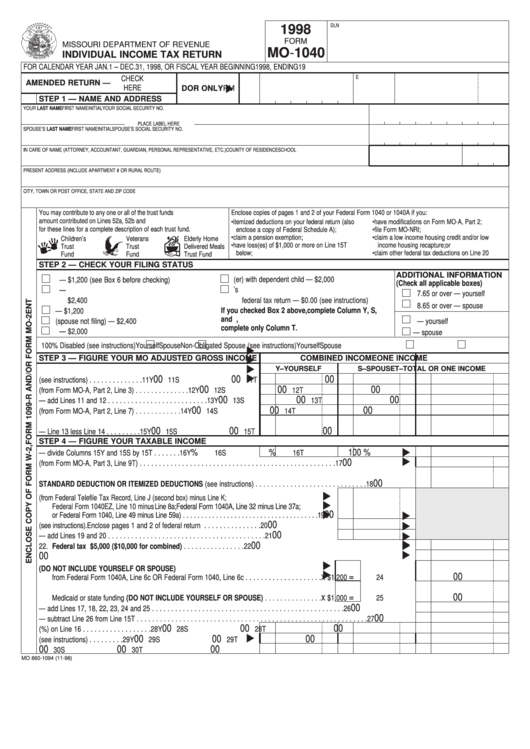

DLN

1998

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-1040

INDIVIDUAL INCOME TAX RETURN

FOR CALENDAR YEAR JAN. 1 – DEC. 31, 1998, OR FISCAL YEAR BEGINNING

1998, ENDING

19

E

CHECK

AMENDED RETURN —

HERE

DOR ONLY

PM

STEP 1 — NAME AND ADDRESS

YOUR LAST NAME

FIRST NAME

INITIAL

YOUR SOCIAL SECURITY NO.

PLACE LABEL HERE

SPOUSE’S LAST NAME

FIRST NAME

INITIAL

SPOUSE’S SOCIAL SECURITY NO.

IN CARE OF NAME (ATTORNEY, ACCOUNTANT, GUARDIAN, PERSONAL REPRESENTATIVE, ETC.)

COUNTY OF RESIDENCE

SCHOOL DIST. NO

PRESENT ADDRESS (INCLUDE APARTMENT # OR RURAL ROUTE)

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

You may contribute to any one or all of the trust funds below. Place the total

Enclose copies of pages 1 and 2 of your Federal Form 1040 or 1040A if you:

amount contributed on Lines 52a, 52b and 52c. Please see the instructions

• itemized deductions on your federal return (also

• have modifications on Form MO-A, Part 2;

for these lines for a complete description of each trust fund.

enclose a copy of Federal Schedule A);

• file Form MO-NRI;

• claim a pension exemption;

• claim a low income housing credit and/or low

Children’s

Veterans

Elderly Home

• have loss(es) of $1,000 or more on Line 15T

income housing recapture; or

Trust

Trust

Delivered Meals

below;

• claim other federal tax deductions on Line 20

Fund

Fund

Trust Fund

STEP 2 — CHECK YOUR FILING STATUS

ADDITIONAL INFORMATION

1. Single — $1,200 (see Box 6 before checking)

5. Qualifying widow(er) with dependent child — $2,000

(Check all applicable boxes)

2. Married and filing a combined Missouri return —

6. Claimed as a dependent on another person’s

7. 65 or over — yourself

federal tax return — $0.00 (see instructions)

$2,400

8. 65 or over — spouse

If you checked Box 2 above, complete Column Y, S,

3A. Married filing separate — $1,200

and T. If you checked any box other than Box 2,

9. Blind — yourself

3B. Married filing separate (spouse not filing) — $2,400

complete only Column T.

4. Head of household — $2,000

10. Blind — spouse

100% Disabled (see instructions)

Yourself

Spouse

Non-Obligated Spouse (see instructions)

Yourself

Spouse

STEP 3 — FIGURE YOUR MO ADJUSTED GROSS INCOME

COMBINED INCOME

ONE INCOME

Y–YOURSELF

S–SPOUSE

T–TOTAL OR ONE INCOME

00

00

00

11. Federal adjusted gross income (see instructions) . . . . . . . . . . . . . .

11Y

11S

11T

00

00

00

12. Total additions (from Form MO-A, Part 2, Line 3) . . . . . . . . . . . . . .

12Y

12S

12T

00

00

00

13. Total income — add Lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . 13Y

13S

13T

00

00

00

14. Total subtractions (from Form MO-A, Part 2, Line 7) . . . . . . . . . . . .

14Y

14S

14T

00

00

00

15. Missouri adjusted gross income — Line 13 less Line 14 . . . . . . . . .

15Y

15S

15T

STEP 4 — FIGURE YOUR TAXABLE INCOME

%

%

100 %

16. Income percentages — divide Columns 15Y and 15S by 15T . . . . . . . 16Y

16S

16T

00

17. Pension exemption (from Form MO-A, Part 3, Line 9T) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18. Missouri STANDARD DEDUCTION OR ITEMIZED DEDUCTIONS (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Federal income tax liability (from Federal Telefile Tax Record, Line J (second box) minus Line K;

Federal Form 1040EZ, Line 10 minus Line 8a; Federal Form 1040A, Line 32 minus Line 37a;

00

or Federal Form 1040, Line 49 minus Line 59a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20. Other federal tax (see instructions). Enclose pages 1 and 2 of federal return . . . . . . . . . . . . . . .

20

00

21. Total federal tax — add Lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22. Federal tax deduction. Enter amount from Line 21 not to exceed $5,000 ($10,000 for combined) . . . . . . . . . . . . . . . .

22

00

23. Exemption amount checked on Lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24. Number of dependents (DO NOT INCLUDE YOURSELF OR SPOUSE)

x

=

00

from Federal Form 1040A, Line 6c OR Federal Form 1040, Line 6c . . . . . . . . . . . . . . . . . . . .

$1,200

24

25. Number of dependents on Line 24 who are 65 years of age or older and do not receive

x

=

00

Medicaid or state funding (DO NOT INCLUDE YOURSELF OR SPOUSE) . . . . . . . . . . . . . . .

$1,000

25

00

26. Total deductions — add Lines 17, 18, 22, 23, 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27. Subtotal — subtract Line 26 from Line 15T . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

00

00

28. Multiply Line 27 by percentages (%) on Line 16 . . . . . . . . . . . . . . . . . . 28Y

28S

28T

00

00

00

29. Enterprise zone income modification (see instructions) . . . . . . . . .

29Y

29S

29T

00

00

00

30. Subtract Line 29 from Line 28. Enter here and on Line 31 . . . . . . . . . . 30Y

30S

30T

MO 860-1094 (11-98)

1

1 2

2