Instructions For Form Mo-Ptc - Property Tax Credit Claim - 1998 Page 2

ADVERTISEMENT

OR

Property taxes paid are the total county and/or city tax(es) paid on your homestead

exclusive of special assessments, penalties, interest and charges for service. To qualify,

4. You must be 60 years of age or older as of December 31, 1998 (born before 1939) and

property taxes must be paid prior to the time a claim is timely filed. Property taxes paid

receive surviving spouse social security benefits during 1998.You must attach a copy of

for calendar year 1998 may be allowed only on a claim filed for the year 1998.

Form 1099-SSA.

Delinquent property taxes paid in 1998 for a prior year do not qualify to be claimed on

In addition to the above qualifications, the following two qualifications must

your 1998 claim.

also be met for all individuals:

If a claimant owned a homestead as a joint tenant or tenant in common with another person

1. Your total household income cannot exceed $25,000. However, if your filing

or persons,the property taxes allowable shall be those which were paid by the claimant.

status is “married-filing combined,” the total combined household income

If a claimant is paying rent with the option to own, the real estate tax must be claimed

cannot exceed $27,000. (Note: If you are a 100% service connected disabled

instead of rent paid.

veteran, veteran’s payments and benefits are excluded from total household

If a claimant owned or rented different homesteads during the calendar year 1998, the

income); and

allowable property tax credit is the allocated property tax and rent paid based upon

2. You must pay property tax on,or rent,the homestead occupied during 1998.

occupancy for the year.

If you meet the above qualifications,complete Form MO-PTC to determine if you are eligible for

If a homestead is part of a larger unit, such as a farm, or multipurpose or multidwelling

a credit or refund.

building covered by a single tax statement, property taxes allowable will be that per-

centage of the total property taxes as the assessed valuation of the homestead is to the

A married couple generally must file a combined claim, reporting income and property

total assessed valuation.

taxes and/or rent of both.A married couple may file separate claims only if each occupied

separate homesteads for the entire 1998 calendar year. Each must then report his/her

All claims must be signed. Any of the following signatures are acceptable: (1)

individual income and property tax and/or rent paid.

claimant’s signature; (2) claimant’s “X”witnessed by two persons; (3) signature of individ-

ual having Power of Attorney with a copy of the Power of Attorney attached; or (4) signa-

If two (2) or more qualified individuals (not a married couple) occupy the same home-

ture of legal guardian,executor,etc.,with a copy of the legal appointment attached.

stead, each must file a separate claim and report his/her individual income and his/her

portion of real estate taxes and/or rent paid.

Important: If the Form MO-PTC is being filed on behalf of a claimant by a nursing

home or residential care facility, a statement to that effect from the claimant’s legal

An executor, administrator or an heir who has received refusal of letters of administra-

guardian must be attached to the Form MO-PTC.

tion or refusal of letters testamentary may file a claim on behalf of the deceased, if the

deceased fulfilled all of the above qualifications prior to date of death.

Internet/World Wide Web

The Department of Revenue has a home page on the World Wide Web. Individuals with

How to File

access to the Internet can obtain informational materials and Missouri tax forms via our

If you are required to file a Form MO-1040, your completed Form MO-PTC

home page.The address is:

must be attached to that return. The amount of property tax credit, Form MO-PTC,

Step 5, Line 19, must be entered on Form MO-1040, Line 39 and applied to any outstand-

Tax Forms Available by Fax

ing income tax liability with the excess credit to be refunded.

Blank Missouri tax forms are available by fax. To access the “Forms-by-Fax” system call

To determine if you are required to file a Form MO-1040, obtain a copy of the Form

(573) 751-4800 from your fax machine handset. The “Forms-by-Fax” system will take

MO-1040 and instructions or call the nearest Department of Revenue Tax Assistance

you through the steps to fax you a copy of the forms you need. If you are speech or

Center for information. Forms may be obtained by contacting: Department of

hearing impaired,please call TDD (800) 735-2966.

Revenue, Office of Accounting and Support, P.O. Box 3022, Jefferson City, MO

65105-3022 or calling (800) 877-6881. (TDD (800) 735-2966).

Missouri Department of Revenue Bulletin Board (MODOR BBS)

The Department of Revenue has an on-line bulletin board system from which individu-

If you are not required to file a Form MO-1040, you may receive a refund by filing Form

als can obtain blank Missouri tax forms and other informational materials.To access the

MO-PTC only.

bulletin board, dial (573) 751-7846 from your personal computer equipped with a

modem and communications software.The Department of Revenue plans to have most

When and Where to File

Missouri tax forms, tax publications, law changes, the Tax Bulletin and many other infor-

Your claim should be filed on or before April 15, 1999. Mail your completed Form

mational articles available on the MODOR BBS.The service is free of charge; only normal

MO-PTC,whether filed as a return itself,or attached to your Form MO-1040 to:

telephone line charges apply.

Department of Revenue

Americans With Disabilities Act (ADA)

P.O. Box 2800

Jefferson City, MO 65105-2800

The state of Missouri offers a Dual Party Relay Service (DPRS) for speech/hearing impaired

individuals. This service was implemented in order to comply with the Americans with

When the due date falls on a Saturday, Sunday or legal holiday, the return will be considered timely

Disabilities Act (ADA). An individual with speech/hearing impairments may call a voice

if filed on the next business day.

user at (800) 735-2966.

Definitions

Homestead is the dwelling, in Missouri, in which you reside, whether owned or rented,

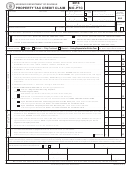

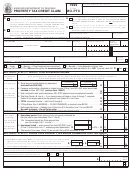

Form MO-PTC

and the surrounding land, not to exceed five (5) acres, as is reasonably necessary for use

of the dwelling as a home. A homestead may be part of a larger unit such as a farm or

Property Tax Credit Claim

building partly rented or used for business. It may be a room in a nursing home, an

apartment or a mobile home unit.

Line-by-Line Instructions

Claimant is the person or persons (husband and wife) claiming the property tax credit

or refund.

These instructions are for guidance only and do not state the complete law.

Household income is the income received by a claimant, spouse and/or children and

If you or your spouse files a Form MO-1040, Individual Income Tax Return, you must

includes all income from sources listed on Form MO-PTC.

attach your Form MO-PTC to that return.

Rent constituting property taxes paid is 20 percent of gross rent paid by a claimant

in the calendar year 1998.Gross rent must be reduced by the amount charged for health

Important: If you are required to file a Form MO-1040, you must complete Form

and personal care services and food furnished as part of the rental agreement.

MO-1040 through Line 37 before you complete Form MO-PTC.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4