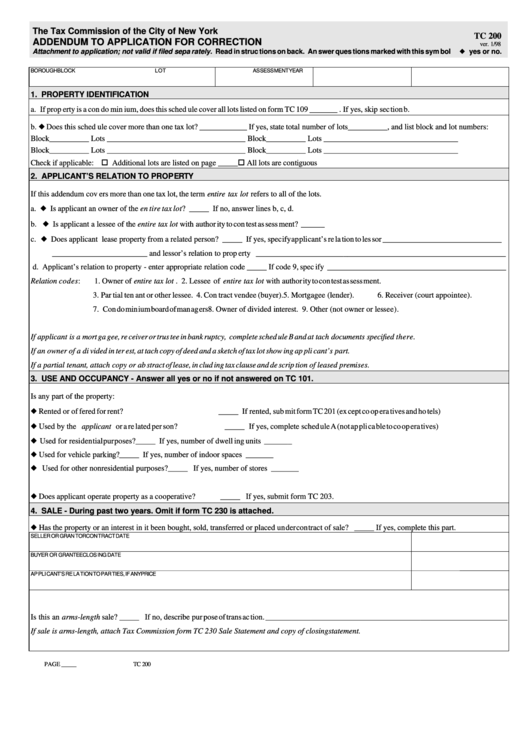

The Tax Com mis sion of the City of New York

TC 200

AD DEN DUM TO AP PLI CA TION FOR CORRECTION

ver. 1/98

At tach ment to ap pli ca tion; not valid if filed sepa rately. Read in struc tions on back. An swer ques tions marked with this sym bol u yes or no.

BOR OUGH

BLOCK

LOT

AS SESS MENT YEAR

1. PROP ERTY IDEN TI FI CA TION

a. If prop erty is a con do min ium, does this sched ule cover all lots listed on form TC 109 _______ . If yes, skip sec tion b.

b. u Does this sched ule cover more than one tax lot? ____________ If yes, state to tal number of lots __________, and list block and lot num bers:

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Check if ap pli ca ble: o Ad di tional lots are listed on page _____

o All lots are con tigu ous

2. AP PLI CANT’S RE LA TION TO PROP ERTY

If this ad den dum cov ers more than one tax lot, the term en tire tax lot re fers to all of the lots.

a. u Is ap pli cant an owner of the en tire tax lot ? _____ If no, an swer lines b, c, d.

b. u Is ap pli cant a les see of the en tire tax lot with author ity to con test as sess ment? ______

c. u Does ap pli cant lease prop erty from a re lated per son? _____ If yes, spec ify ap pli cant’s re la tion to les sor ______________________________

________________________ and les sor’s re la tion to prop erty _______________________________________________________________

d. Ap pli cant’s re la tion to prop erty - en ter ap pro pri ate re la tion code _____ If code 9, spec ify _____________________________________________

Re la tion codes:

1. Owner of en tire tax lot. 2. Les see of en tire tax lot with author ity to con test as sess ment.

3. Par tial ten ant or other lessee. 4. Con tract vendee (buyer).

5. Mort ga gee (lender).

6. Re ceiver (court ap pointee).

7. Con do min ium board of man ag ers

8. Owner of di vided in ter est. 9. Other (not owner or les see).

If ap pli cant is a mort ga gee, re ceiver or trus tee in bank ruptcy, complete sched ule B and at tach docu ments speci fied there.

If an owner of a di vided in ter est, at tach copy of deed and a sketch of tax lot show ing ap pli cant’s part.

If a par tial ten ant, at tach copy or ab stract of lease, in clud ing tax clause and de scrip tion of leased prem ises.

3. USE AND OC CU PANCY - An swer all yes or no if not an swered on TC 101.

Is any part of the prop erty:

u Rented or of fered for rent?

_____ If rented, sub mit form TC 201 (ex cept co op era tives and ho tels)

u Used by the ap pli cant or a re lated per son?

_____ If yes, com plete sched ule A (not ap pli ca ble to co op era tives)

u Used for resi den tial pur poses?

_____ If yes, number of dwell ing units _______

u Used for ve hi cle park ing?

_____ If yes, number of in door spaces _______

u Used for other non resi den tial pur poses?

_____ If yes, number of stores _______

u Does ap pli cant op er ate prop erty as a co op era tive?

_____ If yes, sub mit form TC 203.

4. SALE - Dur ing past two years. Omit if form TC 230 is at tached.

u Has the prop erty or an in ter est in it been bought, sold, trans ferred or placed un der con tract of sale? _____ If yes, com plete this part.

SELLER OR GRAN TOR

CON TRACT DATE

BUYER OR GRANTEE

CLOS ING DATE

AP PLI CANT’S RE LA TION TO PAR TIES, IF ANY

PRICE

Is this an arms- length sale? _____ If no, de scribe pur pose of trans ac tion. _____________________________________________________________

If sale is arms- length, at tach Tax Com mis sion form TC 230 Sale State ment and copy of clos ing state ment.

PAGE _____

TC 200

1

1 2

2