Form Dp-146-Es - Estimate For New Hampshire Non-Resident Personal Property Transfer Tax

ADVERTISEMENT

FORM

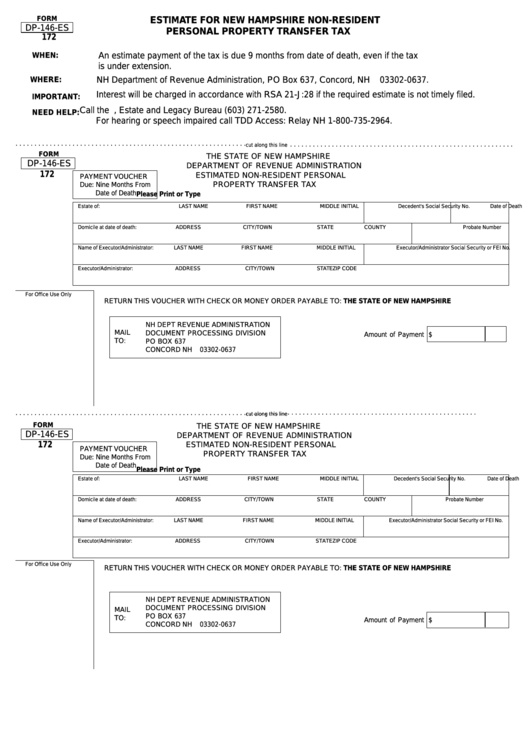

ESTIMATE FOR NEW HAMPSHIRE NON-RESIDENT

DP-146-ES

PERSONAL PROPERTY TRANSFER TAX

172

WHEN:

An estimate payment of the tax is due 9 months from date of death, even if the tax

is under extension.

WHERE:

NH Department of Revenue Administration, PO Box 637, Concord, NH

03302-0637.

Interest will be charged in accordance with RSA 21-J:28 if the required estimate is not timely filed.

IMPORTANT:

Call the N.H. Department of Revenue Administration, Estate and Legacy Bureau (603) 271-2580.

NEED HELP:

For hearing or speech impaired call TDD Access: Relay NH 1-800-735-2964.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

cut along this line

FORM

THE STATE OF NEW HAMPSHIRE

DP-146-ES

DEPARTMENT OF REVENUE ADMINISTRATION

172

ESTIMATED NON-RESIDENT PERSONAL

PAYMENT VOUCHER

PROPERTY TRANSFER TAX

Due: Nine Months From

Date of Death

Please Print or Type

Estate of:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Decedent's Social Security No.

Date of Death

Domicile at date of death:

ADDRESS

CITY/TOWN

STATE

COUNTY

Probate Number

Name of Executor/Administrator:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Executor/Administrator Social Security or FEI No.

Executor/Administrator:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

For Office Use Only

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: THE STATE OF NEW HAMPSHIRE

NH DEPT REVENUE ADMINISTRATION

MAIL

DOCUMENT PROCESSING DIVISION

Amount of Payment $

TO:

PO BOX 637

CONCORD NH

03302-0637

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

cut along this line

FORM

THE STATE OF NEW HAMPSHIRE

DP-146-ES

DEPARTMENT OF REVENUE ADMINISTRATION

172

ESTIMATED NON-RESIDENT PERSONAL

PAYMENT VOUCHER

PROPERTY TRANSFER TAX

Due: Nine Months From

Date of Death

Please Print or Type

Estate of:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Decedent's Social Security No.

Date of Death

Domicile at date of death:

ADDRESS

CITY/TOWN

STATE

COUNTY

Probate Number

Name of Executor/Administrator:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Executor/Administrator Social Security or FEI No.

Executor/Administrator:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

For Office Use Only

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: THE STATE OF NEW HAMPSHIRE

NH DEPT REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 637

TO:

Amount of Payment $

CONCORD NH

03302-0637

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1