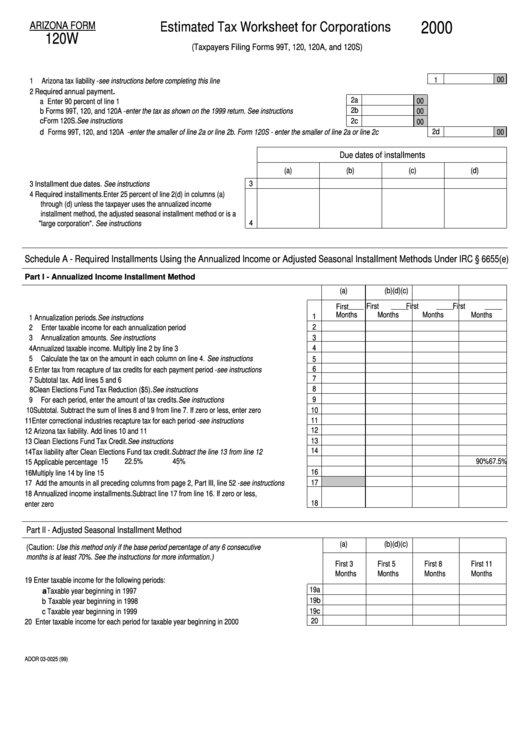

Form 120w - Estimated Tax Worksheet For Corporations - 2000

ADVERTISEMENT

2000

Estimated Tax Worksheet for Corporations

ARIZONA FORM

120W

(Taxpayers Filing Forms 99T, 120, 120A, and 120S)

00

1

1

Arizona tax liability - see instructions before completing this line ..................................................................................................................

2

Required annual payment.

2a

a Enter 90 percent of line 1 .............................................................................................................................

00

2b

b Forms 99T, 120, and 120A - enter the tax as shown on the 1999 return. See instructions ........................

00

c Form 120S. See instructions ........................................................................................................................

2c

00

2d

d Forms 99T, 120, and 120A - enter the smaller of line 2a or line 2b. Form 120S - enter the smaller of line 2a or line 2c ........................

00

Due dates of installments

(a)

(b)

(c)

(d)

3

3

Installment due dates. See instructions ...............................................

4

Required installments. Enter 25 percent of line 2(d) in columns (a)

through (d) unless the taxpayer uses the annualized income

installment method, the adjusted seasonal installment method or is a

4

"large corporation". See instructions .......................................................

Schedule A - Required Installments Using the Annualized Income or Adjusted Seasonal Installment Methods Under IRC § 6655(e)

Part I - Annualized Income Installment Method

(a)

(b)

(c)

(d)

First

First

First

First

Months

Months

Months

Months

1

1

Annualization periods. See instructions ....................................................................................

2

2

Enter taxable income for each annualization period .................................................................

3

3

Annualization amounts. See instructions ...................................................................................

4

4

Annualized taxable income. Multiply line 2 by line 3 .................................................................

5

Calculate the tax on the amount in each column on line 4. See instructions ............................

5

6

6

Enter tax from recapture of tax credits for each payment period - see instructions ..................

7

7

Subtotal tax. Add lines 5 and 6 ..................................................................................................

8

8

Clean Elections Fund Tax Reduction ($5). See instructions ...................................................

9

For each period, enter the amount of tax credits. See instructions ...........................................

9

10

Subtotal. Subtract the sum of lines 8 and 9 from line 7. If zero or less, enter zero ...................

10

11

11

Enter correctional industries recapture tax for each period - see instructions ..........................

12

12

Arizona tax liability. Add lines 10 and 11 ..................................................................................

13

13

Clean Elections Fund Tax Credit. See instructions .................................................................

14

14

Tax liability after Clean Elections Fund tax credit. Subtract the line 13 from line 12 ................

22.5%

45%

67.5%

90%

15

15 Applicable percentage ...............................................................................................................

16

16

Multiply line 14 by line 15 ..........................................................................................................

17

17 Add the amounts in all preceding columns from page 2, Part III, line 52 - see instructions .....

18

Annualized income installments. Subtract line 17 from line 16. If zero or less,

18

enter zero ..................................................................................................................................

Part II - Adjusted Seasonal Installment Method

(a)

(b)

(c)

(d)

(Caution: Use this method only if the base period percentage of any 6 consecutive

months is at least 70%. See the instructions for more information.)

First 3

First 5

First 8

First 11

Months

Months

Months

Months

19

Enter taxable income for the following periods:

19a

a Taxable year beginning in 1997 .............................................................................................

19b

b Taxable year beginning in 1998 .............................................................................................

19c

c Taxable year beginning in 1999 .............................................................................................

20

20 Enter taxable income for each period for taxable year beginning in 2000 ...................... ..........

ADOR 03-0025 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2