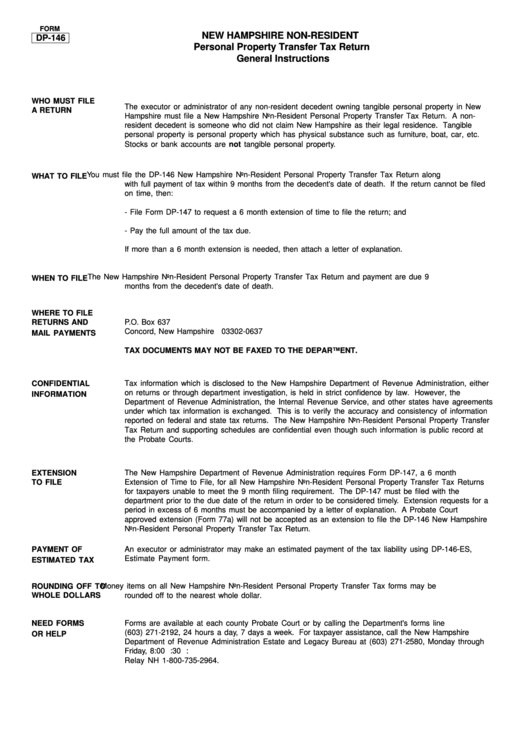

Instructions For Form Dp-146 - New Hampshire Non-Resident Personal Property Transfer Tax Return General Instructions

ADVERTISEMENT

FORM

NEW HAMPSHIRE NON-RESIDENT

DP-146

Personal Property Transfer Tax Return

General Instructions

WHO MUST FILE

The executor or administrator of any non-resident decedent owning tangible personal property in New

A RETURN

Hampshire must file a New Hampshire Non-Resident Personal Property Transfer Tax Return. A non-

resident decedent is someone who did not claim New Hampshire as their legal residence. Tangible

personal property is personal property which has physical substance such as furniture, boat, car, etc.

Stocks or bank accounts are not tangible personal property.

You must file the DP-146 New Hampshire Non-Resident Personal Property Transfer Tax Return along

WHAT TO FILE

with full payment of tax within 9 months from the decedent's date of death. If the return cannot be filed

on time, then:

- File Form DP-147 to request a 6 month extension of time to file the return; and

- Pay the full amount of the tax due.

If more than a 6 month extension is needed, then attach a letter of explanation.

The New Hampshire Non-Resident Personal Property Transfer Tax Return and payment are due 9

WHEN TO FILE

months from the decedent's date of death.

WHERE TO FILE

N.H. Department of Revenue Administration

RETURNS AND

P.O. Box 637

Concord, New Hampshire

03302-0637

MAIL PAYMENTS

TAX DOCUMENTS MAY NOT BE FAXED TO THE DEPARTMENT.

CONFIDENTIAL

Tax information which is disclosed to the New Hampshire Department of Revenue Administration, either

on returns or through department investigation, is held in strict confidence by law. However, the

INFORMATION

Department of Revenue Administration, the Internal Revenue Service, and other states have agreements

under which tax information is exchanged. This is to verify the accuracy and consistency of information

reported on federal and state tax returns. The New Hampshire Non-Resident Personal Property Transfer

Tax Return and supporting schedules are confidential even though such information is public record at

the Probate Courts.

EXTENSION

The New Hampshire Department of Revenue Administration requires Form DP-147, a 6 month

TO FILE

Extension of Time to File, for all New Hampshire Non-Resident Personal Property Transfer Tax Returns

for taxpayers unable to meet the 9 month filing requirement. The DP-147 must be filed with the

department prior to the due date of the return in order to be considered timely. Extension requests for a

period in excess of 6 months must be accompanied by a letter of explanation. A Probate Court

approved extension (Form 77a) will not be accepted as an extension to file the DP-146 New Hampshire

Non-Resident Personal Property Transfer Tax Return.

PAYMENT OF

An executor or administrator may make an estimated payment of the tax liability using DP-146-ES,

Estimate Payment form.

ESTIMATED TAX

ROUNDING OFF TO

Money items on all New Hampshire Non-Resident Personal Property Transfer Tax forms may be

WHOLE DOLLARS

rounded off to the nearest whole dollar.

NEED FORMS

Forms are available at each county Probate Court or by calling the Department's forms line

(603) 271-2192, 24 hours a day, 7 days a week. For taxpayer assistance, call the New Hampshire

OR HELP

Department of Revenue Administration Estate and Legacy Bureau at (603) 271-2580, Monday through

Friday, 8:00 a.m. to 4:30 p.m. Hearing and/or speech impaired individuals may call TDD Access:

Relay NH 1-800-735-2964.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2