Form 807 Draft - Michigan Composite Individual Income Tax Return - 2007 Page 4

ADVERTISEMENT

2007 807, Page 4

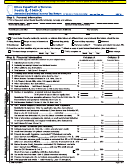

Distributive Income Worksheet

such nonresident flow-through entity on

Column A refers to Distributive Income categories from Schedule(s) K. Column B and C refer to lines on

behalf of all of the nonresident members.

the U.S. 1065 Schedule K and U.S. 1120S Schedule K. Column D is the list of amounts that are added to

arrive at total distributive income that is reported on Form 807, line 47.

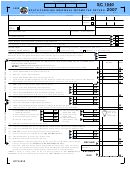

Line 24: If line 22 plus line 23 is less

B

C

D

than line 21, enter the balance of the tax

A

U.S. 1065

U.S. 1120S

Distributive Income

due. This is the tax owed with the return.

Distributive Income Categories

Schedule K

Schedule K

Amounts

Enter any applicable penalties and interest

Ordinary income (loss) from trade or business

X

X

in the spaces provided. Add tax, penalty

activity

Net income (loss) from rental real estate

and interest together and enter the total

X

X

activity

on this line. If balance due is less than $1,

no payment is required. Make check

Net income (loss) from other rental activity

Xx

Xx

payable to “State of Michigan.” Write

Portfolio income (loss):

the firm’s FEIN, “Composite Return,”

Interest income

X

X

and the tax year on the front of the check.

To ensure accurate processing of your

Dividend income

Xx and Xx

Xx and Xx

return, send one check for each return

Royalty income

X

X

type.

Line 26: You may opt to have your

Net short-term capital gain (loss)

X

X

overpayment transferred to your

Net long-term capital gain (loss)

Xx

Xx

withholding tax account. This does not

relieve you from the responsibility to file

Guaranteed payments

X

the withholding tax forms each quarter.

If this satisfies your liability for the year,

Net gain (loss) under section 1231

XX

X

you must file the returns indicating "0"

Other income (loss)

XX

XX

due each quarter.

TOTAL DISTRIBUTIVE INCOME

Line 27: Refund. Subtract line 26 from

Add all amounts in Column D and carry total to Form 807, line 47.

line 25. This is the refund. Treasury will

not refund amounts less than $1.

deductions on U.S. Schedule A are not

reported on another composite return.

allowable subtractions in determining

Attach a schedule showing the amount of

Mail your completed return with payment

Michigan taxable income.

income or loss attributable to each.

(if applicable) to:

Line 36: Enter income (loss) from other

Line 41: Enter gains/losses from the sale

Composite Return

fiduciaries or other flow-through entities

of real or personal property located in

Michigan Department of Treasury

that is included in ordinary income. Losses

Michigan not subject to apportionment.

P.O. Box 30058

must be added back to ordinary income.

Lansing, MI 48909

Line 42: Enter any other income (loss)

Attach a schedule showing the location

allocated to Michigan. Include any

Additions

of companies and amount of income

Michigan net operating loss deduction

Lines 28 through 32: Enter income from

attributable to each.

(NOLD). Attach schedules.

lines X, Xx, X, Xx, Xx, X, X, Xx, X and

Line 37: Enter amounts such as interest

Exemption Allowance

XX of 1120S Schedule K and from lines

from U.S. obligations that are included in

Line 47: Enter the total distributive

X, Xx, X, Xx, Xx, X, X, Xx, XX and XX

line 30a, and other deductions for AGI

income as determined using the worksheet

of U.S. 1065 Schedule K. Guaranteed

(above the line) that were not included in

on this page.

payments, income attributable to other

determining ordinary income. This

Michigan fiduciaries or flow-through

Line 48: Compute the percentage of

includes section 179 depreciation and

entities should be allocated to Michigan

income attributable to Michigan by

amounts included on line XX[x][X] of

on lines 39 through 42. See instructions

dividing total Michigan income (line 46)

U.S. 1120S Schedule K and on line

below.

by the total distributive income (line 47).

XX[x][X] of U.S. 1065 Schedule K. Also

This figure may not exceed 100 percent.

Line 33: Enter the amount of state and

include pension benefits paid to

local income taxes that was used to

SEP, SIMPLE or qualified plan

nonresident partners that were included

determine ordinary income on line XX of

subtractions (PARTNERS ONLY)

in ordinary income but are excluded from

the U.S. 1065 or line XX of the U.S.

Michigan tax by 4 USC 114. Attach a

SEP - Simplified Employee Pensions

1120S.

schedule of all subtractions.

SIMPLE - Savings Incentive Match Plan

Line 34: Enter other additions to income,

Michigan allocated income or loss

for Employees

such as gross interest and dividends from

Line 39: Enter the portion of guaranteed

Line 50: Figure the portion of SEP,

obligations or securities of states and their

payments attributable to services performed

SIMPLE or qualified plan subtractions

political subdivisions other than Michigan.

in Michigan by the nonresident participants.

which is attributable to the participants.

Subtractions

Line 40: Enter income or loss from other

Attach a schedule showing calculations.

Note: Charitable contributions and

fiduciaries or other flow-through entities

Visit Treasury's Web site at:

other amounts reported as itemized

attributable to Michigan that have not been

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4