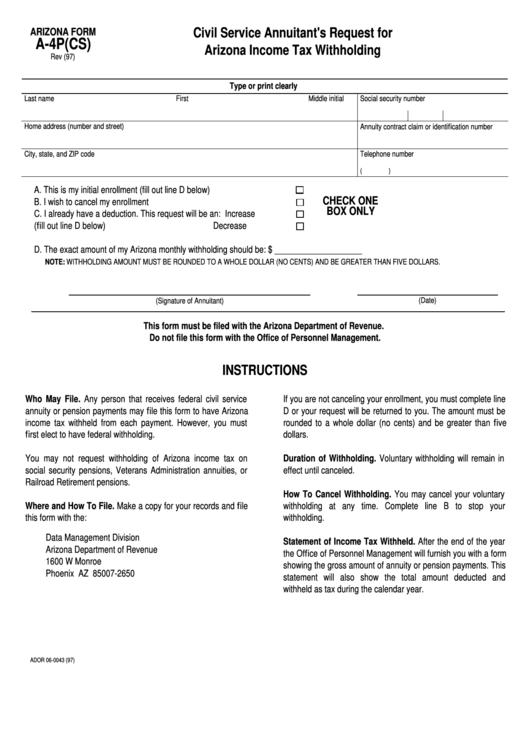

Civil Service Annuitant's Request for

ARIZONA FORM

A-4P(CS)

Arizona Income Tax Withholding

Rev (97)

Type or print clearly

Last name

First

Middle initial

Social security number

Home address (number and street)

Annuity contract claim or identification number

City, state, and ZIP code

Telephone number

(

)

A. This is my initial enrollment (fill out line D below) ....................................

CHECK ONE

B. I wish to cancel my enrollment ................................................................

BOX ONLY

C. I already have a deduction. This request will be an: Increase ................

(fill out line D below)

Decrease ...............

D. The exact amount of my Arizona monthly withholding should be: $ ____________________

NOTE: WITHHOLDING AMOUNT MUST BE ROUNDED TO A WHOLE DOLLAR (NO CENTS) AND BE GREATER THAN FIVE DOLLARS.

(Date)

(Signature of Annuitant)

This form must be filed with the Arizona Department of Revenue.

Do not file this form with the Office of Personnel Management.

INSTRUCTIONS

Who May File. Any person that receives federal civil service

If you are not canceling your enrollment, you must complete line

annuity or pension payments may file this form to have Arizona

D or your request will be returned to you. The amount must be

income tax withheld from each payment. However, you must

rounded to a whole dollar (no cents) and be greater than five

first elect to have federal withholding.

dollars.

You may not request withholding of Arizona income tax on

Duration of Withholding. Voluntary withholding will remain in

social security pensions, Veterans Administration annuities, or

effect until canceled.

Railroad Retirement pensions.

How To Cancel Withholding. You may cancel your voluntary

Where and How To File. Make a copy for your records and file

withholding at any time. Complete line B to stop your

this form with the:

withholding.

Data Management Division

Statement of Income Tax Withheld. After the end of the year

Arizona Department of Revenue

the Office of Personnel Management will furnish you with a form

1600 W Monroe

showing the gross amount of annuity or pension payments. This

Phoenix AZ 85007-2650

statement will also show the total amount deducted and

withheld as tax during the calendar year.

ADOR 06-0043 (97)

1

1