Ets Form 027 - Direct Pay Permit Sales Tax Application - 2001

ADVERTISEMENT

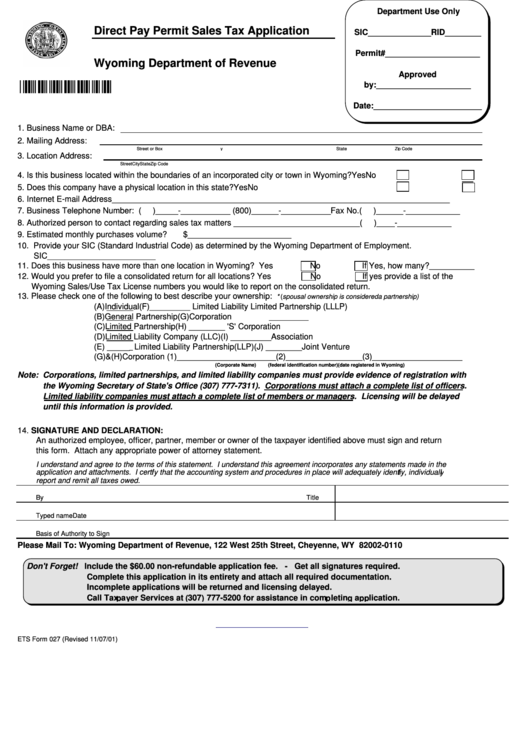

Department Use Only

Direct Pay Permit Sales Tax Application

SIC______________RID________

Permit#_____________________

Wyoming Department of Revenue

Approved

*0-001*

by:_____________________

Date:________________________

1. Business Name or DBA:

2. Mailing Address:

Street or Box No.

City

State

Zip Code

3. Location Address:

Street

City

State

Zip Code

4. Is this business located within the boundaries of an incorporated city or town in Wyoming?

Yes

No

5. Does this company have a physical location in this state?

Yes

No

6. Internet E-mail Address___________________________________________________________________________

7. Business Telephone Number: (

)_____-___________ (800)______-___________Fax No.(

)______-____________

8. Authorized person to contact regarding sales tax matters ____________________________(

)____-____________

9. Estimated monthly purchases volume?

$_______________________

10. Provide your SIC (Standard Industrial Code) as determined by the Wyoming Department of Employment.

SIC________________________

11. Does this business have more than one location in Wyoming? Yes

No

If Yes, how many?__________

12. Would you prefer to file a consolidated return for all locations? Yes

No

If yes provide a list of the

Wyoming Sales/Use Tax License numbers you would like to report on the consolidated return.

13. Please check one of the following to best describe your ownership:

* (spousal ownership is considered a partnership)

(A)

Individual

(F)_________ Limited Liability Limited Partnership (LLLP)

(B)

General Partnership

(G)

Corporation

(C)

Limited Partnership

(H) ________ 'S' Corporation

(D)

Limited Liability Company (LLC) (I) _________ Association

(E) ______Limited Liability Partnership(LLP) (J) ________ Joint Venture

(G)&(H)

Corporation (1)______________________(2)_________________(3)____________________

(Corporate Name)

(federal identification number)

(date registered in Wyoming)

Note: Corporations, limited partnerships, and limited liability companies must provide evidence of registration with

the Wyoming Secretary of State's Office (307) 777-7311). Corporations must attach a complete list of officers .

Limited liability companies must attach a complete list of members or managers . Licensing will be delayed

until this information is provided.

14. SIGNATURE AND DECLARATION:

An authorized employee, officer, partner, member or owner of the taxpayer identified above must sign and return

this form. Attach any appropriate power of attorney statement.

I understand and agree to the terms of this statement. I understand this agreement incorporates any statements made in the

application and attachments. I certify that the accounting system and procedures in place will adequately identify, individually

report and remit all taxes owed.

By

Title

Typed name

Date

Basis of Authority to Sign

Please Mail To: Wyoming Department of Revenue, 122 West 25th Street, Cheyenne, WY 82002-0110

Don't Forget! Include the $60.00 non-refundable application fee. - Get all signatures required.

Complete this application in its entirety and attach all required documentation.

Incomplete applications will be returned and licensing delayed.

Call Taxpayer Services at (307) 777-5200 for assistance in completing application.

ETS Form 027 (Revised 11/07/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2