Form Gid 14 - Calculation For Abatement Of Gross Premium Tax - 2007

ADVERTISEMENT

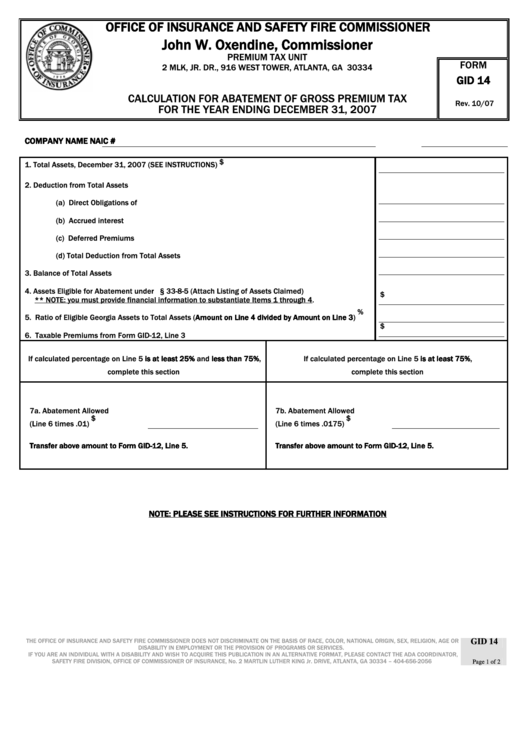

OFFICE OF INSURANCE AND SAFETY FIRE COMMISSIONER

John W. Oxendine, Commissioner

PREMIUM TAX UNIT

FORM

2 MLK, JR. DR., 916 WEST TOWER, ATLANTA, GA 30334

GID 14

CALCULATION FOR ABATEMENT OF GROSS PREMIUM TAX

Rev. 10/07

FOR THE YEAR ENDING DECEMBER 31, 2007

COMPANY NAME

NAIC #

$

1. Total Assets, December 31, 2007 (SEE INSTRUCTIONS)

2. Deduction from Total Assets

(a) Direct Obligations of U.S. Government

(b) Accrued interest

(c) Deferred Premiums

(d) Total Deduction from Total Assets

3. Balance of Total Assets

4. Assets Eligible for Abatement under O.C.G.A. § 33-8-5 (Attach Listing of Assets Claimed)

$

** NOTE: you must provide financial information to substantiate Items 1 through 4.

%

5. Ratio of Eligible Georgia Assets to Total Assets (Amount on Line 4 divided by Amount on Line 3)

$

6. Taxable Premiums from Form GID-12, Line 3

If calculated percentage on Line 5 is at least 25% and less than 75%,

If calculated percentage on Line 5 is at least 75%,

complete this section

complete this section

7a. Abatement Allowed

7b. Abatement Allowed

$

$

(Line 6 times .01)

(Line 6 times .0175)

Transfer above amount to Form GID-12, Line 5.

Transfer above amount to Form GID-12, Line 5.

NOTE: PLEASE SEE INSTRUCTIONS FOR FURTHER INFORMATION

THE OFFICE OF INSURANCE AND SAFETY FIRE COMMISSIONER DOES NOT DISCRIMINATE ON THE BASIS OF RACE, COLOR, NATIONAL ORIGIN, SEX, RELIGION, AGE OR

GID 14

DISABILITY IN EMPLOYMENT OR THE PROVISION OF PROGRAMS OR SERVICES.

IF YOU ARE AN INDIVIDUAL WITH A DISABILITY AND WISH TO ACQUIRE THIS PUBLICATION IN AN ALTERNATIVE FORMAT, PLEASE CONTACT THE ADA COORDINATOR,

SAFETY FIRE DIVISION, OFFICE OF COMMISSIONER OF INSURANCE, No. 2 MARTLIN LUTHER KING Jr. DRIVE, ATLANTA, GA 30334 – 404-656-2056

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2