Oregon Individual Estimated Tax Check Form - City Of Oregon Tax Department - Ohio

ADVERTISEMENT

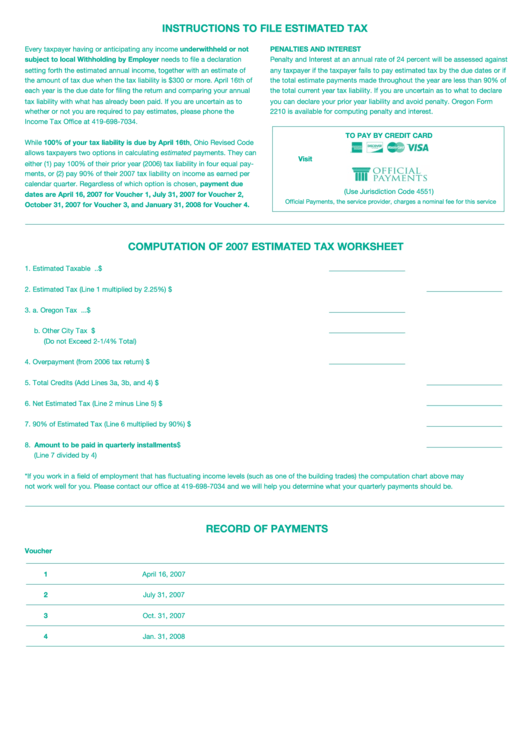

INSTRUCTIONS TO FILE ESTIMATED TAX

Every taxpayer having or anticipating any income underwithheld or not

PENALTIES AND INTEREST

subject to local Withholding by Employer needs to file a declaration

Penalty and Interest at an annual rate of 24 percent will be assessed against

setting forth the estimated annual income, together with an estimate of

any taxpayer if the taxpayer fails to pay estimated tax by the due dates or if

the amount of tax due when the tax liability is $300 or more. April 16th of

the total estimate payments made throughout the year are less than 90% of

each year is the due date for filing the return and comparing your annual

the total current year tax liability. If you are uncertain as to what to declare

tax liability with what has already been paid. If you are uncertain as to

you can declare your prior year liability and avoid penalty. Oregon Form

whether or not you are required to pay estimates, please phone the

2210 is available for computing penalty and interest.

Income Tax Office at 419-698-7034.

TO PAY BY CREDIT CARD

While 100% of your tax liability is due by April 16th, Ohio Revised Code

allows taxpayers two options in calculating estimated payments. They can

Visit or call 1-800-2PAY-TAX

either (1) pay 100% of their prior year (2006) tax liability in four equal pay-

ments, or (2) pay 90% of their 2007 tax liability on income as earned per

calendar quarter. Regardless of which option is chosen, payment due

(Use Jurisdiction Code 4551)

dates are April 16, 2007 for Voucher 1, July 31, 2007 for Voucher 2,

Official Payments, the service provider, charges a nominal fee for this service

October 31, 2007 for Voucher 3, and January 31, 2008 for Voucher 4.

COMPUTATION OF 2007 ESTIMATED TAX WORKSHEET

1. Estimated Taxable Income......................................................................................................

$

2. Estimated Tax (Line 1 multiplied by 2.25%) ...............................................................................................................................

$

3. a. Oregon Tax Withheld .........................................................................................................

$

b. Other City Tax Withheld .....................................................................................................

$

(Do not Exceed 2-1/4% Total)

4. Overpayment (from 2006 tax return) ......................................................................................

$

5. Total Credits (Add Lines 3a, 3b, and 4) ......................................................................................................................................

$

6. Net Estimated Tax (Line 2 minus Line 5) ....................................................................................................................................

$

7. 90% of Estimated Tax (Line 6 multiplied by 90%) .....................................................................................................................

$

8. Amount to be paid in quarterly installments..........................................................................................................................

$

(Line 7 divided by 4)

*If you work in a field of employment that has fluctuating income levels (such as one of the building trades) the computation chart above may

not work well for you. Please contact our office at 419-698-7034 and we will help you determine what your quarterly payments should be.

RECORD OF PAYMENTS

Voucher No.

Due Date

Check No.

Date Paid

Amount Paid

1

April 16, 2007

2

July 31, 2007

3

Oct. 31, 2007

4

Jan. 31, 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2