Instructions For Form Ut-1w - Use Tax For Individuals

ADVERTISEMENT

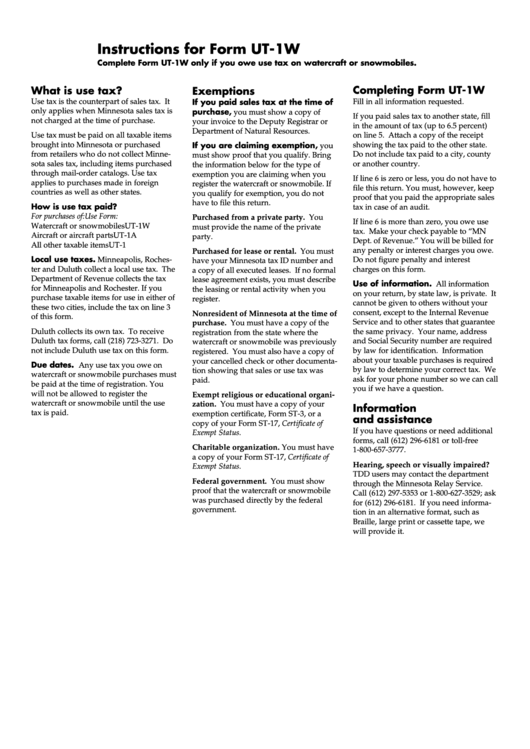

Instructions for Form UT-1W

Complete Form UT-1W only if you owe use tax on watercraft or snowmobiles.

Completing Form UT-1W

What is use tax?

Exemptions

Use tax is the counterpart of sales tax. It

If you paid sales tax at the time of

Fill in all information requested.

only applies when Minnesota sales tax is

purchase, you must show a copy of

If you paid sales tax to another state, fill

not charged at the time of purchase.

your invoice to the Deputy Registrar or

in the amount of tax (up to 6.5 percent)

Department of Natural Resources.

Use tax must be paid on all taxable items

on line 5. Attach a copy of the receipt

brought into Minnesota or purchased

If you are claiming exemption, you

showing the tax paid to the other state.

from retailers who do not collect Minne-

Do not include tax paid to a city, county

must show proof that you qualify. Bring

sota sales tax, including items purchased

or another country.

the information below for the type of

through mail-order catalogs. Use tax

exemption you are claiming when you

If line 6 is zero or less, you do not have to

applies to purchases made in foreign

register the watercraft or snowmobile. If

file this return. You must, however, keep

countries as well as other states.

you qualify for exemption, you do not

proof that you paid the appropriate sales

have to file this return.

How is use tax paid?

tax in case of an audit.

For purchases of:

Use Form:

Purchased from a private party. You

If line 6 is more than zero, you owe use

Watercraft or snowmobiles

UT-1W

must provide the name of the private

tax. Make your check payable to “MN

Aircraft or aircraft parts

UT-1A

party.

Dept. of Revenue.” You will be billed for

All other taxable items

UT-1

any penalty or interest charges you owe.

Purchased for lease or rental. You must

Local use taxes. Minneapolis, Roches-

Do not figure penalty and interest

have your Minnesota tax ID number and

ter and Duluth collect a local use tax. The

charges on this form.

a copy of all executed leases. If no formal

Department of Revenue collects the tax

lease agreement exists, you must describe

Use of information. All information

for Minneapolis and Rochester. If you

the leasing or rental activity when you

on your return, by state law, is private. It

purchase taxable items for use in either of

register.

cannot be given to others without your

these two cities, include the tax on line 3

consent, except to the Internal Revenue

Nonresident of Minnesota at the time of

of this form.

Service and to other states that guarantee

purchase. You must have a copy of the

Duluth collects its own tax. To receive

the same privacy. Your name, address

registration from the state where the

Duluth tax forms, call (218) 723-3271. Do

and Social Security number are required

watercraft or snowmobile was previously

not include Duluth use tax on this form.

by law for identification. Information

registered. You must also have a copy of

about your taxable purchases is required

your cancelled check or other documenta-

Due dates. Any use tax you owe on

by law to determine your correct tax. We

tion showing that sales or use tax was

watercraft or snowmobile purchases must

ask for your phone number so we can call

paid.

be paid at the time of registration. You

you if we have a question.

will not be allowed to register the

Exempt religious or educational organi-

watercraft or snowmobile until the use

zation. You must have a copy of your

Information

tax is paid.

exemption certificate, Form ST-3, or a

and assistance

copy of your Form ST-17, Certificate of

If you have questions or need additional

Exempt Status.

forms, call (612) 296-6181 or toll-free

Charitable organization. You must have

1-800-657-3777.

a copy of your Form ST-17, Certificate of

Hearing, speech or visually impaired?

Exempt Status.

TDD users may contact the department

Federal government. You must show

through the Minnesota Relay Service.

proof that the watercraft or snowmobile

Call (612) 297-5353 or 1-800-627-3529; ask

was purchased directly by the federal

for (612) 296-6181. If you need informa-

government.

tion in an alternative format, such as

Braille, large print or cassette tape, we

will provide it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1