Form S1040 - Individual Income Tax Return 1999 Saginaw

ADVERTISEMENT

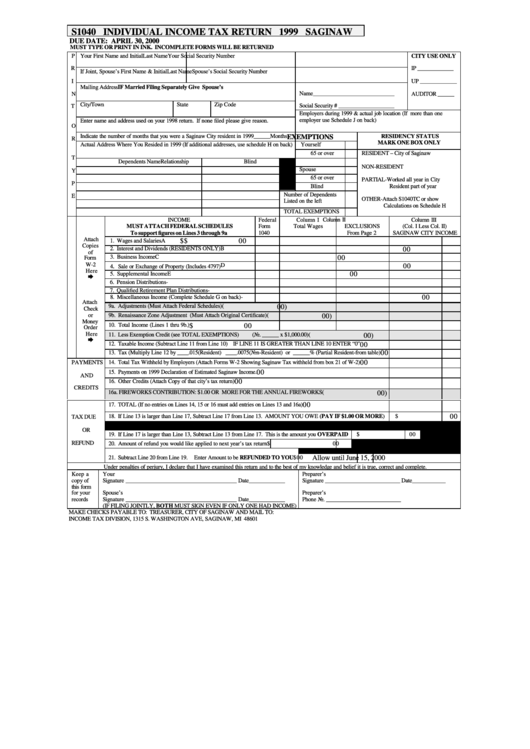

S1040 INDIVIDUAL INCOME TAX RETURN 1999 SAGINAW

DUE DATE: APRIL 30, 2000

MUST TYPE OR PRINT IN INK. INCOMPLETE FORMS WILL BE RETURNED

P

Your First Name and Initial

Last Name

Your Social Security Number

CITY USE ONLY

R

IP _____________

If Joint, Spouse’s First Name & Initial

Last Name

Spouse’s Social Security Number

I

UP _____________

Mailing Address

IF Married Filing Separately Give Spouse’s

Name_____________________________

N

AUDITOR ______

City/Town

State

Zip Code

Social Security # ____________________

T

Employers during 1999 & actual job location (If more than one

employer use Schedule J on back)

Enter name and address used on your 1998 return. If none filed please give reason.

O

Indicate the number of months that you were a Saginaw City resident in 1999______Months

RESIDENCY STATUS

EXEMPTIONS

R

MARK ONE BOX ONLY

Actual Address Where You Resided in 1999 (If additional addresses, use schedule H on back)

Yourself

65 or over

RESIDENT – City of Saginaw

T

Dependents Name

Relationship

Blind

NON-RESIDENT

Spouse

Y

65 or over

PARTIAL-Worked all year in City

P

Blind

Resident part of year

Number of Dependents

E

OTHER-Attach S1040TC or show

Listed on the left

Calculations on Schedule H

TOTAL EXEMPTIONS

INCOME

Federal

Column I

Column II

Column III

MUST ATTACH FEDERAL SCHEDULES

Form

Total Wages

EXCLUSIONS

(Col. I Less Col. II)

To support figures on Lines 3 through 9a

1040

From Page 2

SAGINAW CITY INCOME

Attach

1. Wages and Salaries

A

$

$

00

Copies

2. Interest and Dividends (RESIDENTS ONLY)

B

00

of

3. Business Income

C

00

Form

W-2

D

.

00

4

Sale or Exchange of Property (Includes 4797)

Here

00

5. Supplemental Income

E

è

6. Pension Distributions

-

7. Qualified Retirement Plan Distributions

-

8. Miscellaneous Income (Complete Schedule G on back)

-

00

Attach

9a. Adjustments (Must Attach Federal Schedules)

(

00)

Check

or

9b. Renaissance Zone Adjustment (Must Attach Original Certificate)

(

00)

Money

10. Total Income (Lines 1 thru 9b.)

$

00

Order

Here

11. Less Exemption Credit (see TOTAL EXEMPTIONS)

(No. ______ x $1,000.00)

(

00)

è

12. Taxable Income (Subtract Line 11 from Line 10) IF LINE 11 IS GREATER THAN LINE 10 ENTER “0”

00

00

13. Tax (Multiply Line 12 by ____.015(Resident) ____.0075(Non-Resident) or ______% (Partial Resident-from table)

00

PAYMENTS

14. Total Tax Withheld by Employers (Attach Forms W-2 Showing Saginaw Tax withheld from box 21 of W-2)

00

15. Payments on 1999 Declaration of Estimated Saginaw Income.

AND

00

16. Other Credits (Attach Copy of that city’s tax return)

CREDITS

16a. FIREWORKS CONTRIBUTION: $1.00 OR MORE FOR THE ANNUAL FIREWORKS

(

00)

17. TOTAL (If no entries on Lines 14, 15 or 16 must add entries on Lines 13 and 16a)

00

00

18. If Line 13 is larger than Line 17, Subtract Line 17 from Line 13. AMOUNT YOU OWE (PAY IF $1.00 OR MORE)

$

TAX DUE

OR

19. If Line 17 is larger than Line 13, Subtract Line 13 from Line 17. This is the amount you OVERPAID

$

00

REFUND

20. Amount of refund you would like applied to next year’s tax return

$

00

Allow until June 15, 2000

21. Subtract Line 20 from Line 19.

Enter Amount to be REFUNDED TO YOU

$

00

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

Keep a

Your

Preparer’s

copy of

Signature ________________________________________ Date_____________

Signature ___________________________ Date____________

this form

for your

Spouse’s

Preparer’s

records

Signature ________________________________________ Date_____________

Phone No. ___________________________

(IF FILING JOINTLY, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME)

MAKE CHECKS PAYABLE TO: TREASURER, CITY OF SAGINAW AND MAIL TO:

INCOME TAX DIVISION, 1315 S. WASHINGTON AVE, SAGINAW, MI 48601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3