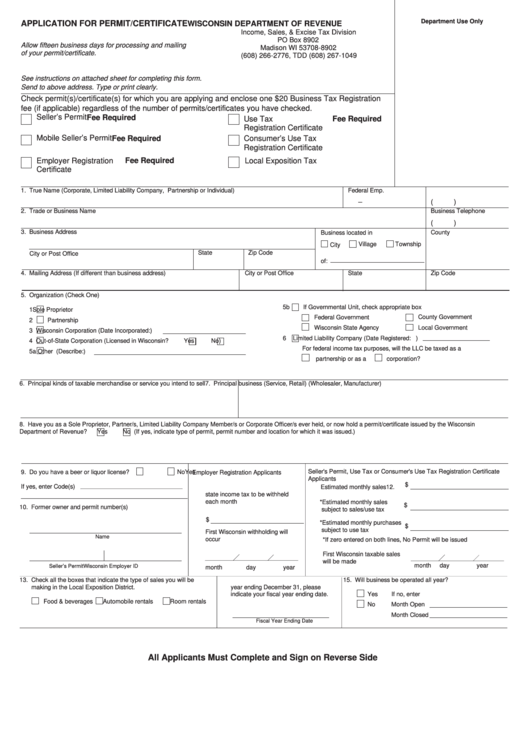

Department Use Only

APPLICATION FOR PERMIT/CERTIFICATE

WISCONSIN DEPARTMENT OF REVENUE

Income, Sales, & Excise Tax Division

PO Box 8902

Allow fifteen business days for processing and mailing

Madison WI 53708-8902

of your permit/certificate.

(608) 266-2776, TDD (608) 267-1049

See instructions on attached sheet for completing this form.

Send to above address. Type or print clearly.

Check permit(s)/certificate(s) for which you are applying and enclose one $20 Business Tax Registration

fee (if applicable) regardless of the number of permits/certificates you have checked.

Seller’s Permit

Fee Required

Use Tax

Fee Required

Registration Certificate

Mobile Seller’s Permit

Fee Required

Consumer’s Use Tax

Registration Certificate

Fee Required

Employer Registration

Local Exposition Tax

Certificate

1. True Name (Corporate, Limited Liability Company, Partnership or Individual)

Federal Emp. I.D. No.

Telephone No.

–

(

)

2. Trade or Business Name

Business Telephone

(

)

3. Business Address

Business located in

County

Village

Township

City

State

Zip Code

City or Post Office

of:

4. Mailing Address (If different than business address)

City or Post Office

State

Zip Code

5. Organization (Check One)

5b

If Governmental Unit, check appropriate box

1

Sole Proprietor

Federal Government

County Government

2

Partnership

Wisconsin State Agency

Local Government

3

Wisconsin Corporation (Date Incorporated:

)

6

Limited Liability Company (Date Registered:

)

4

Out-of-State Corporation (Licensed in Wisconsin?

Yes

No)

For federal income tax purposes, will the LLC be taxed as a

5a

Other (Describe:

)

partnership or as a

corporation?

6. Principal kinds of taxable merchandise or service you intend to sell

7. Principal business (Service, Retail) (Wholesaler, Manufacturer)

8. Have you as a Sole Proprietor, Partner/s, Limited Liability Company Member/s or Corporate Officer/s ever held, or now hold a permit/certificate issued by the Wisconsin

Department of Revenue?

Yes

No (If yes, indicate type of permit, permit number and location for which it was issued.)

Seller's Permit, Use Tax or Consumer's Use Tax Registration Certificate

9. Do you have a beer or liquor license?

Yes

No

Employer Registration Applicants

Applicants

$

If yes, enter Code(s)

11. Estimated amount of Wisconsin

12.

Estimated monthly sales

state income tax to be withheld

each month

*Estimated monthly sales

$

10. Former owner and permit number(s)

subject to sales/use tax

$

*Estimated monthly purchases

$

subject to use tax

First Wisconsin withholding will

Name

occur

*If zero entered on both lines, No Permit will be issued

First Wisconsin taxable sales

will be made

month

day

year

Seller’s Permit

Wisconsin Employer ID

month

day

year

13. Check all the boxes that indicate the type of sales you will be

14. If your income year is other than the

15. Will business be operated all year?

making in the Local Exposition District.

year ending December 31, please

Yes

If no, enter

indicate your fiscal year ending date.

Food & beverages

Automobile rentals

Room rentals

No

Month Open

Month Closed

Fiscal Year Ending Date

All Applicants Must Complete and Sign on Reverse Side

1

1 2

2