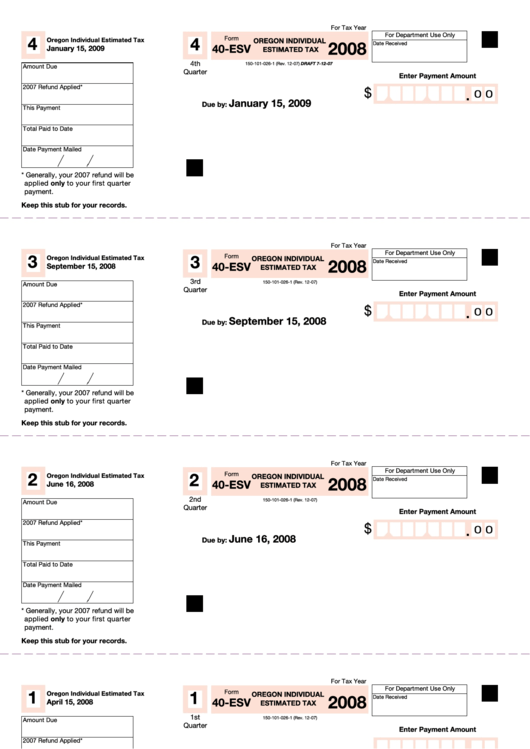

Form 40-Esv - Oregon Individual Estimated Tax - 2008

ADVERTISEMENT

For Department Use Only

For Tax Year

4

4

Form

Oregon Individual Estimated Tax

OREGON INDIVIDUAL

2008

Date Received

40-ESV

January 15, 2009

ESTIMATED TAX

4th

150-101-026-1 (Rev. 12-07) DRAFT 7-12-07

Amount Due

Quarter

Enter Payment Amount

2007 Refund Applied*

$

0 0

January 15, 2009

Due by:

This Payment

Total Paid to Date

Date Payment Mailed

* Generally, your 2007 refund will be

applied only to your first quarter

payment.

Keep this stub for your records.

For Department Use Only

For Tax Year

3

3

Form

Oregon Individual Estimated Tax

OREGON INDIVIDUAL

2008

Date Received

40-ESV

September 15, 2008

ESTIMATED TAX

3rd

150-101-026-1 (Rev. 12-07)

Amount Due

Quarter

Enter Payment Amount

2007 Refund Applied*

$

0 0

September 15, 2008

Due by:

This Payment

Total Paid to Date

Date Payment Mailed

* Generally, your 2007 refund will be

applied only to your first quarter

payment.

Keep this stub for your records.

For Department Use Only

For Tax Year

2

2

Form

Oregon Individual Estimated Tax

OREGON INDIVIDUAL

2008

Date Received

40-ESV

June 16, 2008

ESTIMATED TAX

2nd

150-101-026-1 (Rev. 12-07)

Amount Due

Quarter

Enter Payment Amount

2007 Refund Applied*

$

0 0

June 16, 2008

Due by:

This Payment

Total Paid to Date

Date Payment Mailed

* Generally, your 2007 refund will be

applied only to your first quarter

payment.

Keep this stub for your records.

For Department Use Only

For Tax Year

1

1

Form

Oregon Individual Estimated Tax

OREGON INDIVIDUAL

2008

Date Received

40-ESV

April 15, 2008

ESTIMATED TAX

1st

150-101-026-1 (Rev. 12-07)

Amount Due

Quarter

Enter Payment Amount

2007 Refund Applied*

$

0 0

April 15, 2008

Due by:

This Payment

Total Paid to Date

Date Payment Mailed

* Generally, your 2007 refund will be

applied only to your first quarter

payment.

Keep this stub for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1