Instructions For Form Rct-121a - Gross Premiums Tax Report For Domestic Casualty Life Or Life Insurance Companies Associations Or Exchanges

ADVERTISEMENT

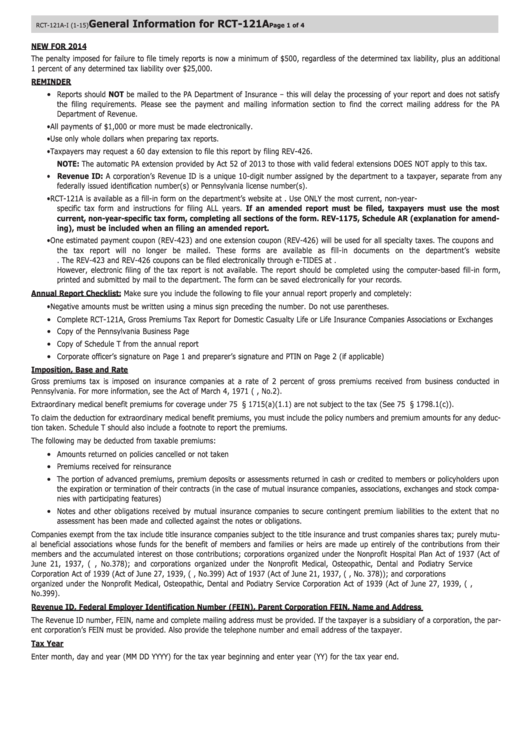

General Information for RCT-121A

RCT-121A-I (1-15)

Page 1 of 4

NEW FOR 2014

The penalty imposed for failure to file timely reports is now a minimum of $500, regardless of the determined tax liability, plus an additional

1 percent of any determined tax liability over $25,000.

REMINDER

• Reports should NOT be mailed to the PA Department of Insurance – this will delay the processing of your report and does not satisfy

the filing requirements. Please see the payment and mailing information section to find the correct mailing address for the PA

Department of Revenue.

• All payments of $1,000 or more must be made electronically.

• Use only whole dollars when preparing tax reports.

• Taxpayers may request a 60 day extension to file this report by filing REV-426.

NOTE: The automatic PA extension provided by Act 52 of 2013 to those with valid federal extensions DOES NOT apply to this tax.

• Revenue ID: A corporation’s Revenue ID is a unique 10-digit number assigned by the department to a taxpayer, separate from any

federally issued identification number(s) or Pennsylvania license number(s).

• RCT-121A is available as a fill-in form on the department’s website at Use ONLY the most current, non-year-

specific tax form and instructions for filing ALL years. If an amended report must be filed, taxpayers must use the most

current, non-year-specific tax form, completing all sections of the form. REV-1175, Schedule AR (explanation for amend-

ing), must be included when an filing an amended report.

• One estimated payment coupon (REV-423) and one extension coupon (REV-426) will be used for all specialty taxes. The coupons and

the tax report will no longer be mailed. These forms are available as fill-in documents on the department’s website

The REV-423 and REV-426 coupons can be filed electronically through e-TIDES at

However, electronic filing of the tax report is not available. The report should be completed using the computer-based fill-in form,

printed and submitted by mail to the department. The form can be saved electronically for your records.

Annual Report Checklist: Make sure you include the following to file your annual report properly and completely:

• Negative amounts must be written using a minus sign preceding the number. Do not use parentheses.

• Complete RCT-121A, Gross Premiums Tax Report for Domestic Casualty Life or Life Insurance Companies Associations or Exchanges

• Copy of the Pennsylvania Business Page

• Copy of Schedule T from the annual report

• Corporate officer’s signature on Page 1 and preparer’s signature and PTIN on Page 2 (if applicable)

Imposition, Base and Rate

Gross premiums tax is imposed on insurance companies at a rate of 2 percent of gross premiums received from business conducted in

Pennsylvania. For more information, see the Act of March 4, 1971 (P.L. 6, No.2).

Extraordinary medical benefit premiums for coverage under 75 Pa.C.S. § 1715(a)(1.1) are not subject to the tax (See 75 Pa.C.S. § 1798.1(c)).

To claim the deduction for extraordinary medical benefit premiums, you must include the policy numbers and premium amounts for any deduc-

tion taken. Schedule T should also include a footnote to report the premiums.

The following may be deducted from taxable premiums:

• Amounts returned on policies cancelled or not taken

• Premiums received for reinsurance

• The portion of advanced premiums, premium deposits or assessments returned in cash or credited to members or policyholders upon

the expiration or termination of their contracts (in the case of mutual insurance companies, associations, exchanges and stock compa-

nies with participating features)

• Notes and other obligations received by mutual insurance companies to secure contingent premium liabilities to the extent that no

assessment has been made and collected against the notes or obligations.

Companies exempt from the tax include title insurance companies subject to the title insurance and trust companies shares tax; purely mutu-

al beneficial associations whose funds for the benefit of members and families or heirs are made up entirely of the contributions from their

members and the accumulated interest on those contributions; corporations organized under the Nonprofit Hospital Plan Act of 1937 (Act of

June 21, 1937, (P.L. 1948, No.378); and corporations organized under the Nonprofit Medical, Osteopathic, Dental and Podiatry Service

Corporation Act of 1939 (Act of June 27, 1939, (P.L. 1125, No.399) Act of 1937 (Act of June 21, 1937, (P.L. 1948, No. 378)); and corporations

organized under the Nonprofit Medical, Osteopathic, Dental and Podiatry Service Corporation Act of 1939 (Act of June 27, 1939, (P.L. 1125,

No.399).

Revenue ID, Federal Employer Identification Number (FEIN), Parent Corporation FEIN, Name and Address

The Revenue ID number, FEIN, name and complete mailing address must be provided. If the taxpayer is a subsidiary of a corporation, the par-

ent corporation’s FEIN must be provided. Also provide the telephone number and email address of the taxpayer.

Tax Year

Enter month, day and year (MM DD YYYY) for the tax year beginning and enter year (YY) for the tax year end.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4