Instructions For Form Mo-Ptc - Property Tax Credit Claim - 1998

ADVERTISEMENT

You or your spouse must have been Missouri residents for the entire 1998 calendar

Instructions for

year. If claimant would have otherwise qualified for a property tax credit and

would have been a resident for the entire 1998 calendar year but died before the

1998 Form MO-PTC

last day of the calendar year,the claimant would still qualify for the credit for 1998.

Property Tax Credit Claim

OR

2. You or your spouse may also qualify for this credit if you or your spouse is a

These instructions are for guidance only and do not state the complete law.

veteran of any branch of the armed forces of the United States or this state and

you or your spouse became 100% disabled as a result of such service. If you are

the surviving spouse of a 100% service connected disabled veteran, all of the

veteran’s benefits must be reported. Note: You must attach a copy of the letter

Important Items for 1998

received from the Department of Veterans Affairs that states your qualifications

as a 100% service connected disabled veteran.This letter must state,“To be filed

1. If you are required to file a Form MO-1040, Individual Income Tax Return, you

with Form MO-PTC,Property Tax Credit Claim.”

must attach Form MO-PTC, Property Tax Credit Claim to that form.This will ensure

OR

efficient processing of your claim.

3. If you or your spouse are under age 65, claimant may qualify for the credit only if

2. The due date for Form MO-PTC is April 15,1999.

disabled as defined in Section 135.010(2), RSMo.Note: Rent must be paid by the

3. Send claims to: Department of Revenue, P.O. Box 2800, Jefferson City, MO

claimant.

65105-2800.

Disabled: (as defined in Section 135.010(2), RSMo). The inability to engage in

any substantial gainful activity by reason of any medically determined physical or

mental impairment which can be expected to result in death or which has lasted or

General Instructions

can be expected to last for a continuous period of not less than 12 months. A

claimant shall not be required to be gainfully employed prior to such disability.

Who May Claim Credit

Note: Minor children do not qualify for the Property Tax Credit.

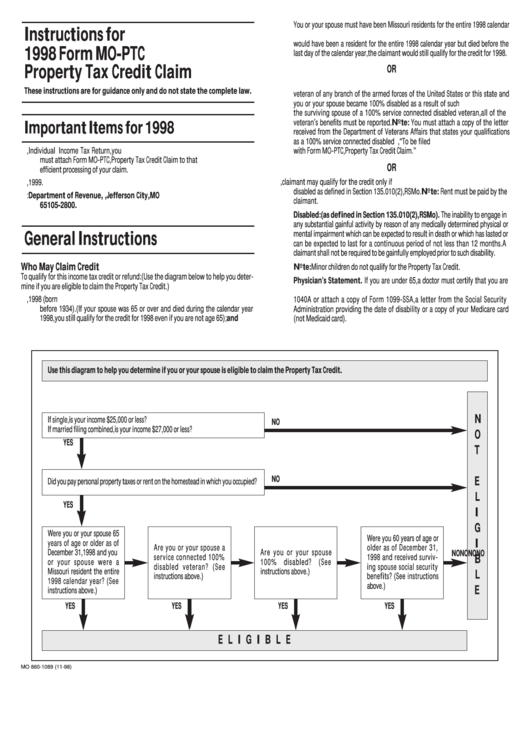

To qualify for this income tax credit or refund:(Use the diagram below to help you deter-

Physician’s Statement. If you are under 65, a doctor must certify that you are

mine if you are eligible to claim the Property Tax Credit.)

disabled. You must complete Part II of either Federal Form 1040 or Federal Form

1. You or your spouse must be 65 years of age or over as of December 31,1998 (born

1040A or attach a copy of Form 1099-SSA, a letter from the Social Security

before 1934). (If your spouse was 65 or over and died during the calendar year

Administration providing the date of disability or a copy of your Medicare card

1998,you still qualify for the credit for 1998 even if you are not age 65);and

(not Medicaid card).

Use this diagram to help you determine if you or your spouse is eligible to claim the Property Tax Credit.

N

If single,is your income $25,000 or less?

NO

If married filing combined,is your income $27,000 or less?

O

YES

T

NO

E

Did you pay personal property taxes or rent on the homestead in which you occupied?

L

YES

I

G

Were you or your spouse 65

Were you 60 years of age or

I

years of age or older as of

Are you or your spouse a

older as of December 31,

December 31, 1998 and you

Are you or your spouse

NO

NO

NO

NO

service connected 100%

1998 and received surviv-

B

or your spouse were a

100% disabled? (See

disabled veteran? (See

ing spouse social security

Missouri resident the entire

instructions above.)

L

instructions above.)

benefits? (See instructions

1998 calendar year? (See

above.)

E

instructions above.)

YES

YES

YES

YES

E L I G I B L E

MO 860-1089 (11-98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4