Instructions For Form Ar2220 - Underpayment Of Estimated Tax By Corporations

ADVERTISEMENT

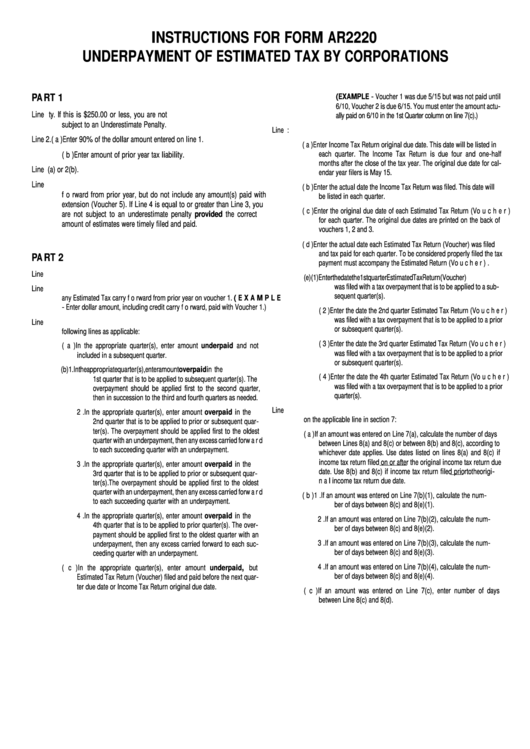

INSTRUCTIONS FOR FORM AR2220

UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS

PA RT 1

(EXAMPLE - Voucher 1 was due 5/15 but was not paid until

6/10, Voucher 2 is due 6/15. You must enter the amount actu-

Line 1.

Enter current year tax liability. If this is $250.00 or less, you are not

ally paid on 6/10 in the 1st Quarter column on line 7(c).)

subject to an Underestimate Penalty.

Line 8.

Date Return Due/Filed:

Line 2.

( a ) Enter 90% of the dollar amount entered on line 1.

( a )

Enter Income Tax Return original due date. This date will be listed in

each quarter. The Income Tax Return is due four and one-half

( b ) Enter amount of prior year tax liability.

months after the close of the tax year. The original due date for cal-

Line 3.

Enter lesser of 2(a) or 2(b).

endar year filers is May 15.

Line 4.

Enter amount of total estimated tax paid. Include estimated tax carry-

( b )

Enter the actual date the Income Tax Return was filed. This date will

f o rward from prior year, but do not include any amount(s) paid with

be listed in each quarter.

extension (Voucher 5). If Line 4 is equal to or greater than Line 3, you

( c )

Enter the original due date of each Estimated Tax Return (Vo u c h e r )

are not subject to an underestimate penalty provided the correct

for each quarter. The original due dates are printed on the back of

amount of estimates were timely filed and paid.

vouchers 1, 2 and 3.

( d )

Enter the actual date each Estimated Tax Return (Voucher) was filed

and tax paid for each quarter. To be considered properly filed the tax

PA RT 2

payment must accompany the Estimated Return (Vo u c h e r ) .

Line 5.

Enter amount on Line 3 above divided equally among the four quarters.

( e ) ( 1 ) Enter the date the 1st quarter Estimated Tax Return (Vo u c h e r )

was filed with a tax overpayment that is to be applied to a sub-

Line 6.

Enter actual amount of money paid with each Quarterly Vo u c h e r. Include

sequent quarter(s).

any Estimated Tax carry f o rward from prior year on voucher 1. ( E X A M P L E

- Enter dollar amount, including credit carry f o rward, paid with Voucher 1.)

( 2 ) Enter the date the 2nd quarter Estimated Tax Return (Vo u c h e r )

was filed with a tax overpayment that is to be applied to a prior

Line 7.

Enter amounts subject to Underpayment of Estimated Tax Penalty on the

or subsequent quarter(s).

following lines as applicable:

( 3 ) Enter the date the 3rd quarter Estimated Tax Return (Vo u c h e r )

( a )

In the appropriate quarter(s), enter amount underpaid and not

was filed with a tax overpayment that is to be applied to a prior

included in a subsequent quarter.

or subsequent quarter(s).

( b )

1 .

In the appropriate quarter(s), enter amount overpaid in the

( 4 ) Enter the date the 4th quarter Estimated Tax Return (Vo u c h e r )

1st quarter that is to be applied to subsequent quarter(s). The

was filed with a tax overpayment that is to be applied to a prior

overpayment should be applied first to the second quarter,

q u a r t e r ( s ) .

then in succession to the third and fourth quarters as needed.

Line 9.

Enter the number of days for each underpayment of estimated tax shown

2 .

In the appropriate quarter(s), enter amount overpaid in the

on the applicable line in section 7:

2nd quarter that is to be applied to prior or subsequent quar-

ter(s). The overpayment should be applied first to the oldest

( a )

If an amount was entered on Line 7(a), calculate the number of days

quarter with an underpayment, then any excess carried forw a r d

between Lines 8(a) and 8(c) or between 8(b) and 8(c), according to

to each succeeding quarter with an underpayment.

whichever date applies. Use dates listed on lines 8(a) and 8(c) if

income tax return filed on or after the original income tax return due

3 .

In the appropriate quarter(s), enter amount overpaid in the

date. Use 8(b) and 8(c) if income tax return filed p r i o r to the origi-

3rd quarter that is to be applied to prior or subsequent quar-

n a l income tax return due date.

ter(s).The overpayment should be applied first to the oldest

quarter with an underpayment, then any excess carried forw a r d

( b ) 1 .

If an amount was entered on Line 7(b)(1), calculate the num-

to each succeeding quarter with an underpayment.

ber of days between 8(c) and 8(e)(1).

4 .

In the appropriate quarter(s), enter amount overpaid in the

2 .

If an amount was entered on Line 7(b)(2), calculate the num-

4th quarter that is to be applied to prior quarter(s). The over-

ber of days between 8(c) and 8(e)(2).

payment should be applied first to the oldest quarter with an

3 .

If an amount was entered on Line 7(b)(3), calculate the num-

underpayment, then any excess carried forward to each suc-

ber of days between 8(c) and 8(e)(3).

ceeding quarter with an underpayment.

4 .

If an amount was entered on Line 7(b)(4), calculate the num-

( c )

In the appropriate quarter(s), enter amount underpaid, b u t

ber of days between 8(c) and 8(e)(4).

Estimated Tax Return (Voucher) filed and paid before the next quar-

ter due date or Income Tax Return original due date.

( c )

If an amount was entered on Line 7(c), enter number of days

between Line 8(c) and 8(d).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2