FYI - click in 'Name of Individual,...' field to begin, and tab

Print

Clear

throughout. Use mouse to check applicable boxes or Enter.

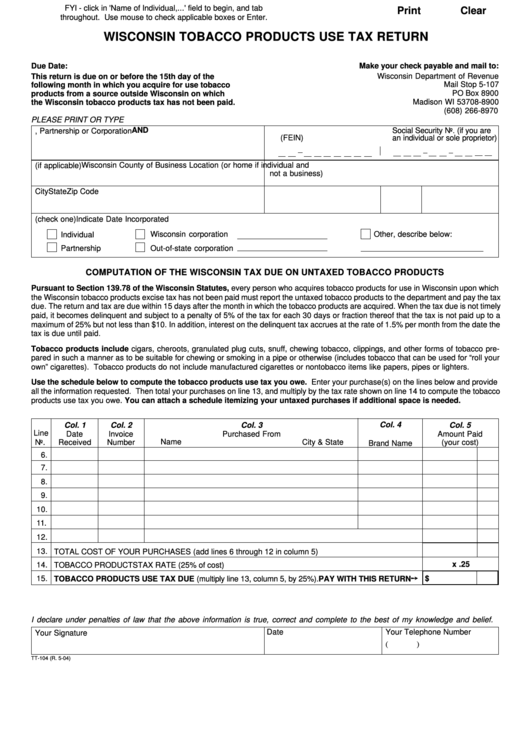

WISCONSIN TOBACCO PRODUCTS USE TAX RETURN

Make your check payable and mail to:

Due Date:

Wisconsin Department of Revenue

This return is due on or before the 15th day of the

Mail Stop 5-107

following month in which you acquire for use tobacco

PO Box 8900

products from a source outside Wisconsin on which

Madison WI 53708-8900

the Wisconsin tobacco products tax has not been paid.

(608) 266-8970

PLEASE PRINT OR TYPE

2. Federal Employer ID No. AND

Social Security No. (if you are

1. Name of Individual, Partnership or Corporation

(FEIN)

an individual or sole proprietor)

Wisconsin County of Business Location (or home if individual and

3. Business Name (if applicable)

not a business)

4. Mailing Address - Street or P.O. Box

City

State

Zip Code

5. Type of Organization (check one)

Indicate Date Incorporated

Other, describe below:

Wisconsin corporation

Individual

Partnership

Out-of-state corporation

COMPUTATION OF THE WISCONSIN TAX DUE ON UNTAXED TOBACCO PRODUCTS

Pursuant to Section 139.78 of the Wisconsin Statutes, every person who acquires tobacco products for use in Wisconsin upon which

the Wisconsin tobacco products excise tax has not been paid must report the untaxed tobacco products to the department and pay the tax

due. The return and tax are due within 15 days after the month in which the tobacco products are acquired. When the tax due is not timely

paid, it becomes delinquent and subject to a penalty of 5% of the tax for each 30 days or fraction thereof that the tax is not paid up to a

maximum of 25% but not less than $10. In addition, interest on the delinquent tax accrues at the rate of 1.5% per month from the date the

tax is due until paid.

Tobacco products include cigars, cheroots, granulated plug cuts, snuff, chewing tobacco, clippings, and other forms of tobacco pre-

pared in such a manner as to be suitable for chewing or smoking in a pipe or otherwise (includes tobacco that can be used for “roll your

own” cigarettes). Tobacco products do not include manufactured cigarettes or nontobacco items like papers, pipes or lighters.

Use the schedule below to compute the tobacco products use tax you owe. Enter your purchase(s) on the lines below and provide

all the information requested. Then total your purchases on line 13, and multiply by the tax rate shown on line 14 to compute the tobacco

products use tax you owe. You can attach a schedule itemizing your untaxed purchases if additional space is needed.

Col. 3

Col. 4

Col. 1

Col. 2

Col. 5

Line

Date

Invoice

Purchased From

Amount Paid

Name

City & State

No.

Received

Number

(your cost)

Brand Name

6.

7.

8.

9.

10.

11.

12.

13.

TOTAL COST OF YOUR PURCHASES (add lines 6 through 12 in column 5)

x .25

14.

TOBACCO PRODUCTS TAX RATE (25% of cost)

TOBACCO PRODUCTS USE TAX DUE (multiply line 13, column 5, by 25%). PAY WITH THIS RETURN ➙

15.

$

I declare under penalties of law that the above information is true, correct and complete to the best of my knowledge and belief.

Date

Your Telephone Number

Your Signature

(

)

TT-104 (R. 5-04)

1

1