Form Ri-1020es - Corporation Tax Voucher

ADVERTISEMENT

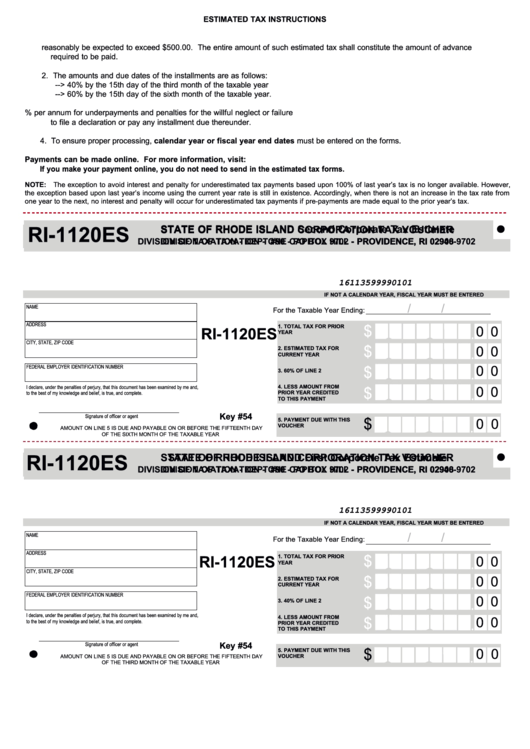

ESTIMATED TAX INSTRUCTIONS

1. Every corporation shall file a declaration of its estimated tax for the taxable year if its estimated tax for such taxable year can

reasonably be expected to exceed $500.00. The entire amount of such estimated tax shall constitute the amount of advance

required to be paid.

2. The amounts and due dates of the installments are as follows:

--> 40% by the 15th day of the third month of the taxable year

--> 60% by the 15th day of the sixth month of the taxable year.

3. Every corporation is subject to an assessment of 18% per annum for underpayments and penalties for the willful neglect or failure

to file a declaration or pay any installment due thereunder.

4. To ensure proper processing, calendar year or fiscal year end dates must be entered on the forms.

Payments can be made online. For more information, visit: https://

If you make your payment online, you do not need to send in the estimated tax forms.

NOTE: The exception to avoid interest and penalty for underestimated tax payments based upon 100% of last year’s tax is no longer available. However,

the exception based upon last year’s income using the current year rate is still in existence. Accordingly, when there is not an increase in the tax rate from

one year to the next, no interest and penalty will occur for underestimated tax payments if pre-payments are made equal to the prior year’s tax.

STATE OF RHODE ISLAND Second Corporate Tax Estimate

STATE OF RHODE ISLAND CORPORATION TAX VOUCHER

RI-1120ES

DIVISION OF TAXATION - DEPT #90 - PO BOX 9702 - PROVIDENCE, RI 02940-9702

DIVISION OF TAXATION - ONE CAPITOL HILL - PROVIDENCE, RI 02908

16113599990101

IF NOT A CALENDAR YEAR, FISCAL YEAR MUST BE ENTERED

/

/

NAME

For the Taxable Year Ending:

ADDRESS

1. TOTAL TAX FOR PRIOR

$

0 0

RI-1120ES

YEAR

CITY, STATE, ZIP CODE

$

0 0

2. ESTIMATED TAX FOR

CURRENT YEAR

FEDERAL EMPLOYER IDENTIFICATION NUMBER

0 0

$

3. 60% OF LINE 2

4. LESS AMOUNT FROM

I declare, under the penalties of perjury, that this document has been examined by me and,

0 0

$

PRIOR YEAR CREDITED

to the best of my knowledge and belief, is true, and complete.

TO THIS PAYMENT

Key #54

Signature of officer or agent

5. PAYMENT DUE WITH THIS

$

0 0

VOUCHER

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE THE FIFTEENTH DAY

OF THE SIXTH MONTH OF THE TAXABLE YEAR

STATE OF RHODE ISLAND CORPORATION TAX VOUCHER

STATE OF RHODE ISLAND First Corporate Tax Estimate

RI-1120ES

DIVISION OF TAXATION - DEPT #90 - PO BOX 9702 - PROVIDENCE, RI 02940-9702

DIVISION OF TAXATION - ONE CAPITOL HILL - PROVIDENCE, RI 02908

16113599990101

IF NOT A CALENDAR YEAR, FISCAL YEAR MUST BE ENTERED

NAME

/

/

For the Taxable Year Ending:

ADDRESS

1. TOTAL TAX FOR PRIOR

$

RI-1120ES

0 0

YEAR

CITY, STATE, ZIP CODE

$

2. ESTIMATED TAX FOR

0 0

CURRENT YEAR

FEDERAL EMPLOYER IDENTIFICATION NUMBER

0 0

$

3. 40% OF LINE 2

I declare, under the penalties of perjury, that this document has been examined by me and,

4. LESS AMOUNT FROM

0 0

$

to the best of my knowledge and belief, is true, and complete.

PRIOR YEAR CREDITED

TO THIS PAYMENT

Signature of officer or agent

Key #54

5. PAYMENT DUE WITH THIS

$

0 0

VOUCHER

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE THE FIFTEENTH DAY

OF THE THIRD MONTH OF THE TAXABLE YEAR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1