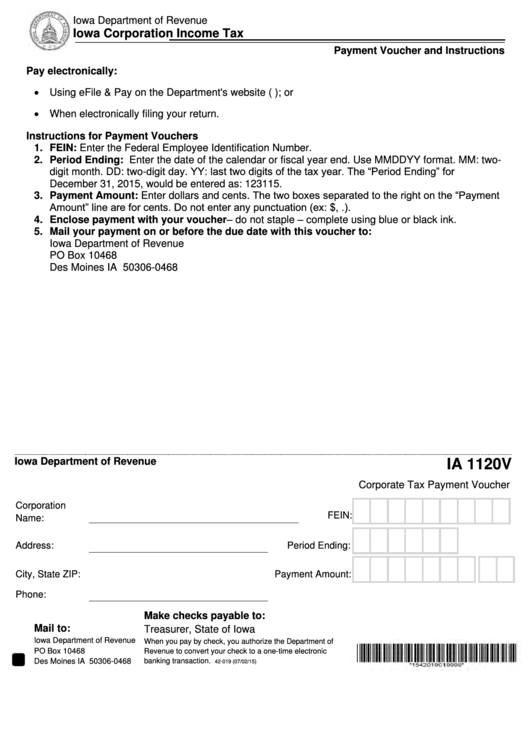

Form Ia 1120v - Corporate Tax Payment Voucher - Iowa Corporation Income Tax

ADVERTISEMENT

Iowa Department of Revenue

Iowa Corporation Income Tax

https://tax.iowa.gov

Payment Voucher and Instructions

Pay electronically:

Using eFile & Pay on the Department's website (https://tax.iowa.gov); or

When electronically filing your return.

Instructions for Payment Vouchers

1. FEIN: Enter the Federal Employee Identification Number.

2. Period Ending: Enter the date of the calendar or fiscal year end. Use MMDDYY format. MM: two-

digit month. DD: two-digit day. YY: last two digits of the tax year. The “Period Ending” for

December 31, 2015, would be entered as: 123115.

3. Payment Amount: Enter dollars and cents. The two boxes separated to the right on the “Payment

Amount” line are for cents. Do not enter any punctuation (ex: $, .).

4. Enclose payment with your voucher – do not staple – complete using blue or black ink.

5. Mail your payment on or before the due date with this voucher to:

Iowa Department of Revenue

PO Box 10468

Des Moines IA 50306-0468

Iowa Department of Revenue

IA 1120V

Corporate Tax Payment Voucher

Corporation

FEIN:

Name:

Address:

Period Ending:

City, State ZIP:

Payment Amount:

Phone:

Make checks payable to:

Mail to:

Treasurer, State of Iowa

Iowa Department of Revenue

When you pay by check, you authorize the Department of

PO Box 10468

Revenue to convert your check to a one-time electronic

Des Moines IA 50306-0468

banking transaction.

42-019 (07/02/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1