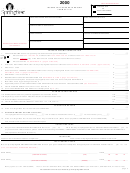

Form Sf-1120 - Income Tax Corporate Return - 1999 Page 2

ADVERTISEMENT

APPLIES TO SPRINGFIELD LOCATION ONLY

SCHEDULE C–PROFIT (OR LOSS) FROM BUSINESS

ATTACH A COMPLETE COPY OF YOUR FEDERAL 1120 OR 1120S.

BUSINESS DEDUCTIONS

. 00

. 00

1

Gross Receipts. . . . . . . . . . . . . . . . . . . . . . . . . .

1

$ _________________

12

Compensation of officers . . . . . . . . . . . .

12

$ _______________

. 00

. 00

2

Less returns and allowances . . . . . . . . . . . . . . .

2

__________________

13

Salaries and wages-not deducted elsewhere.

13

________________

. 00

. 00

3

Net Receipts. . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

__________________

14

Rents . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

________________

. 00

15

Depreciation . . . . . . . . . . . . . . . . . . . . . .

15

________________

COST OF GOODS SOLD

. 00

. 00

4

Inventory at beginning of period . . . . . . . . . . . . .

4

__________________

16

Contributions . . . . . . . . . . . . . . . . . . . . .

16

________________

. 00

. 00

5

Merchandise bought for manufacture or sale. . .

5

__________________

17

Taxes (attach statement) . . . . . . . . . . . .

17

________________

. 00

. 00

6

Salaries and wages . . . . . . . . . . . . . . . . . . . . . .

6

__________________

18

Interest . . . . . . . . . . . . . . . . . . . . . . . . . .

18

________________

. 00

. 00

7

Other costs (attach statement) . . . . . . . . . . . . . .

7

__________________

19

Repairs . . . . . . . . . . . . . . . . . . . . . . . . . .

19

________________

. 00

. 00

8

Total—lines 4 through 7 . . . . . . . . . . . . . . . . . . .

8

__________________

20

Bad Debts . . . . . . . . . . . . . . . . . . . . . . .

20

________________

. 00

. 00

9

Less inventory at end of period . . . . . . . . . . . . .

9

__________________

21

Other (attach statement) . . . . . . . . . . . .

21

________________

. 00

. 00

10

Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . .

10

__________________

22

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

________________

. 00

. 00

11

Gross Profit—line 3 less line 10 . . . . . . . . . . . . .

11

__________________

23

Total—lines 12 through 22 . . . . . . . . . . .

23

________________

. 00

24

Net profit or loss—line 11 less line 23 . .

24

________________

. 00

25

Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

________________

. 00

26

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

________________

. 00

27

Income from rents and royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

________________

. 00

28

Gain or loss from sale or exchange of property (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

________________

. 00

29

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

________________

. 00

30

Total income (add lines 24 through 29) Enter here and on p. 1 line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

________________

SCHEDULE D—BUSINESS ALLOCATION PERCENTAGE

To compute the percentage for column III, divide column II by column I.

COLUMN I

COLUMN II

COLUMN III

Located

Located in

Percentage

Everywhere

Springfield

. 00

. 00

1A Average net book value of REAL AND TANGIBLE PERSONAL PROPERTY . . . .

$ _______________

$ _______________

. 00

. 00

1B Gross annual rent paid for REAL PROPERTY only, multiplied by 8. . . . . . . . . . . .

________________

________________

. 00

. 00

1C TOTAL—ADD lines 1A and 1B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

________________

____________ %

2

Total WAGES, SALARIES, COMMISSIONS and OTHER COMPENSATION

. 00

. 00

of all employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

________________

____________ %

. 00

. 00

3

GROSS RECEIPTS from sales made or services rendered. . . . . . . . . . . . . . . . . .

________________

________________

____________ %

4

ADD together the percentages in COLUMN III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

____________ %

5

BUSINESS ALLOCATION PERCENTAGE—DIVIDE total from line 4 by the number *three, enter here and on PAGE 1, LINE 6 . . . .

____________ %

*When computing the Business Allocation Percentage, a factor should only be excluded from the computation when such a factor does not apply to the taxpayer’s

business operation. The sum of percentages in column III should be divided by the number of factors actually used.

SCHEDULE E

Schedule E is used to adjust the amount reported on page 1, line 1, to give effect to the requirements of the City of Springfield Income Tax Ordinance. The time

period used to compute items for Schedule E must be the same as the time period used to report income on page 1, line 1. Schedule E adjustments are allowed

only to the extent directly related to the NET INCOME as shown on page 1, line 1.

PERIOD FROM: ____________________ TO: ____________________

mo

day

yr

mo

day

yr

COLUMN 1

COLUMN 2

ADD—Items Not Deductible

DEDUCT—Items Not Taxable and Allowed Deductions

1

Adjustments to income relating to prior periods

6

Interest from U.S. obligations and from United

. 00

. 00

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$_______________

States governmental units . . . . . . . . . . . . .

$ ______________

2

All expenses (including interest) incurred in connection

7

Dividends-Received-Deduction (exclude divi-

. 00

with derivation of income not subject to Springfield

dends in line 6 above) . . . . . . . . . . . . . . . .

_______________

. 00

income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

. 00

. 00

3

Springfield income tax paid or accrued . . . . . . . . . . . . .

________________

8

Dividend gross up of foreign taxes . . . . . . .

_______________

. 00

. 00

4

Other (submit schedule) . . . . . . . . . . . . . . . . . . . . . . . . .

________________

9

Foreign tax deduction. . . . . . . . . . . . . . . . .

_______________

. 00

. 00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

10 Other (submit schedule) . . . . . . . . . . . . . . .

_______________

. 00

. 00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________

. 00

. 00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

________________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________

. 00

5

ADD—Lines 1, 2, 3 and 4. (enter on page 1, line 2). . . .

$ _______________

11 TOTAL DEDUCTIONS—ADD Lines 6, 7, 8,

. 00

9 and 10 (enter on page 1, line 4) . . . . . . .

$ ______________

page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2