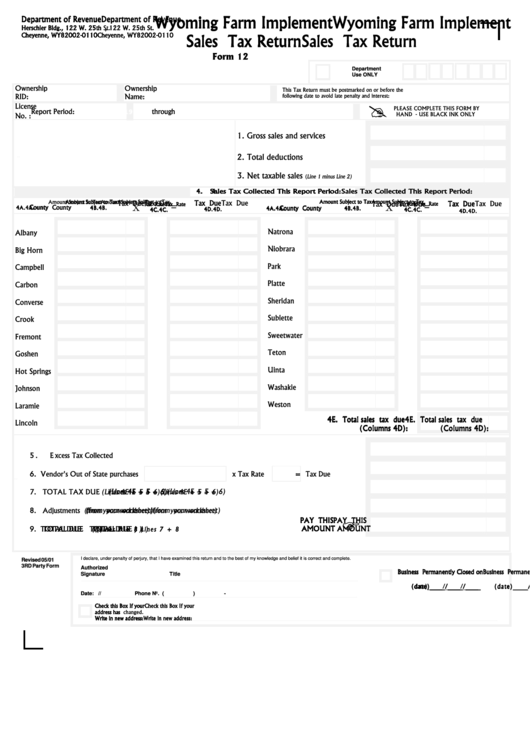

Form 12 - Sales Tax Return

Download a blank fillable Form 12 - Sales Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 12 - Sales Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Wyoming .arm Implement

Wyoming .arm Implement

Wyoming .arm Implement

Wyoming .arm Implement

Wyoming .arm Implement

Department of Revenue

Department of Revenue

Department of Revenue

Department of Revenue

Department of Revenue

Herschler Bldg., 122 W. 25th St.

Herschler Bldg., 122 W. 25th St.

Herschler Bldg., 122 W. 25th St.

Herschler Bldg., 122 W. 25th St.

Herschler Bldg., 122 W. 25th St.

Cheyenne, WY

Cheyenne, WY

82002-0110

82002-0110

Cheyenne, WY

Cheyenne, WY

Cheyenne, WY

82002-0110

82002-0110

82002-0110

Sales Tax Return

Sales Tax Return

Sales Tax Return

Sales Tax Return

Sales Tax Return

.orm 12

Department

Use ONLY

Ownership

Ownership

This Tax Return must be postmarked on or before the

RID:

Name:

following date to avoid late penalty and interest:

(

License

PLEASE COMPLETE THIS .ORM BY

Report Period:

through

Feb 01, 1996

Feb 29, 1996

HAND - USE BLACK INK ONLY

No. :

1. Gross sales and services ...........

2. Total deductions ....................

3. Net taxable sales

(Line 1 minus Line 2)

4. 4. 4. 4. 4.

Sales Tax Collected This Report Period:

Sales Tax Collected This Report Period:

Sales Tax Collected This Report Period:

Sales Tax Collected This Report Period:

Sales Tax Collected This Report Period:

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

:

Tax Rate

Tax Rate

Tax Rate

Tax Rate

Tax Rate

:

Tax Rate

Tax Rate

Tax Rate

Tax Rate

Tax Rate

=

=

County

County

County

County

County

4A.

4A.

4A.

County

County

County

County

County

4A.

4A.

4B.

4B.

4B.

4B.

4B.

4A.

4A.

4A.

4A.

4A.

4B.

4B.

4B.

4B.

4B.

4D.

4D.

4D.

4D.

4D.

4C.

4C.

4C.

4C.

4C.

4C.

4C.

4C.

4C.

4C.

4D.

4D.

4D.

4D.

4D.

Natrona

Albany

Niobrara

Big Horn

Park

Campbell

Platte

Carbon

Sheridan

Converse

Sublette

Crook

Sweetwater

.remont

Teton

Goshen

Uinta

Hot Springs

Washakie

Johnson

Weston

Laramie

4E. Total sales tax due

4E. Total sales tax due

4E. Total sales tax due

4E. Total sales tax due

4E. Total sales tax due

Lincoln

(Columns 4D):

(Columns 4D):

(Columns 4D):

(Columns 4D):

(Columns 4D):

.....................................................................................................

5.

Excess Tax Collected

......

6. Vendor's Out of State purchases

$

x Tax Rate

= Tax Due

............................................................................

7.

TOTAL TAX DUE (Lines 4E + 5 + 6)

(Lines 4E + 5 + 6)

(Lines 4E + 5 + 6)

(Lines 4E + 5 + 6)

(Lines 4E + 5 + 6)

..............................................................................

8.

Adjustments (from your worksheet)

(from your worksheet)

(from your worksheet)

(from your worksheet)

(from your worksheet)

.

PAY THIS

PAY THIS

PAY THIS

PAY THIS

PAY THIS

..............................................................

TOTAL DUE

TOTAL DUE

( ( ( ( (

) ) ) ) )

AMOUNT

AMOUNT

AMOUNT

AMOUNT

AMOUNT

9. TOTAL DUE

TOTAL DUE

TOTAL DUE

Lines 7 + 8

Lines 7 + 8

Lines 7 + 8

Lines 7 + 8

Lines 7 + 8

,

,

.

I declare, under penalty of perjury, that I have examined this return and to the best of my knowledge and belief it is correct and complete.

Revised 05/01

3RD Party Form

Authorized

Business Permanently Closed on

Business Permanently Closed on

Business Permanently Closed on

Business Permanently Closed on

Business Permanently Closed on

Signature

Title

(date)_____/_____/_____

(date)_____/_____/_____

(date)_____/_____/_____

(date)_____/_____/_____

(date)_____/_____/_____

Date:

/

/

Phone No. (

)

-

Check this Box If your

Check this Box If your

Check this Box If your

Check this Box If your

Check this Box If your

address has changed.

address has changed.

address has changed.

address has changed.

address has changed.

Write in new address:

Write in new address:

Write in new address:

Write in new address:

Write in new address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3