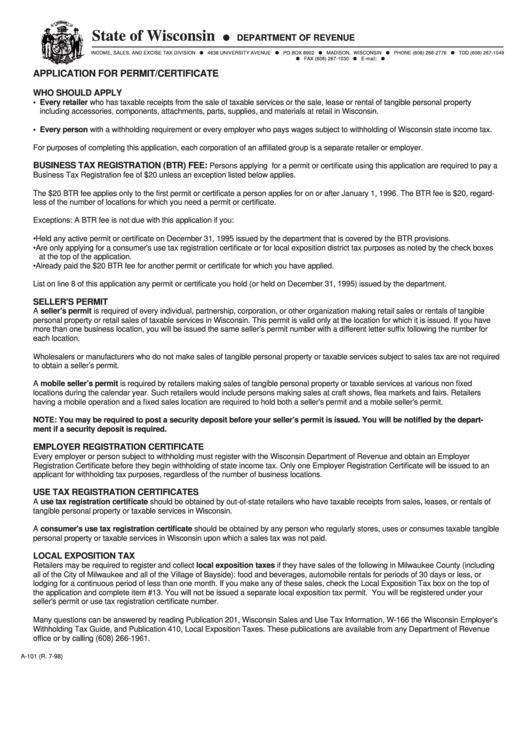

Application For Permit/certificate (A-101) Instructions

ADVERTISEMENT

State of Wisconsin

DEPARTMENT OF REVENUE

INCOME, SALES, AND EXCISE TAX DIVISION

4638 UNIVERSITY AVENUE

PO BOX 8902

MADISON, WISCONSIN

PHONE (608) 266-2776

TDD (608) 267-1049

FAX (608) 267-1030

E-mail: sales10@mail.state.wi.us

APPLICATION FOR PERMIT/CERTIFICATE

WHO SHOULD APPLY

• Every retailer who has taxable receipts from the sale of taxable services or the sale, lease or rental of tangible personal property

including accessories, components, attachments, parts, supplies, and materials at retail in Wisconsin.

• Every person with a withholding requirement or every employer who pays wages subject to withholding of Wisconsin state income tax.

For purposes of completing this application, each corporation of an affiliated group is a separate retailer or employer.

BUSINESS TAX REGISTRATION (BTR) FEE:

Persons applying for a permit or certificate using this application are required to pay a

Business Tax Registration fee of $20 unless an exception listed below applies.

The $20 BTR fee applies only to the first permit or certificate a person applies for on or after January 1, 1996. The BTR fee is $20, regard-

less of the number of locations for which you need a permit or certificate.

Exceptions: A BTR fee is not due with this application if you:

• Held any active permit or certificate on December 31, 1995 issued by the department that is covered by the BTR provisions.

• Are only applying for a consumer's use tax registration certificate or for local exposition district tax purposes as noted by the check boxes

at the top of the application.

• Already paid the $20 BTR fee for another permit or certificate for which you have applied.

List on line 8 of this application any permit or certificate you hold (or held on December 31, 1995) issued by the department.

SELLER'S PERMIT

A seller’s permit is required of every individual, partnership, corporation, or other organization making retail sales or rentals of tangible

personal property or retail sales of taxable services in Wisconsin. This permit is valid only at the location for which it is issued. If you have

more than one business location, you will be issued the same seller’s permit number with a different letter suffix following the number for

each location.

Wholesalers or manufacturers who do not make sales of tangible personal property or taxable services subject to sales tax are not required

to obtain a seller’s permit.

A mobile seller’s permit is required by retailers making sales of tangible personal property or taxable services at various non fixed

locations during the calendar year. Such retailers would include persons making sales at craft shows, flea markets and fairs. Retailers

having a mobile operation and a fixed sales location are required to hold both a seller’s permit and a mobile seller’s permit.

NOTE: You may be required to post a security deposit before your seller’s permit is issued. You will be notified by the depart-

ment if a security deposit is required.

EMPLOYER REGISTRATION CERTIFICATE

Every employer or person subject to withholding must register with the Wisconsin Department of Revenue and obtain an Employer

Registration Certificate before they begin withholding of state income tax. Only one Employer Registration Certificate will be issued to an

applicant for withholding tax purposes, regardless of the number of business locations.

USE TAX REGISTRATION CERTIFICATES

A use tax registration certificate should be obtained by out-of-state retailers who have taxable receipts from sales, leases, or rentals of

tangible personal property or taxable services in Wisconsin.

A consumer's use tax registration certificate should be obtained by any person who regularly stores, uses or consumes taxable tangible

personal property or taxable services in Wisconsin upon which a sales tax was not paid.

LOCAL EXPOSITION TAX

Retailers may be required to register and collect local exposition taxes if they have sales of the following in Milwaukee County (including

all of the City of Milwaukee and all of the Village of Bayside): food and beverages, automobile rentals for periods of 30 days or less, or

lodging for a continuous period of less than one month. If you make any of these sales, check the Local Exposition Tax box on the top of

the application and complete item #13. You will not be issued a separate local exposition tax permit. You will be registered under your

seller's permit or use tax registration certificate number.

Many questions can be answered by reading Publication 201, Wisconsin Sales and Use Tax Information, W-166 the Wisconsin Employer’s

Withholding Tax Guide, and Publication 410, Local Exposition Taxes. These publications are available from any Department of Revenue

office or by calling (608) 266-1961.

A-101 (R. 7-98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2