Form Wec Draft - Employee Withholding Exemption Certificate - 2017

ADVERTISEMENT

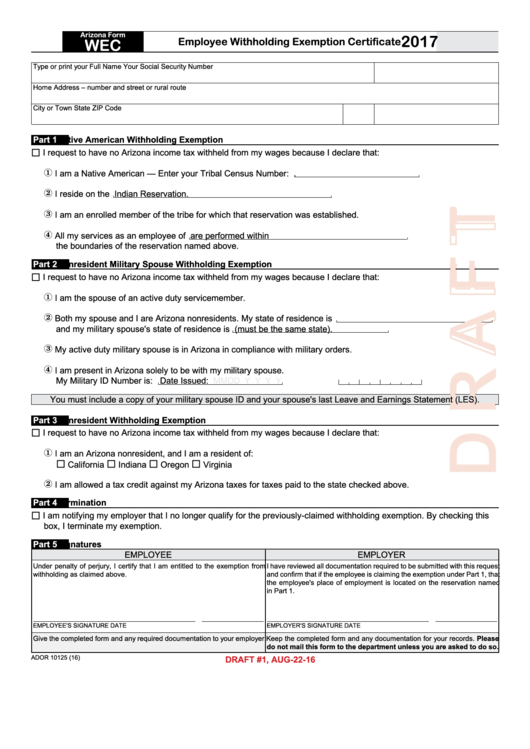

Arizona Form

2017

Employee Withholding Exemption Certificate

WEC

Type or print your Full Name

Your Social Security Number

Home Address – number and street or rural route

City or Town

State

ZIP Code

Native American Withholding Exemption

Part 1

I request to have no Arizona income tax withheld from my wages because I declare that:

I am a Native American — Enter your Tribal Census Number:

.

I reside on the

Indian Reservation.

I am an enrolled member of the tribe for which that reservation was established.

All my services as an employee of

are performed within

the boundaries of the reservation named above.

Part 2

Nonresident Military Spouse Withholding Exemption

I request to have no Arizona income tax withheld from my wages because I declare that:

I am the spouse of an active duty servicemember.

Both my spouse and I are Arizona nonresidents. My state of residence is

and my military spouse's state of residence is

(must be the same state).

My active duty military spouse is in Arizona in compliance with military orders.

I am present in Arizona solely to be with my military spouse.

My Military ID Number is:

Date Issued:

M M D D Y Y Y Y

You must include a copy of your military spouse ID and your spouse's last Leave and Earnings Statement (LES).

Part 3

Nonresident Withholding Exemption

I request to have no Arizona income tax withheld from my wages because I declare that:

I am an Arizona nonresident, and I am a resident of:

California

Indiana

Oregon

Virginia

I am allowed a tax credit against my Arizona taxes for taxes paid to the state checked above.

Part 4

Termination

I am notifying my employer that I no longer qualify for the previously-claimed withholding exemption. By checking this

box, I terminate my exemption.

Part 5

Signatures

EMPLOYEE

EMPLOYER

Under penalty of perjury, I certify that I am entitled to the exemption from

I have reviewed all documentation required to be submitted with this request

withholding as claimed above.

and confirm that if the employee is claiming the exemption under Part 1, that

the employee's place of employment is located on the reservation named

in Part 1.

EMPLOYEE'S SIGNATURE

DATE

EMPLOYER'S SIGNATURE

DATE

Give the completed form and any required documentation to your employer. Keep the completed form and any documentation for your records. Please

do not mail this form to the department unless you are asked to do so.

ADOR 10125 (16)

DRAFT #1, AUG-22-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1