Form Mi-1045 - Application For Net Operating Loss Refund Instructions

ADVERTISEMENT

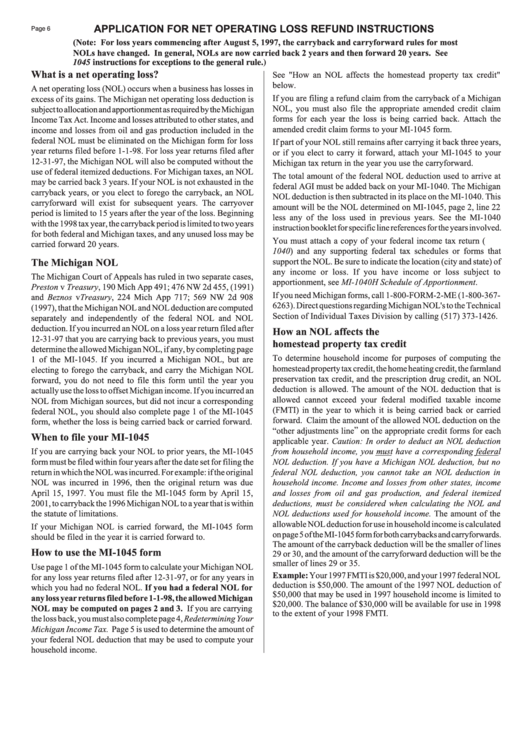

APPLICATION FOR NET OPERATING LOSS REFUND INSTRUCTIONS

Page 6

(Note: For loss years commencing after August 5, 1997, the carryback and carryforward rules for most

NOLs have changed. In general, NOLs are now carried back 2 years and then forward 20 years. See

U.S. 1045 instructions for exceptions to the general rule.)

What is a net operating loss?

See "How an NOL affects the homestead property tax credit"

below.

A net operating loss (NOL) occurs when a business has losses in

If you are filing a refund claim from the carryback of a Michigan

excess of its gains. The Michigan net operating loss deduction is

NOL, you must also file the appropriate amended credit claim

subject to allocation and apportionment as required by the Michigan

forms for each year the loss is being carried back. Attach the

Income Tax Act. Income and losses attributed to other states, and

amended credit claim forms to your MI-1045 form.

income and losses from oil and gas production included in the

federal NOL must be eliminated on the Michigan form for loss

If part of your NOL still remains after carrying it back three years,

year returns filed before 1-1-98. For loss year returns filed after

or if you elect to carry it forward, attach your MI-1045 to your

12-31-97, the Michigan NOL will also be computed without the

Michigan tax return in the year you use the carryforward.

use of federal itemized deductions. For Michigan taxes, an NOL

The total amount of the federal NOL deduction used to arrive at

may be carried back 3 years. If your NOL is not exhausted in the

federal AGI must be added back on your MI-1040. The Michigan

carryback years, or you elect to forego the carryback, an NOL

NOL deduction is then subtracted in its place on the MI-1040. This

carryforward will exist for subsequent years. The carryover

amount will be the NOL determined on MI-1045, page 2, line 22

period is limited to 15 years after the year of the loss. Beginning

less any of the loss used in previous years. See the MI-1040

with the 1998 tax year, the carryback period is limited to two years

instruction booklet for specific line references for the years involved.

for both federal and Michigan taxes, and any unused loss may be

You must attach a copy of your federal income tax return (U.S.

carried forward 20 years.

1040) and any supporting federal tax schedules or forms that

support the NOL. Be sure to indicate the location (city and state) of

The Michigan NOL

any income or loss. If you have income or loss subject to

The Michigan Court of Appeals has ruled in two separate cases,

apportionment, see MI-1040H Schedule of Apportionment.

Preston v Treasury, 190 Mich App 491; 476 NW 2d 455, (1991)

If you need Michigan forms, call 1-800-FORM-2-ME (1-800-367-

and Beznos vTreasury, 224 Mich App 717; 569 NW 2d 908

6263). Direct questions regarding Michigan NOL's to the Technical

(1997), that the Michigan NOL and NOL deduction are computed

Section of Individual Taxes Division by calling (517) 373-1426.

separately and independently of the federal NOL and NOL

deduction. If you incurred an NOL on a loss year return filed after

How an NOL affects the

12-31-97 that you are carrying back to previous years, you must

homestead property tax credit

determine the allowed Michigan NOL, if any, by completing page

To determine household income for purposes of computing the

1 of the MI-1045. If you incurred a Michigan NOL, but are

homestead property tax credit, the home heating credit, the farmland

electing to forego the carryback, and carry the Michigan NOL

preservation tax credit, and the prescription drug credit, an NOL

forward, you do not need to file this form until the year you

deduction is allowed. The amount of the NOL deduction that is

actually use the loss to offset Michigan income. If you incurred an

allowed cannot exceed your federal modified taxable income

NOL from Michigan sources, but did not incur a corresponding

(FMTI) in the year to which it is being carried back or carried

federal NOL, you should also complete page 1 of the MI-1045

forward. Claim the amount of the allowed NOL deduction on the

form, whether the loss is being carried back or carried forward.

“other adjustments line” on the appropriate credit forms for each

When to file your MI-1045

applicable year. Caution: In order to deduct an NOL deduction

If you are carrying back your NOL to prior years, the MI-1045

from household income, you must have a corresponding federal

form must be filed within four years after the date set for filing the

NOL deduction. If you have a Michigan NOL deduction, but no

return in which the NOL was incurred. For example: if the original

federal NOL deduction, you cannot take an NOL deduction in

NOL was incurred in 1996, then the original return was due

household income. Income and losses from other states, income

April 15, 1997. You must file the MI-1045 form by April 15,

and losses from oil and gas production, and federal itemized

2001, to carryback the 1996 Michigan NOL to a year that is within

deductions, must be considered when calculating the NOL and

the statute of limitations.

NOL deductions used for household income. The amount of the

allowable NOL deduction for use in household income is calculated

If your Michigan NOL is carried forward, the MI-1045 form

on page 5 of the MI-1045 form for both carrybacks and carryforwards.

should be filed in the year it is carried forward to.

The amount of the carryback deduction will be the smaller of lines

How to use the MI-1045 form

29 or 30, and the amount of the carryforward deduction will be the

smaller of lines 29 or 35.

Use page 1 of the MI-1045 form to calculate your Michigan NOL

Example: Your 1997 FMTI is $20,000, and your 1997 federal NOL

for any loss year returns filed after 12-31-97, or for any years in

deduction is $50,000. The amount of the 1997 NOL deduction of

which you had no federal NOL. If you had a federal NOL for

$50,000 that may be used in 1997 household income is limited to

any loss year returns filed before 1-1-98, the allowed Michigan

$20,000. The balance of $30,000 will be available for use in 1998

NOL may be computed on pages 2 and 3. If you are carrying

to the extent of your 1998 FMTI.

the loss back, you must also complete page 4, Redetermining Your

Michigan Income Tax. Page 5 is used to determine the amount of

your federal NOL deduction that may be used to compute your

household income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2