Instructions For Form 115a - Tax On Premiums Charged By Unauthorized Insurers

ADVERTISEMENT

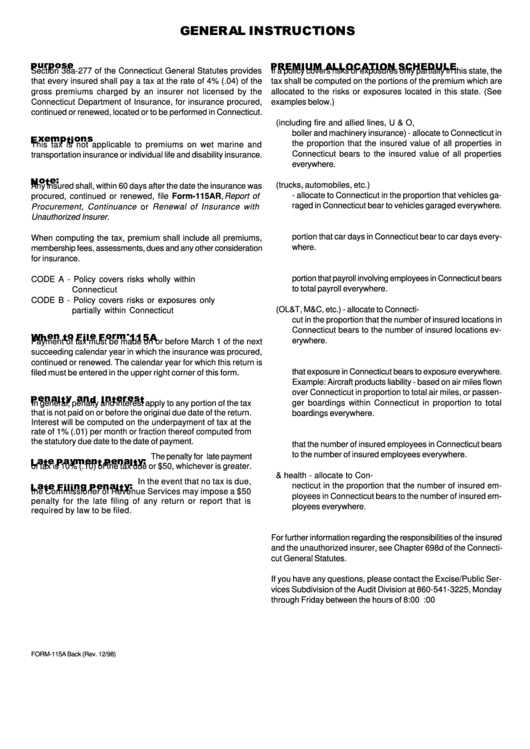

Section 38a-277 of the Connecticut General Statutes provides

If a policy covers risks or exposures only partially in this state, the

that every insured shall pay a tax at the rate of 4% (.04) of the

tax shall be computed on the portions of the premium which are

gross premiums charged by an insurer not licensed by the

allocated to the risks or exposures located in this state. (See

Connecticut Department of Insurance, for insurance procured,

examples below.)

continued or renewed, located or to be performed in Connecticut.

A. Property coverage (including fire and allied lines, U & O,

boiler and machinery insurance) - allocate to Connecticut in

the proportion that the insured value of all properties in

This tax is not applicable to premiums on wet marine and

Connecticut bears to the insured value of all properties

transportation insurance or individual life and disability insurance.

everywhere.

B. Coverage on mobile equipment (trucks, automobiles, etc.)

Any insured shall, within 60 days after the date the insurance was

- allocate to Connecticut in the proportion that vehicles ga-

procured, continued or renewed, file Form-115AR, Report of

raged in Connecticut bear to vehicles garaged everywhere.

Procurement, Continuance or Renewal of Insurance with

Unauthorized Insurer.

C. Railroad rolling stock - allocate to Connecticut in the pro-

portion that car days in Connecticut bear to car days every-

When computing the tax, premium shall include all premiums,

where.

membership fees, assessments, dues and any other consideration

for insurance.

D. Workers compensation - allocate to Connecticut in the pro-

portion that payroll involving employees in Connecticut bears

CODE A - Policy covers risks wholly within

to total payroll everywhere.

Connecticut

CODE B - Policy covers risks or exposures only

E. Liability coverages (OL&T, M&C, etc.) - allocate to Connecti-

partially within Connecticut

cut in the proportion that the number of insured locations in

Connecticut bears to the number of insured locations ev-

erywhere.

Payment of tax must be made on or before March 1 of the next

succeeding calendar year in which the insurance was procured,

F.

Products liability - allocate to Connecticut in the proportion

continued or renewed. The calendar year for which this return is

that exposure in Connecticut bears to exposure everywhere.

filed must be entered in the upper right corner of this form.

Example: Aircraft products liability - based on air miles flown

over Connecticut in proportion to total air miles, or passen-

I

ger boardings within Connecticut in proportion to total

n general, penalty and interest apply to any portion of the tax

that is not paid on or before the original due date of the return.

boardings everywhere.

Interest will be computed on the underpayment of tax at the

rate of 1% (.01) per month or fraction thereof computed from

G. Travel accident - allocate to Connecticut in the proportion

the statutory due date to the date of payment.

that the number of insured employees in Connecticut bears

to the number of insured employees everywhere.

The penalty for late payment

of tax is 10% (.10) of the tax due or $50, whichever is greater.

H. Group life and group accident & health - allocate to Con-

In the event that no tax is due,

necticut in the proportion that the number of insured em-

the Commissioner of Revenue Services may impose a $50

ployees in Connecticut bears to the number of insured em-

penalty for the late filing of any return or report that is

ployees everywhere.

required by law to be filed.

For further information regarding the responsibilities of the insured

and the unauthorized insurer, see Chapter 698d of the Connecti-

cut General Statutes.

If you have any questions, please contact the Excise/Public Ser-

vices Subdivision of the Audit Division at 860-541-3225, Monday

through Friday between the hours of 8:00 a.m. and 5:00 p.m.

FORM-115A Back (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1