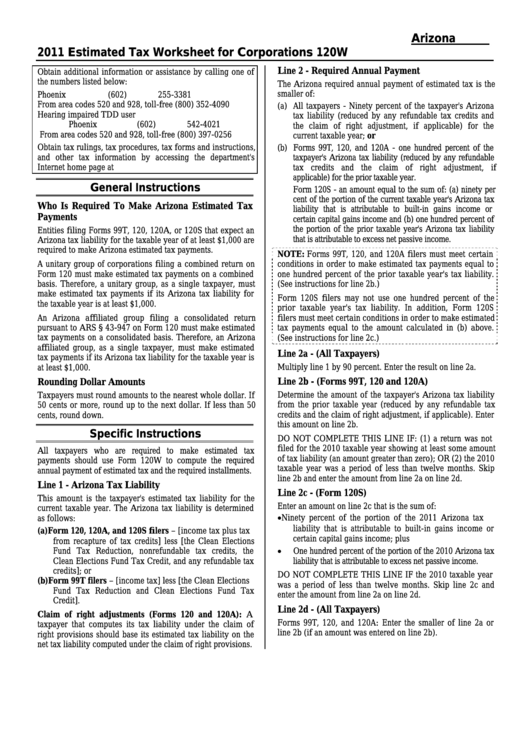

Instructions For Arizona Form 120w - Estimated Tax Worksheet For Corporations - 2011

ADVERTISEMENT

Arizona Form

2011 Estimated Tax Worksheet for Corporations

120W

Line 2 - Required Annual Payment

Obtain additional information or assistance by calling one of

the numbers listed below:

The Arizona required annual payment of estimated tax is the

smaller of:

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

(a) All taxpayers - Ninety percent of the taxpayer's Arizona

Hearing impaired TDD user

tax liability (reduced by any refundable tax credits and

Phoenix

(602) 542-4021

the claim of right adjustment, if applicable) for the

From area codes 520 and 928, toll-free

(800) 397-0256

current taxable year; or

Obtain tax rulings, tax procedures, tax forms and instructions,

(b) Forms 99T, 120, and 120A - one hundred percent of the

and other tax information by accessing the department's

taxpayer's Arizona tax liability (reduced by any refundable

Internet home page at

tax credits and the claim of right adjustment, if

applicable) for the prior taxable year.

General Instructions

Form 120S - an amount equal to the sum of: (a) ninety per

cent of the portion of the current taxable year's Arizona tax

Who Is Required To Make Arizona Estimated Tax

liability that is attributable to built-in gains income or

Payments

certain capital gains income and (b) one hundred percent of

the portion of the prior taxable year's Arizona tax liability

Entities filing Forms 99T, 120, 120A, or 120S that expect an

that is attributable to excess net passive income.

Arizona tax liability for the taxable year of at least $1,000 are

required to make Arizona estimated tax payments.

NOTE: Forms 99T, 120, and 120A filers must meet certain

A unitary group of corporations filing a combined return on

conditions in order to make estimated tax payments equal to

Form 120 must make estimated tax payments on a combined

one hundred percent of the prior taxable year's tax liability.

basis. Therefore, a unitary group, as a single taxpayer, must

(See instructions for line 2b.)

make estimated tax payments if its Arizona tax liability for

Form 120S filers may not use one hundred percent of the

the taxable year is at least $1,000.

prior taxable year's tax liability. In addition, Form 120S

An Arizona affiliated group filing a consolidated return

filers must meet certain conditions in order to make estimated

pursuant to ARS § 43-947 on Form 120 must make estimated

tax payments equal to the amount calculated in (b) above.

tax payments on a consolidated basis. Therefore, an Arizona

(See instructions for line 2c.)

affiliated group, as a single taxpayer, must make estimated

Line 2a - (All Taxpayers)

tax payments if its Arizona tax liability for the taxable year is

Multiply line 1 by 90 percent. Enter the result on line 2a.

at least $1,000.

Line 2b - (Forms 99T, 120 and 120A)

Rounding Dollar Amounts

Determine the amount of the taxpayer's Arizona tax liability

Taxpayers must round amounts to the nearest whole dollar. If

from the prior taxable year (reduced by any refundable tax

50 cents or more, round up to the next dollar. If less than 50

credits and the claim of right adjustment, if applicable). Enter

cents, round down.

this amount on line 2b.

Specific Instructions

DO NOT COMPLETE THIS LINE IF: (1) a return was not

filed for the 2010 taxable year showing at least some amount

All taxpayers who are required to make estimated tax

of tax liability (an amount greater than zero); OR (2) the 2010

payments should use Form 120W to compute the required

taxable year was a period of less than twelve months. Skip

annual payment of estimated tax and the required installments.

line 2b and enter the amount from line 2a on line 2d.

Line 1 - Arizona Tax Liability

Line 2c - (Form 120S)

This amount is the taxpayer's estimated tax liability for the

Enter an amount on line 2c that is the sum of:

current taxable year. The Arizona tax liability is determined

as follows:

Ninety percent of the portion of the 2011 Arizona tax

liability that is attributable to built-in gains income or

(a) Form 120, 120A, and 120S filers – [income tax plus tax

certain capital gains income; plus

from recapture of tax credits] less [the Clean Elections

Fund Tax Reduction, nonrefundable tax credits, the

One hundred percent of the portion of the 2010 Arizona tax

Clean Elections Fund Tax Credit, and any refundable tax

liability that is attributable to excess net passive income.

credits]; or

DO NOT COMPLETE THIS LINE IF the 2010 taxable year

(b) Form 99T filers – [income tax] less [the Clean Elections

was a period of less than twelve months. Skip line 2c and

Fund Tax Reduction and Clean Elections Fund Tax

enter the amount from line 2a on line 2d.

Credit].

Line 2d - (All Taxpayers)

Claim of right adjustments (Forms 120 and 120A): A

Forms 99T, 120, and 120A: Enter the smaller of line 2a or

taxpayer that computes its tax liability under the claim of

line 2b (if an amount was entered on line 2b).

right provisions should base its estimated tax liability on the

net tax liability computed under the claim of right provisions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4