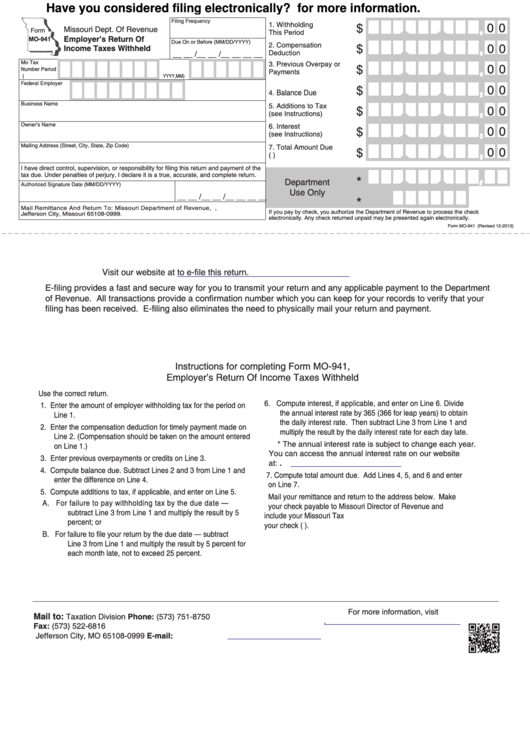

Have you considered filing electronically? Click here for more information.

Filing Frequency

1. Withholding

0 0

$

Missouri Dept. Of Revenue

Form

•

This Period ....................

•

•

Employer’s Return Of

MO-941

Due On or Before (MM/DD/YYYY)

2. Compensation

0 0

$

Income Taxes Withheld

•

__ __ /__ __ /__ __ __ __

Deduction ......................

•

Mo Tax I.D.

For Tax

3. Previous Overpay or

0 0

$

Number

Period

Payments ......................

•

•

( YYYY,MM)

Federal Employer

$

0 0

I.D. Number

Balance Due

4.

...................

•

•

Business Name

5. Additions to Tax

0 0

$

(see Instructions) ...........

•

•

Owner’s Name

6. Interest

0 0

$

•

(see Instructions) ...........

•

Mailing Address (Street, City, State, Zip Code)

7. Total Amount Due

0 0

$

(U.S. funds only) ............

•

•

I have direct control, supervision, or responsibility for filing this return and payment of the

tax due. Under penalties of perjury, I declare it is a true, accurate, and complete return.

*

•

Department

•

Authorized Signature

Date (MM/DD/YYYY)

Use Only

__ __ /__ __ /__ __ __ __

*

Mail Remittance And Return To: Missouri Department of Revenue, P.O. Box 999,

If you pay by check, you authorize the Department of Revenue to process the check

Jefferson City, Missouri 65108‑0999.

electronically. Any check returned unpaid may be presented again electronically.

Form MO‑941 (Revised 12‑2013)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Reset Form

Print Form

Visit our website at

to e‑file this return.

E‑filing provides a fast and secure way for you to transmit your return and any applicable payment to the Department

of Revenue. All transactions provide a confirmation number which you can keep for your records to verify that your

filing has been received. E‑filing also eliminates the need to physically mail your return and payment.

Instructions for completing Form MO‑941,

Employer’s Return Of Income Taxes Withheld

Use the correct return.

6.

Compute interest, if applicable, and enter on Line 6. Divide

1. Enter the amount of employer withholding tax for the period on

the annual interest rate by 365 (366 for leap years) to obtain

Line 1.

the daily interest rate. Then subtract Line 3 from Line 1 and

2. Enter the compensation deduction for timely payment made on

multiply the result by the daily interest rate for each day late.

Line 2. (Compensation should be taken on the amount entered

* The annual interest rate is subject to change each year.

on Line 1.)

You can access the annual interest rate on our website

3. Enter previous overpayments or credits on Line 3.

at:

4. Compute balance due. Subtract Lines 2 and 3 from Line 1 and

7. Compute total amount due. Add Lines 4, 5, and 6 and enter

enter the difference on Line 4.

on Line 7.

5. Compute additions to tax, if applicable, and enter on Line 5.

Mail your remittance and return to the address below. Make

A. For failure to pay withholding tax by the due date —

your check payable to Missouri Director of Revenue and

subtract Line 3 from Line 1 and multiply the result by 5

include your Missouri Tax I.D. Number in the lower left area of

percent; or

your check (U.S. funds only).

B. For failure to file your return by the due date — subtract

Line 3 from Line 1 and multiply the result by 5 percent for

each month late, not to exceed 25 percent.

For more information, visit

Mail to:

Phone: (573) 751‑8750

Taxation Division

Fax: (573) 522‑6816

P.O. Box 999

E-mail:

withholding@dor.mo.gov

Jefferson City, MO 65108‑0999

1

1