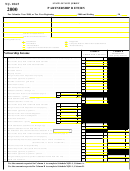

SCHEDULE

STATE OF NEW JERSEY

NJK-1

(Form NJ-1065)

PARTNER’S SHARE OF INCOME

2007

For Calendar Year 2007, or Fiscal Year Beginning ____________________, 2007 and ending _______________, 20______

PART I

General Information

Partner’s SS # or Federal EIN

Partnership’s Federal EIN

Partner’s Name

Partnership’s Name

Street Address

Partnership’s Street Address

City

State

Zip Code

City

State

Zip Code

Enter Partner’s percentage of:

What type of entity is partner? (see instructions)___________________

(i) Before Decrease

(ii) End of Year

Code

or Termination

Date Partner’s Interest in Partnership began: _______________________________

Profit Sharing

__________________%

___________________%

Month

Day

Year

Final NJK-1

Hedge Fund

Loss Sharing

__________________%

___________________%

Amended NJK-1

Member of Composite Return

Capital Ownership

__________________%

___________________%

PART II

Income Information

NJ-1040 Filers

B. New Jersey Source

Income Classifications

A. Total Distribution

Enter Amounts on

NJ-1040NR Filers

Amounts

Line Shown Below

.

1. Partnership Income (loss)

2. Net Guaranteed Payments

3. Partner’s 401(k) Contribution

4. Distributive Share of Partnership

Income (loss)

Line 20, Page 2

Line 22, Page 1

(Line 1 plus Line 2 minus Line 3)

Line 19, Page 2

5. Pension

6. Net Gain (loss) from Disposition

of Assets as a Result of a

Line 18, Page 2

Line 18, Page 1

Complete Liquidation

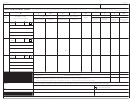

PART III

Partner’s Information

Nonresident Partner’s Share of NJ Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

1.

1st Quarter NJ

2nd Quarter NJ

3rd Quarter NJ

4th Quarter NJ

Other NJ Tax Payments

Estimated Tax Payment

Estimated Tax Payment

Estimated Tax Payment

Estimated Tax Payment

Partner’s HEZ Deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

2.

Partner’s Sheltered Workshop Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3.

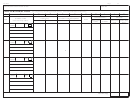

PART IV

Supplemental Information

(Attach Schedule)

THIS FORM MAY BE REPRODUCED

1

1 2

2 3

3 4

4