Form 104 Ptc - Colorado Property Tax/rent/heat Rebate Application - 1999

ADVERTISEMENT

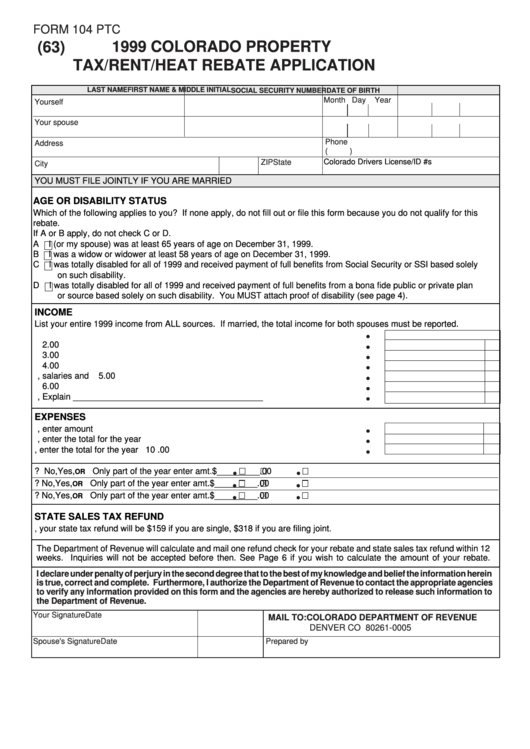

FORM 104 PTC

1999 COLORADO PROPERTY

(63)

TAX/RENT/HEAT REBATE APPLICATION

LAST NAME

FIRST NAME & MIDDLE INITIAL

DATE OF BIRTH

SOCIAL SECURITY NUMBER

Month Day

Year

Yourself

Your spouse

Phone

Address

(

)

State

ZIP

Colorado Drivers License/ID #s

City

YOU MUST FILE JOINTLY IF YOU ARE MARRIED

AGE OR DISABILITY STATUS

Which of the following applies to you? If none apply, do not fill out or file this form because you do not qualify for this

rebate.

If A or B apply, do not check C or D.

A

I (or my spouse) was at least 65 years of age on December 31, 1999.

B

I was a widow or widower at least 58 years of age on December 31, 1999.

C

I was totally disabled for all of 1999 and received payment of full benefits from Social Security or SSI based solely

on such disability.

D

I was totally disabled for all of 1999 and received payment of full benefits from a bona fide public or private plan

or source based solely on such disability. You MUST attach proof of disability (see page 4).

INCOME

List your entire 1999 income from ALL sources. If married, the total income for both spouses must be reported.

1. Enter number of months you received Medicare during 1999 .................................

1

Months

2. Social Security and/or SSI benefits received in 1999 ..............................................

2

.00

3. Colorado Old Age Pension payments received in 1999 ..........................................

3

.00

4. Private or VA pension payments received in 1999 ..................................................

4

.00

5. Wages, salaries and tips ..........................................................................................

5

.00

6. Interest and dividends ..............................................................................................

6

.00

7. Other income, Explain ________________________________________ ............

7

.00

EXPENSES

8. If you paid 1998 property tax in 1999, enter amount here .......................................

8

.00

9. If you paid rent in 1999, enter the total for the year here .........................................

9

.00

10. If you paid heat or fuel expenses in 1999, enter the total for the year here ............

10

.00

11. Are your meals included in your rent payments?

No, Yes,

Only part of the year enter amt.$ _________ .00

OR

12. Did you pay rent for a property tax exempt unit?

No, Yes,

Only part of the year enter amt.$ _________ .00

OR

13. Was your heat included in your rent payments?

No, Yes,

Only part of the year enter amt.$ _________ .00

OR

STATE SALES TAX REFUND

14. If you qualify, your state tax refund will be $159 if you are single, $318 if you are filing joint.

The Department of Revenue will calculate and mail one refund check for your rebate and state sales tax refund within 12

weeks. Inquiries will not be accepted before then. See Page 6 if you wish to calculate the amount of your rebate.

I declare under penalty of perjury in the second degree that to the best of my knowledge and belief the information herein

is true, correct and complete. Furthermore, I authorize the Department of Revenue to contact the appropriate agencies

to verify any information provided on this form and the agencies are hereby authorized to release such information to

the Department of Revenue.

Your Signature

Date

MAIL TO: COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0005

Spouse's Signature

Date

Prepared by

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1