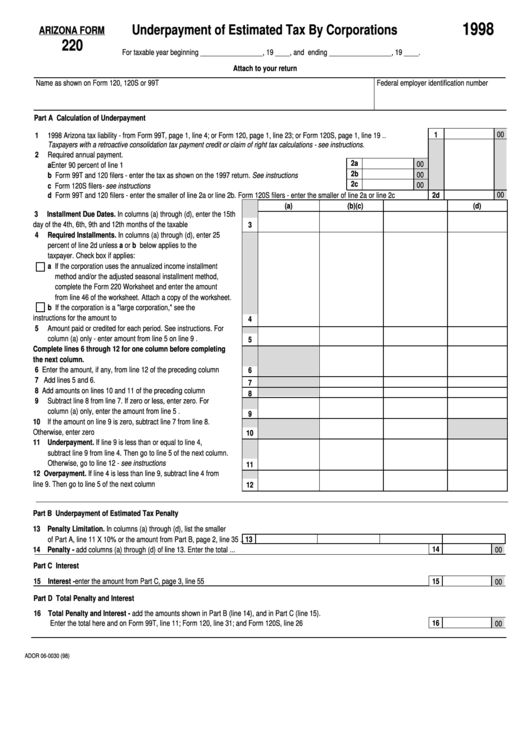

1998

Underpayment of Estimated Tax By Corporations

ARIZONA FORM

220

For taxable year beginning _________________, 19 ____, and ending _________________, 19 ____.

Attach to your return

Name as shown on Form 120, 120S or 99T

Federal employer identification number

Part A Calculation of Underpayment

1

00

1

1998 Arizona tax liability - from Form 99T, page 1, line 4; or Form 120, page 1, line 23; or Form 120S, page 1, line 19 .........................

Taxpayers with a retroactive consolidation tax payment credit or claim of right tax calculations - see instructions.

2

Required annual payment.

2a

00

a Enter 90 percent of line 1 .........................................................................................................................

2b

00

b Form 99T and 120 filers - enter the tax as shown on the 1997 return. See instructions .........................

2c

00

c Form 120S filers - see instructions ..........................................................................................................

00

d Form 99T and 120 filers - enter the smaller of line 2a or line 2b. Form 120S filers - enter the smaller of line 2a or line 2c .................

2d

(a)

(b)

(c)

(d)

3

Installment Due Dates. In columns (a) through (d), enter the 15th

day of the 4th, 6th, 9th and 12th months of the taxable year............

3

4

Required Installments. In columns (a) through (d), enter 25

percent of line 2d unless a or b below applies to the

taxpayer. Check box if applies:

a If the corporation uses the annualized income installment

method and/or the adjusted seasonal installment method,

complete the Form 220 Worksheet and enter the amount

from line 46 of the worksheet. Attach a copy of the worksheet.

b If the corporation is a "large corporation," see the

instructions for the amount to enter..............................................

4

5

Amount paid or credited for each period. See instructions. For

column (a) only - enter amount from line 5 on line 9 ........................

5

Complete lines 6 through 12 for one column before completing

the next column.

6

Enter the amount, if any, from line 12 of the preceding column ......

6

7

Add lines 5 and 6. .............................................................................

7

8

Add amounts on lines 10 and 11 of the preceding column ...............

8

9

Subtract line 8 from line 7. If zero or less, enter zero. For

column (a) only, enter the amount from line 5 ..................................

9

10 If the amount on line 9 is zero, subtract line 7 from line 8.

Otherwise, enter zero .......................................................................

10

11 Underpayment. If line 9 is less than or equal to line 4,

subtract line 9 from line 4. Then go to line 5 of the next column.

Otherwise, go to line 12 - see instructions .......................................

11

12 Overpayment. If line 4 is less than line 9, subtract line 4 from

line 9. Then go to line 5 of the next column .....................................

12

Part B Underpayment of Estimated Tax Penalty

13 Penalty Limitation. In columns (a) through (d), list the smaller

of Part A, line 11 X 10% or the amount from Part B, page 2, line 35 ..

13

14

14 Penalty - add columns (a) through (d) of line 13. Enter the total ..............................................................................................................

00

Part C Interest

15 Interest - enter the amount from Part C, page 3, line 55 ........................................................................................................................

15

00

Part D Total Penalty and Interest

16 Total Penalty and Interest - add the amounts shown in Part B (line 14), and in Part C (line 15).

Enter the total here and on Form 99T, line 11; Form 120, line 31; and Form 120S, line 26 .......................................................

16

00

ADOR 06-0030 (98)

1

1 2

2 3

3 4

4