2017

Form 800ES

VIRGINIA DEPARTMENT OF TAXATION

INSURANCE PREMIUMS LICENSE TAX

ESTIMATED TAX PAYMENT VOUCHERS

GENERAL INFORMATION

Online Services

The Department’s website, , has information to help you with your tax filing responsibilities.

eForms: File and pay your estimated tax online for free. Simply complete the online version of the paper estimated

voucher by entering the tax information as you would if you were completing a paper form.

Business iFile: An online version of the estimated voucher allows you to enter tax information as you would if you were

completing a paper form and schedule your date of payment.

EFT Credit: Electronically send your tax payment. See our Electronic Payment Guide for details.

e-Alerts: With our free e-Alerts service, we’ll send you e-mails on topics you select. You can even get reminders about

upcoming return due dates. Sign up today on our website.

PDF Forms: Virginia tax forms are available to print or download.

Secure E-mail: Use our iFile Secure Message Center.

INSTRUCTIONS FOR 2017

DECLARATION OF ESTIMATED TAX FOR THE INSURANCE PREMIUMS LICENSE TAX

FILING REQUIREMENTS - Any company with annual direct gross premiums license tax liability that is expected to exceed

$3,000 (after tax credits) is required to file estimated payments. Declarations must be dated and signed by a company officer.

For more information, call the Office of Customer Services at (804) 404-4163.

WHERE TO FILE AND PAY - You can file and pay online at . For paper filing, file the declaration with

the Virginia Department of Taxation, PO Box 26179, Richmond, VA 23260-6179. The declaration must be accompanied

by a check or money order made payable to the Virginia Department of Taxation for the amount of the installment due.

WHEN TO FILE AND PAY - Insurance companies should follow the declaration and payment schedule shown in the table

below.

FAILURE TO PAY - Underpayment of estimated insurance premiums license tax will generally result in an addition to the

tax from the due date of the install ment until paid, or until the due date for filing the annual return, whichever is earlier. If the

company has an underpayment of estimated tax and believes an addition to the tax should not be assessed, Form 800C,

Underpayment of Virginia Estimated Premiums License Tax, must be enclosed with the company’s premiums license tax

return along with schedules that support the applicable exception.

OTHER INQUIRIES - Call (804) 404-4163 or write Virginia Department of Taxation, PO Box 715, Richmond, VA 23218-

0715. Do not mail returns to this address.

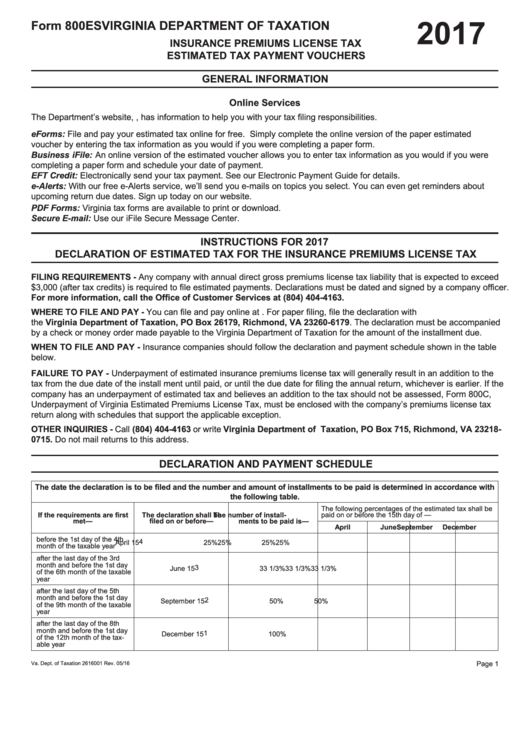

DECLARATION AND PAYMENT SCHEDULE

The date the declaration is to be filed and the number and amount of installments to be paid is determined in accordance with

the following table.

The following percentages of the estimated tax shall be

If the requirements are first

The declaration shall be

The number of install-

paid on or before the 15th day of —

met—

filed on or before—

ments to be paid is—

April

June

September

December

before the 1st day of the 4th

4

April 15

25%

25%

25%

25%

month of the taxable year

after the last day of the 3rd

month and before the 1st day

3

June 15

.......

33 1/3%

33 1/3%

33 1/3%

of the 6th month of the taxable

year

after the last day of the 5th

month and before the 1st day

2

September 15

.......

.......

50%

50%

of the 9th month of the taxable

year

after the last day of the 8th

month and before the 1st day

1

December 15

.......

.......

.......

100%

of the 12th month of the tax-

able year

Page 1

Va. Dept. of Taxation 2616001 Rev. 05/16

1

1 2

2 3

3 4

4