Form 44-007 - Annual Verified Summary Of Payments Report (Vsp) - 2007

ADVERTISEMENT

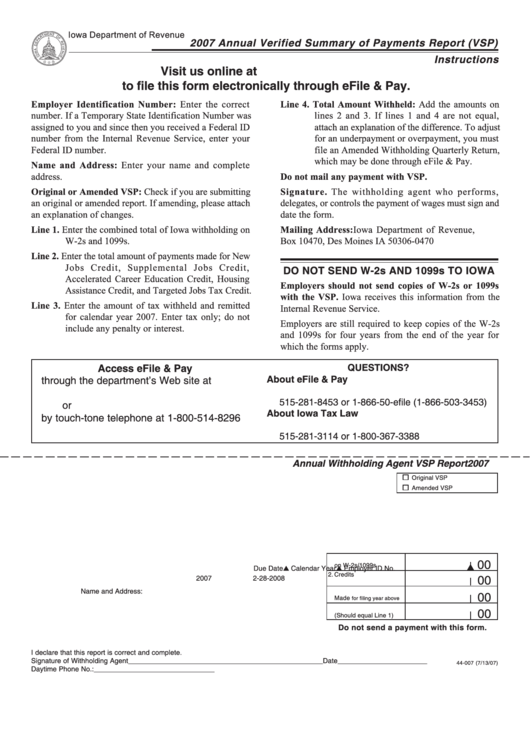

Iowa Department of Revenue

2007 Annual Verified Summary of Payments Report (VSP)

Instructions

Visit us online at

to file this form electronically through eFile & Pay.

Employer Identification Number: Enter the correct

Line 4. Total Amount Withheld: Add the amounts on

number. If a Temporary State Identification Number was

lines 2 and 3. If lines 1 and 4 are not equal,

assigned to you and since then you received a Federal ID

attach an explanation of the difference. To adjust

number from the Internal Revenue Service, enter your

for an underpayment or overpayment, you must

Federal ID number.

file an Amended Withholding Quarterly Return,

which may be done through eFile & Pay.

Name and Address: Enter your name and complete

address.

Do not mail any payment with VSP.

Original or Amended VSP: Check if you are submitting

Signature. The withholding agent who performs,

an original or amended report. If amending, please attach

delegates, or controls the payment of wages must sign and

an explanation of changes.

date the form.

Line 1. Enter the combined total of Iowa withholding on

Mailing Address: Iowa Department of Revenue, P.O.

W-2s and 1099s.

Box 10470, Des Moines IA 50306-0470

Line 2. Enter the total amount of payments made for New

Jobs Credit, Supplemental Jobs Credit,

DO NOT SEND W-2s AND 1099s TO IOWA

Accelerated Career Education Credit, Housing

Employers should not send copies of W-2s or 1099s

Assistance Credit, and Targeted Jobs Tax Credit.

with the VSP. Iowa receives this information from the

Line 3. Enter the amount of tax withheld and remitted

Internal Revenue Service.

for calendar year 2007. Enter tax only; do not

Employers are still required to keep copies of the W-2s

include any penalty or interest.

and 1099s for four years from the end of the year for

which the forms apply.

Access eFile & Pay

QUESTIONS?

About eFile & Pay

through the department’s Web site at

idrefile@iowa.gov

515-281-8453 or 1-866-50-efile (1-866-503-3453)

or

About Iowa Tax Law

by touch-tone telephone at 1-800-514-8296

idr@iowa.gov

515-281-3114 or 1-800-367-3388

Annual Withholding Agent VSP Report 2007

Original VSP

Amended VSP

1. Total Iowa Withholding

00

on W-2s/1099s

Employer ID No.

Calendar Year

Due Date

2. Credits

00

2007

2-28-2008

Name and Address:

3. Withholding Payments

00

Made

for filing year above

4. Total of lines 2 and 3.

00

(Should equal Line 1)

Do not send a payment with this form.

I declare that this report is correct and complete.

Signature of Withholding Agent __________________________________________________ Date _______________________

44-007 (7/13/07)

Daytime Phone No.: _______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1